BNB Shows Renewed Strength After Reclaiming Key Support Zone

The Binance Coin (BNB) is regaining momentum following a recovery after a closely monitored support area, and this development has boosted the mood of the large-cap altcoins as purchasers begin to take over.

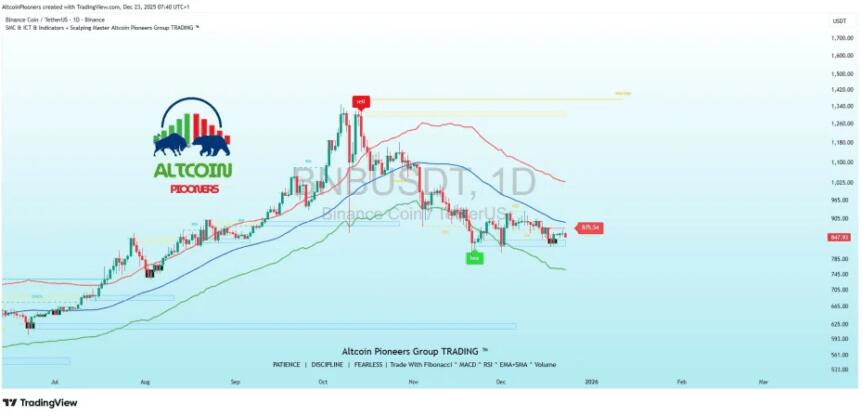

BNB Reclaims Key $840-$875 Accumulation Zone

According to analysts at Altcoin Pioneers, BNB has pushed above the $840-$875 range, a zone traders had been watching for accumulation. The move came after a short pullback during low trading volume, suggesting sellers did not apply much pressure.

Market watchers say the bounce looks driven by steady buying, not forced liquidations. BNB has held near the $850 level for most sessions, which points to buyers actively defending this area.

Technical signals support that view. The relative strength index has moved back into bullish territory after a weak stretch. At the same time, the MACD shows selling pressure fading while buying interest builds. Analysts say this mix of signals fits with an early cycle-level reversal rather than a short-term bounce.

-

- Source: Altcoin Pioneers

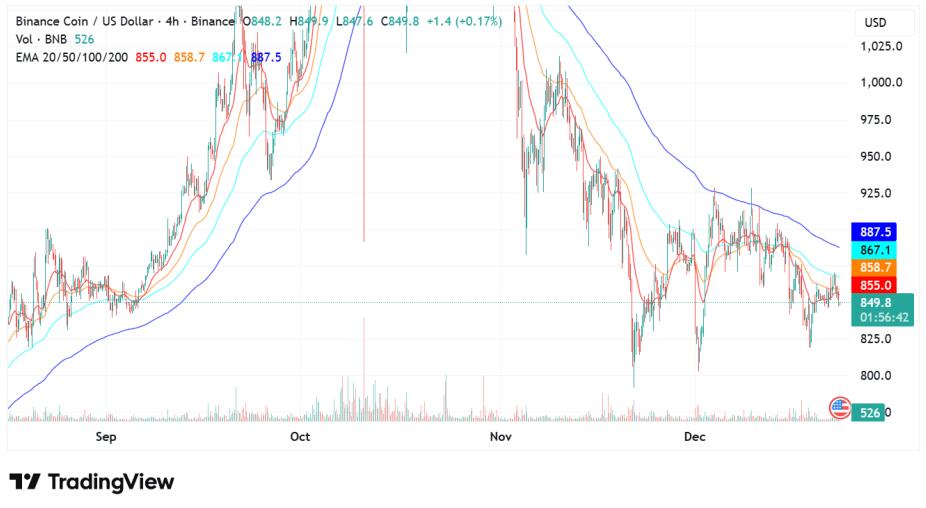

Price Holds Key Retracement Range

Other technical signals suggest BNB’s price action remains calm. Analysts point to trading near the volume-weighted average price, or VWAP, as a sign of balanced activity.

Buyers and sellers appear evenly matched, not rushed. Prices often pause around the VWAP during transition periods, which can help form a base before the next move.

Fibonacci levels are also in focus. BNB continues to trade between the 0.382 and 0.5 retracement zones. These levels have often acted as buffers during pullbacks.

As long as price holds within this range, analysts say downside risk looks limited. But a clear break below it could open the door to deeper losses.

-

- Source: TradingView

Moving Average Compression Signals Possible Breakout

Moving averages are beginning to shorten in the short run. This is usually an indicator that the selling pressure has not been changing. The 20 and 50-day EMAs are converging towards the range of around 850, indicating that the price movements have decreased after the last decline.

These silent periods are usually succeeded by price moves according to analysts. The emphasis has now changed to the 100 day EMA and the 200 day EMA between the range of $870 and 890. This area acts as a key test. Any upward increase would help in the greater recovery.

Higher lows are also being observed among traders. Such trend can indicate an increasing strength in case momentum prevails. The initial resistance is between 965-1025 which is close to the recent highs. There is a second resistance zone of between 1100 and 1180 whereby selling was highest previously.

Provided that BNB can support itself and break these levels, analysts believe that the setup will indicate a potential second leg to the upside.

-

- Source: TradingView

This article was originally published as BNB Shows Renewed Strength After Reclaiming Key Support Zone on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

OpenVPP accused of falsely advertising cooperation with the US government; SEC commissioner clarifies no involvement

Trump's allegation against Noem would constitute a federal crime: analyst