$27B Bitcoin, Ethereum Options Expiry Today: Here’s What to Expect

The post $27B Bitcoin, Ethereum Options Expiry Today: Here’s What to Expect appeared first on Coinpedia Fintech News

Around $27 billion worth of Bitcoin, Ethereum options expired today on Deribit, one of the world’s largest crypto options exchanges. Bitcoin is trading near $88,000, while Ethereum is hovering close to $2,950, as traders brace for possible volatility.

With such a large amount of contracts settling at once, the expiry could have a massive impact on the crypto market

Bitcoin Faces $23.6 Billion Option Expiry

Bitcoin accounts for the biggest share of today’s expiry, with over $23.6 billion in BTC options rolling off. Data from Deribit shows 268,000 option contracts settled at the same time, clearing a major amount of risk from the market in a single session.

Despite the size of the expiry, trader positioning still leans positive. The put-to-call ratio stands at 0.38, which means more traders were betting on higher prices than lower ones.

The “max pain” level, where most option holders would see losses, was near $96,000. This level often acts like a price magnet around expiry, even if briefly.

Bitcoin Eyeing $100K level

Over the past few weeks, Bitcoin has remained stuck in a tight range, repeatedly testing both sides. Crypto analyst Michael van de Poppe noted that sellers have failed to push BTC below $86.5K, showing strong buyer support.

However, every move above $90K has been rejected, highlighting heavy selling pressure at that level.

Analysts say $90,000 is the key barrier. A clear breakout above it, backed by strong volume, could restore bullish momentum and open the path toward the $100,000 mark.

Ethereum Traders Remain Cautious After Options Expiry

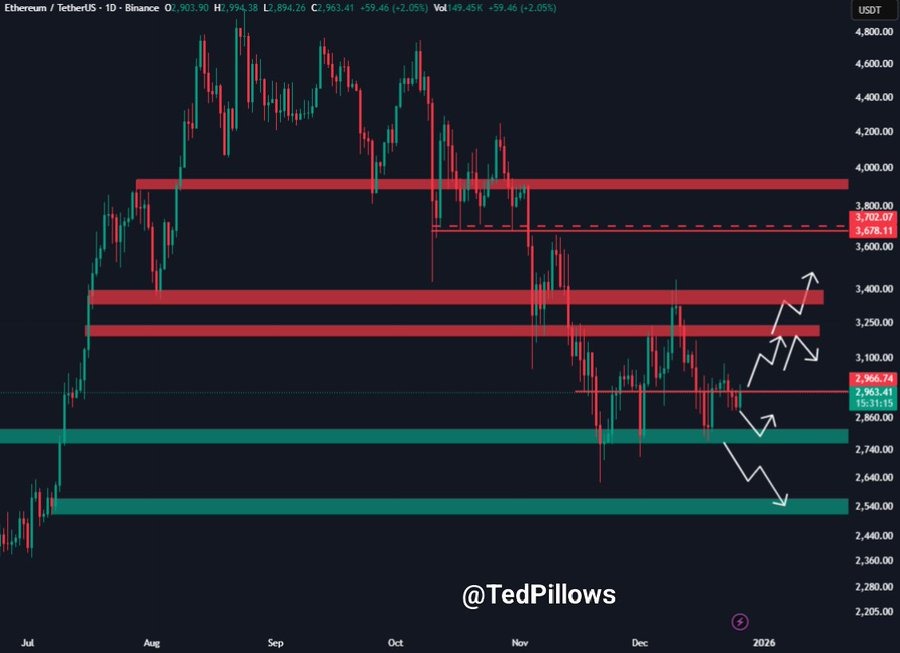

Ethereum is also under the spotlight, with nearly $4 billion in ETH options expiring. Although ETH has seen small price gains, traders remain cautious rather than confident. The max pain level sits near $3,100, keeping pressure on the price.

Ethereum has once again failed to hold above the key $3,000 level, which is worrying traders. Crypto analyst Ted noted that unless ETH clearly moves back above $3,000, the risk of another drop stays high.

If the price falls below $2,800, selling pressure could increase quickly. Below that, the next strong support lies around $2,600, $2,500, where buyers stepped in during earlier sell-offs.

XRP and Solana Show Mixed Signals

XRP options show continued pressure, with traders closely watching the $1.80 support level. A break below this could lead to further downside.

Solana shows a more balanced picture. Options data remains neutral, and SOL has already seen a small recovery around $123.

As 2026 approaches, this option’s expiry could act as an important turning point for the token.

You May Also Like

Is Putnam Global Technology A (PGTAX) a strong mutual fund pick right now?

WazirX founder confirms that the Indian crypto exchange’s dispute with Binance has escalated to formal litigation