Ripple Price Analysis: XRP Structure Will Remain Bearish Until This Key Level Is Reclaimed

Ripple’s XRP remains under sustained bearish pressure, with recent price action showing limited recovery attempts and continued acceptance at lower levels. The broader structure suggests the market is still in a corrective phase rather than transitioning into accumulation.

XRP Price Analysis

The Daily Chart

On the daily timeframe, XRP continues to trade within a well-defined descending channel that has been respected since the major breakdown earlier in the trend. The asset is currently hovering just above a key demand zone around the $1.80 area, which has acted as a buyer’s base during recent pullbacks. Despite this support holding for now, the overall structure remains weak, as XRP is still capped below the descending trendline and remains under both the 100-day and 200-day moving averages.

The repeated failure to reclaim the former support-turned-resistance zone around $2.40 to $2.50 reinforces the bearish bias on the higher timeframe. Until XRP can decisively break above the descending structure and reclaim these dynamic resistance levels, any upside moves are likely to be corrective rather than trend-changing. As long as the price remains below the channel midline, the daily outlook favors continued consolidation or a gradual drift toward lower demand zones.

The 4-Hour Chart

The 4-hour chart provides more clarity on recent developments, showing XRP consolidating tightly after another rejection from the descending channel resistance. The price is currently compressing near the lower boundary of the channel, with sellers stepping in aggressively on minor rallies. This behavior indicates that bearish momentum, while slowing, has not yet been invalidated.

The current price action suggests that buyers are defending the $1.80 region, but the lack of strong bullish displacement highlights weak follow-through demand. Without a clear break above the short-term descending trendline, XRP remains vulnerable to another downside expansion toward deeper demand levels.

A confirmed breakout above the channel resistance would be required to shift the intraday bias and signal that sellers are losing control. Until then, the structure favors range-bound price action with downside risk still present.

The post Ripple Price Analysis: XRP Structure Will Remain Bearish Until This Key Level Is Reclaimed appeared first on CryptoPotato.

You May Also Like

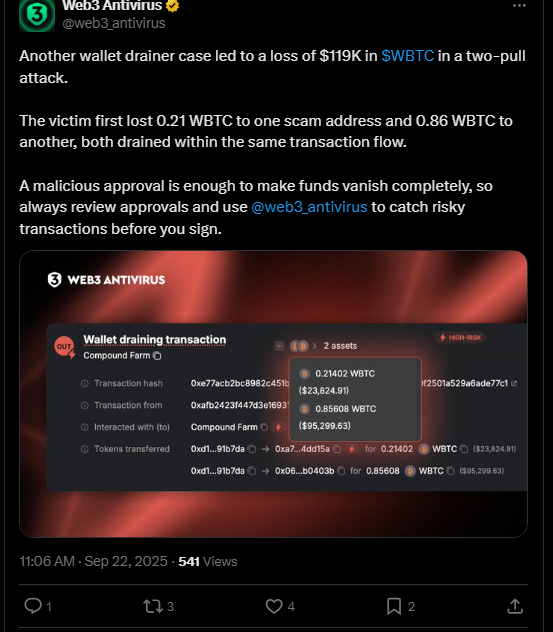

$119K WBTC Drained in Wallet Scam Amid Fake Airdrop Surge

SwayHorizonAi Reviews — Are Their Market Insights Legit? A Quick Overview