Solana (SOL) Price: Rebounds as Chaikin Money Flow Shows Easing Selling Pressure

TLDR

- Solana price recovered above $120 and is currently trading near $126, but faces resistance at the $127-$128 zone

- The cryptocurrency needs to break above $130 to shift short-term momentum, with major resistance levels at $135 and $144

- Chaikin Money Flow indicator shows capital outflows are slowing, suggesting selling pressure is easing

- New Solana addresses dropped 11.3% from 6.077 million to 5.390 million over ten days, showing weaker network participation

- Recovery depends on existing holders maintaining support rather than new investor inflows

Solana has started a recovery wave after dropping to $117 earlier this week. The cryptocurrency climbed above the $120 mark and is currently trading near $126.

Solana (SOL) Price

Solana (SOL) Price

The price moved above key technical levels including the $122 and $124 zones. SOL also surpassed the 100-hourly simple moving average during the recovery.

However, bulls are facing resistance around the $127-$128 area. A bearish trend line on the hourly chart shows resistance forming at $127.

The recovery came after SOL bounced from the $117 support level. The move cleared the 50% Fibonacci retracement level of the recent downward move from $134 to $117.

Bulls pushed the price above $125 but met resistance near $127. The 61.8% Fibonacci retracement level sits at this resistance zone.

Key Resistance Levels Ahead

The next major resistance stands at $130. This level represents a critical threshold for changing short-term momentum.

If Solana clears $130, the main resistance target would be $135. A successful close above $135 could open the path toward $144.

Further gains beyond $144 might send the price toward the $150 level. However, each resistance level will require sustained buying pressure to overcome.

On the downside, initial support sits near $125. The first major support level is located at $122.

A break below $122 could push Solana toward the $117 support zone. Falling below $117 might expose the $108 level as the next downside target.

On-Chain Metrics Show Mixed Signals

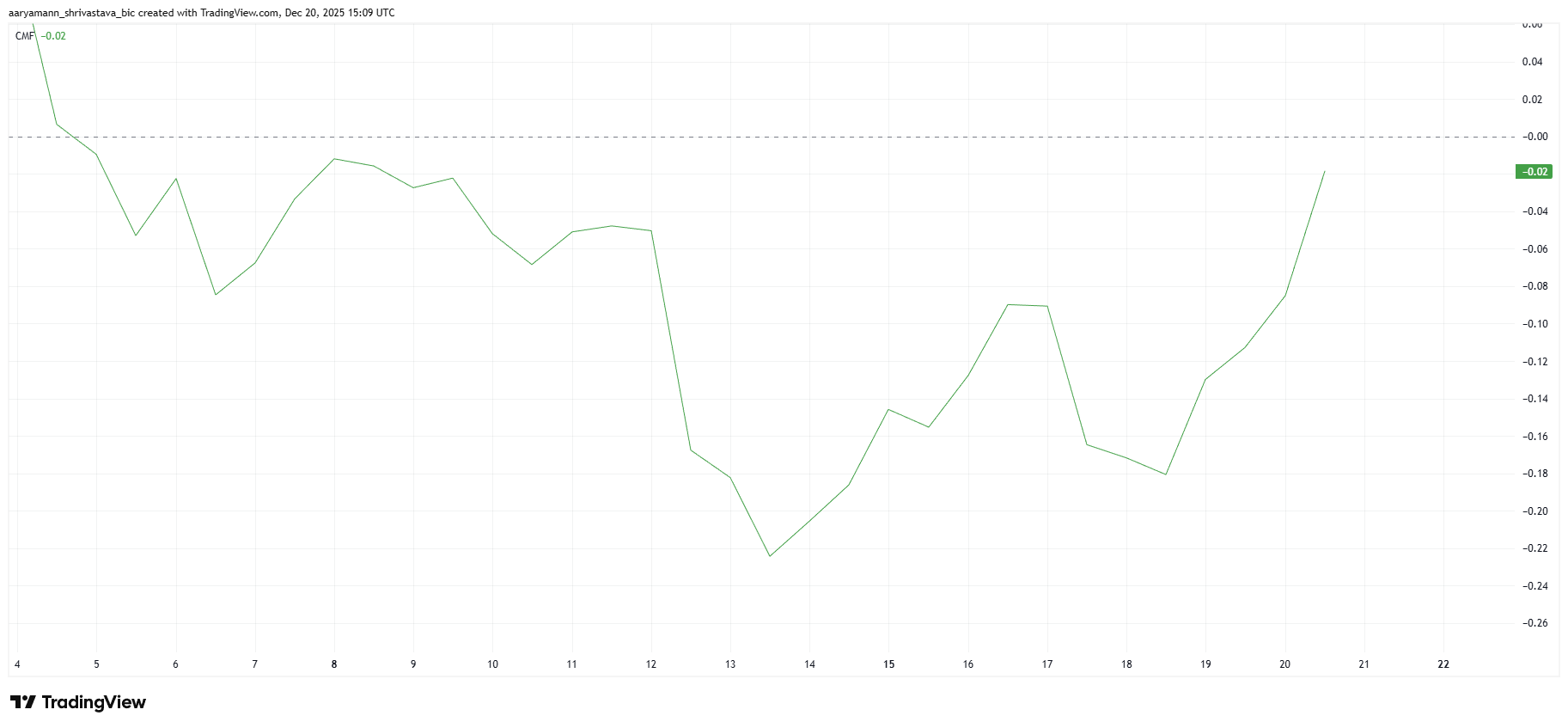

The Chaikin Money Flow indicator has posted an uptick over recent days. While the indicator remains below the zero line, the upward movement suggests capital outflows are slowing.

Source: TradingView

Source: TradingView

This change in flow patterns often precedes a shift toward inflows. When buying pressure exceeds selling activity, prices typically respond quickly.

However, network growth data presents a more cautious picture. New Solana addresses have declined sharply in recent sessions.

The number of new addresses dropped from 6.077 million to 5.390 million over ten days. This represents an 11.3% decrease in network participation.

The decline in new addresses suggests weaker interest from fresh investors. New market participants appear hesitant to enter at current price levels.

This lack of new demand means existing Solana holders carry more weight in supporting price stability. Current holders must maintain their positions or add to them for recovery to continue.

The recovery attempt shows SOL trading in a consolidation pattern rather than a clear breakout. Price action remains capped below the $130 resistance level at the time of writing.

The post Solana (SOL) Price: Rebounds as Chaikin Money Flow Shows Easing Selling Pressure appeared first on CoinCentral.

You May Also Like

Layer Brett Picked As The Best Crypto To Buy Now By Experts Over Pi Coin & VeChain

Intel’s stock surges as Nvidia invests $5 billion in the chipmaker