Ethereum (ETH) Flexes Bullish Muscle: Is $3.5K Within Striking Distance?

- Ethereum is currently trading around the $3K mark.

- The daily trading volume of ETH has increased by 98%.

With a brief spike in the crypto market, a mixed signal is found across the digital assets. But the broader market sentiment is lingering in fear, as the Fear and Greed Index value holds at 29. The largest asset, Bitcoin (BTC), has slipped to $88.8K, while Ethereum (ETH), the largest altcoin, has registered a modest gain of over 1.63% in the last 24 hours.

The bearish shadow over the asset seems to have cleared as of now, which might invite the bulls into the market. A jump toward $3.2K could support faster recovery in the ETH market. It has visited a low trading range at around $2,945.39, and later, with the bullish shift, the price has risen to a high of $3,056.98.

At the time of writing, Ethereum traded within the $3,023 zone, with its market cap at $365.56 billion. Moreover, the daily trading volume of the asset has increased by 98.68%, reaching the $14.81 billion mark. As per Coinglass data, the market has experienced a 24-hour liquidation of $49.28 million worth of ETH.

Are Ethereum Bulls Ready to Seize Full Control?

With the current bullish momentum of Ethereum, the price might rise toward the $3,045 resistance range. The steady upside pressure could trigger the golden cross emergence, and the asset would see more gains and enter the $3.1K zone. On the downside, if the ETH price initiates a downward movement, the nearest support level could be $3,001. Upon a breakdown, the potential bears might push the death cross out and drive the altcoin price toward the $2.9K mark.

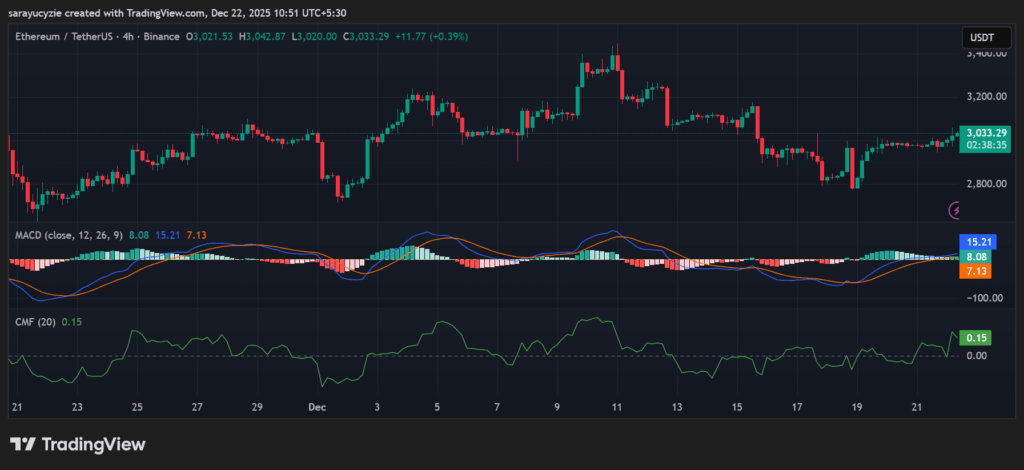

ETH chart (Source: TradingView)

ETH chart (Source: TradingView)

Ethereum’s Moving Average Convergence Divergence (MACD) line is above the signal line, which indicates bullish momentum. The recent price gains are strengthening, and this may be an early confirmation of an uptrend. In addition, the Chaikin Money Flow (CMF) indicator found at 0.15 suggests moderate buying pressure in the ETH market. The capital is flowing into the asset, with the buyers showing more strength, supporting the bullish bias.

The Bull Bear Power (BBP) value of 81.02 implies strong bullish dominance, pushing the ETH price well above. It reflects strong upward momentum, but also has the chance of overextension if it rises too quickly. Besides, Ethereum’s daily Relative Strength Index (RSI) reading at 60.65 hints at moderate upside sentiment. The asset is not yet overbought, and this shows a healthy uptrend, with enough room for further upside if the momentum continues.

Top Updated Crypto News

Galaxy Digital Warns Bitcoin 2026 Outlook Highly Unpredictable

You May Also Like

Pi Network Implements Protocol v23 on Testnet, Boosts Pi Coin Value

Robert W. Baird & Co. Discloses Core AI Design Parameters and Launches Public Testing of Baird NEUROFORGE™ Equity AI