Cardano Price Outlook: ADA Bears Target $0.27 Support Amid Declining Investor Confidence

Highlights:

- Cardano price has slipped 2% to $0.36, as the bearish grip strengthens in the market.

- On-chain data indicates that investors are offloading ADA tokens, adding to the intense bearish sentiment in the ADA market.

- The derivatives and technical outlook indicate a potential for further downside, as ADA bears target $0.27 support levels.

Cardano (ADA) price is trading $0.36, indicating a 2% drop in the past 24 hours. Meanwhile, holders are selling off ADA tokens, which adds to the bearish sentiment. In the meantime, short bets in the derivatives market have increased, suggesting additional signs of downside force in Cardano.

According to Santiment, the large-wallet holders of Cardano are decreasing, which is a negative indicator that the sentiment is turning bearish. The metric shows that the whales with 100,000-1 million (red line), 1 million-10 million (yellow line), and 10 million-100 million (blue line) lost a total of 90 million Cardano tokens on Saturday through Tuesday. This has created selling pressure in the Cardano market, hence the recent price drop.

Cardano Supply Distribution: Santiment

Cardano Supply Distribution: Santiment

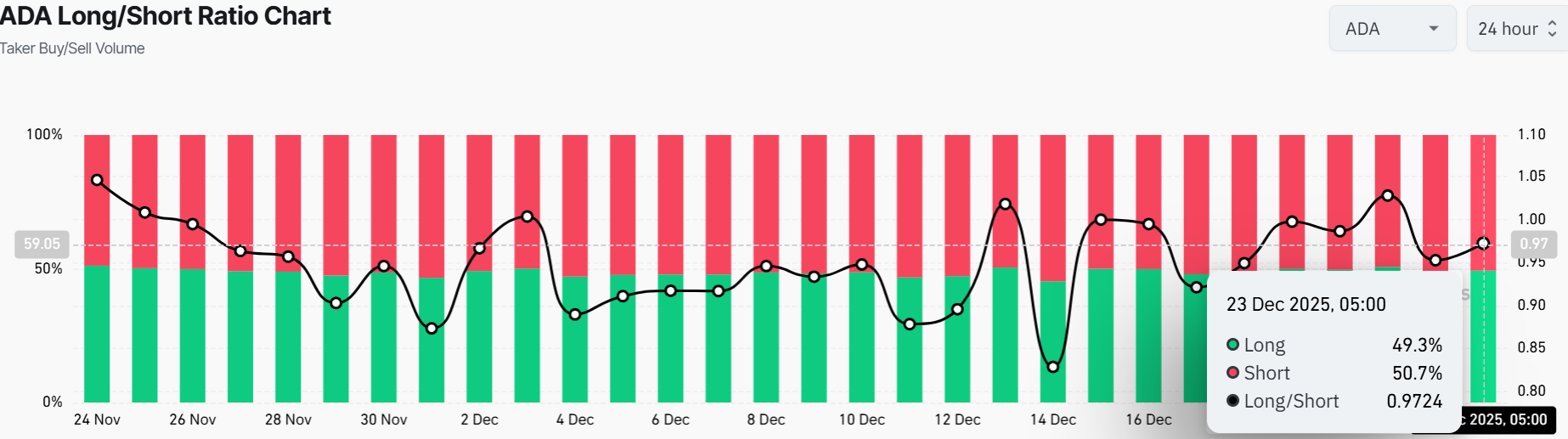

On the other hand, Coinglass data shows that the long-to-short ratio of ADA at Coinglass sits at 0.9724. This ratio is lower than one, with the shorts taking the lion’s share of 50.7%, while the longs take the rest (49.3%). This indicates that the market is bearish, with more traders betting that ADA will be underpriced.

ADA Long/Short Ratio: CoinGlass

ADA Long/Short Ratio: CoinGlass

ADA Bears Target $0.27 Support if $0.36 Support Cracks

Looking at the Cardano daily chart, the price is at $0.36, slightly below the 50-day simple moving average (SMA) of $0.44, which is now acting as strong resistance. Further, the 200-day at $0.67 is also acting as a long-term resistance zone, cushioning the bulls against any further upside. Currently, the token is hovering within the consolidation channel, as bulls are attempting to break out soon.

A quick look at the momentum indicators, the Relative Strength Index (RSI) is near 37.64. This signals that ADA is neither overbought nor oversold, meaning there’s plenty of room for a move in either direction. However, the bearish grip is strong. The MACD (Moving Average Convergence Divergence) is flat, with buyers attempting to regain momentum. This is reinforced by the MACD flipping above the signal line.

ADA/USD 1-day chart: TradingView

ADA/USD 1-day chart: TradingView

On resistance, the immediate overhead is at $0.44. If Cardano price breaks above this mark, the next targets are $0.48. In a highly bullish case, the token could rally towards the long-term barrier at $0.67. On the other hand, if support at $0.36 breaks, Cardano price may slide back to $0.35-$0.27 support zone. For now, investors should keep an eye on volume, which is down 6%%, indicating a recent drop in market activity, adding to the bearish grip.

Looking ahead, the next few weeks could push the ADA price above $0.44 or higher if bullish sentiment holds and the whole crypto market flips positive. In the long term, if the bulls hold above $0.48 resistance, a breakout to $0.67 isn’t off the table by year-end.

eToro Platform

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

You May Also Like

Zhongchi Chefu acquired $1.87 billion worth of digital assets from a crypto giant for $1.1 billion.

XRP news: Ripple expands RLUSD stablecoin use in UAE via Zand Bank