Daily Market Update: Markets Rebound While Gold Reaches All-Time High

TLDR

- Bitcoin traded near $88,800 on Monday as global markets showed risk appetite with Asian stocks rising over 1%

- Gold hit an all-time high above $4,380 per ounce, tracking toward its best annual performance since 1979

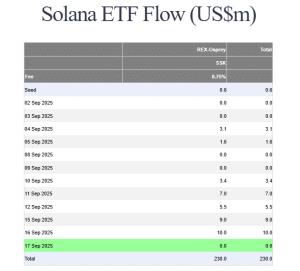

- Ether climbed back above $3,000 while XRP, Solana, and Dogecoin gained after recent volatility

- Over $576 million in crypto positions were liquidated during the recent volatile period

- Wall Street strategists set bullish 2026 targets with JPMorgan forecasting S&P 500 at 7,500

Bitcoin maintained its position near $88,800 on Monday as global markets showed renewed appetite for risk assets. The leading cryptocurrency traded steadily while broader markets posted gains across multiple asset classes.

Bitcoin (BTC) Price

Bitcoin (BTC) Price

Ether recovered to trade above $3,000 during the session. Other major cryptocurrencies including XRP, Solana, and Dogecoin also posted gains following a period of sharp price swings.

The crypto market recently experienced turbulence with over $576 million in positions liquidated. Thin year-end liquidity and lingering leverage have kept rallies in check according to traders.

Gold pushed to a record high above $4,380 per ounce on Monday. The precious metal is on pace for its strongest annual performance since 1979.

Central bank buying and steady inflows into gold-backed exchange-traded funds have supported the rally. Growing expectations that the Federal Reserve will deliver rate cuts in 2026 added to gold’s momentum.

Asian equities advanced more than 1% led by technology shares. The MSCI Asia Pacific Index rose as U.S. equity futures also traded higher.

Markets showed stability after U.S. equities rebounded late last week. The move helped calm global markets heading into the final weeks of the year.

Stock Market Performance

The S&P 500 closed within 1% of its record high after five straight sessions of gains. The Nasdaq Composite ended November within 3% of its peak despite snapping a seven-month winning streak.

E-Mini S&P 500 Mar 26 (ES=F)

E-Mini S&P 500 Mar 26 (ES=F)

The Dow Jones Industrial Average traded less than 2% below its record close. Markets finished the holiday-shortened week on a positive note.

Technology stocks showed mixed performance over the past month. Meta shares declined 13% while Nvidia dropped about 8% during the period.

Rate Cut Expectations

Traders currently predict an 86.9% chance of a quarter-point rate cut at the Federal Reserve’s December meeting. The Fed entered its mandatory blackout period on Saturday ahead of its December 9-10 policy meeting.

President Trump announced he had selected his nominee for the next Federal Reserve chair. He stated expectations for the nominee to deliver interest rate cuts without naming his choice.

Wall Street strategists issued bullish forecasts for 2026. JPMorgan set a target of 7,500 for the S&P 500 by the end of next year, representing nearly a 10% gain from current levels.

HSBC strategists also set their 2026 price target at 7,500. Deutsche Bank predicted the index would reach 8,000, with all three firms citing the AI technology cycle as a key driver.

Data from K33 Research shows long-term bitcoin holders are nearing the end of an extended selling phase. Institutional buyers have begun absorbing bitcoin faster than miners can produce it according to the research.

Corporate treasuries and ETFs increased their bitcoin purchases even after prices fell more than 30% from October highs. Japan’s recent rate hike pushed government bond yields to multi-year highs as the yen strengthened.

The post Daily Market Update: Markets Rebound While Gold Reaches All-Time High appeared first on CoinCentral.

You May Also Like

SEC Approves New Generic Listing Rules For Crypto ETPs That Will Streamline Entire Process

Zero-Trust Databases: Redefining the Future of Data Security