XRP Sees New Address Growth, But Price Still Struggles Below $2

XRP has struggled to regain momentum after failing to reclaim the $2.00 level. Broader market uncertainty has capped upside, keeping price action constrained.

Still, the approach of a new year is drawing renewed attention to the altcoin, supported by rising interest in exchange-traded fund products tied to XRP-linked strategies.

Roundhill Aims To Launch A Different XRP ETF

Roundhill Investments, a US-based asset manager known for thematic ETFs, has filed an updated XRP-related product with the US Securities and Exchange Commission. The filing signals growing regulatory acceptance of XRP as a reference asset within structured investment vehicles, marking a notable step for its presence in traditional finance.

The proposed ETF does not represent a spot XRP fund and will not directly hold XRP tokens. Instead, the product is structured to generate income through options premiums tied to other XRP-based ETFs. In practical terms, the fund aims to capture returns from XRP price movements rather than ownership, with a potential launch expected in 2026.

Holders Flock Towards XRP

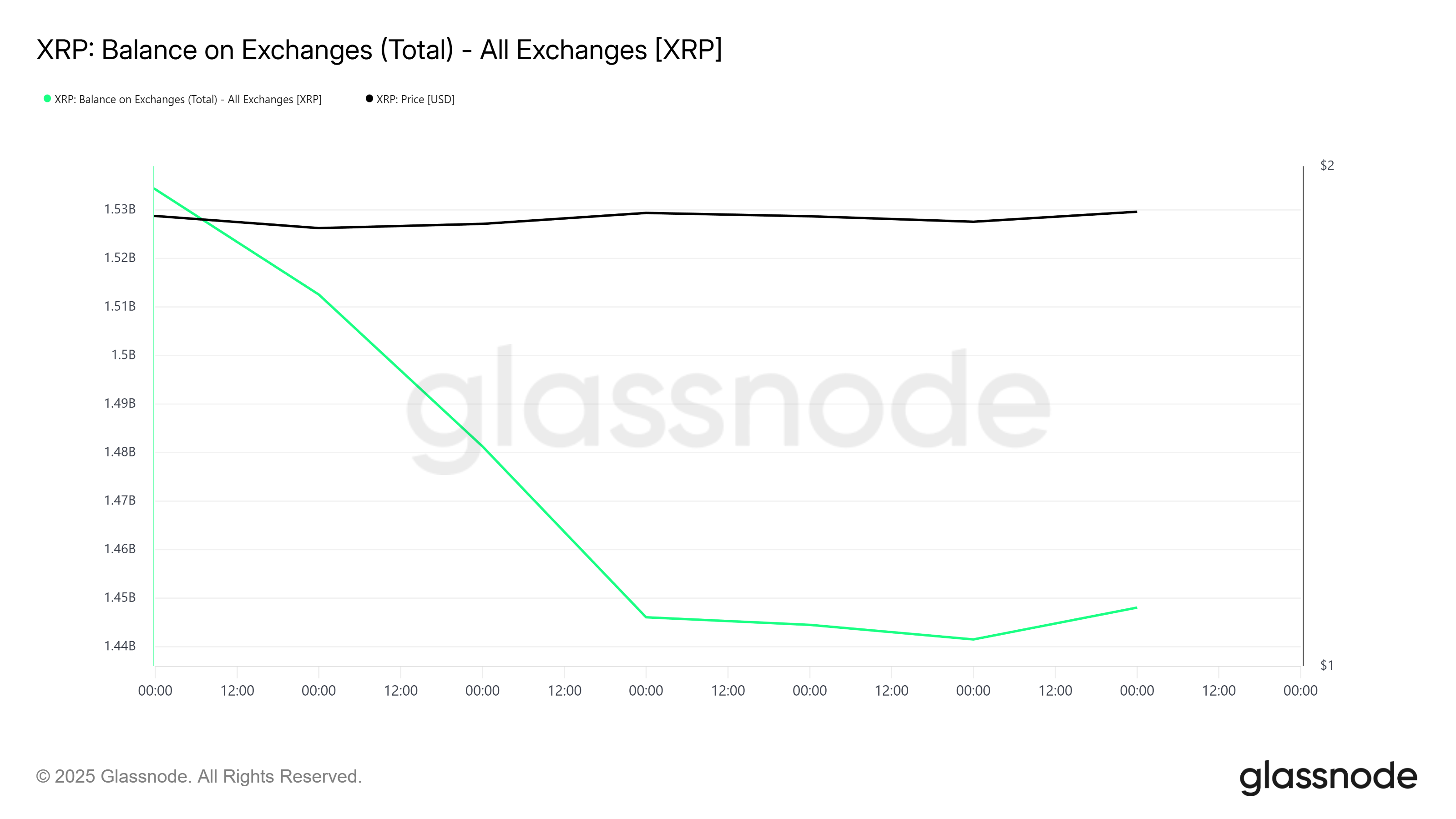

Despite this development, existing XRP holders remain cautious. Exchange balance data shows little movement over recent days, indicating that investors are neither aggressively accumulating nor distributing tokens. This flatlining suggests hesitation as participants await a clearer market direction.

While the lack of inflows limits immediate upside, the absence of large-scale selling reduces downside pressure. Neutral positioning often reflects uncertainty rather than bearish conviction. For XRP, stability at current levels may provide a base for future moves once stronger signals emerge.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

XRP Exchange Balance. Source: Glassnode

XRP Exchange Balance. Source: Glassnode

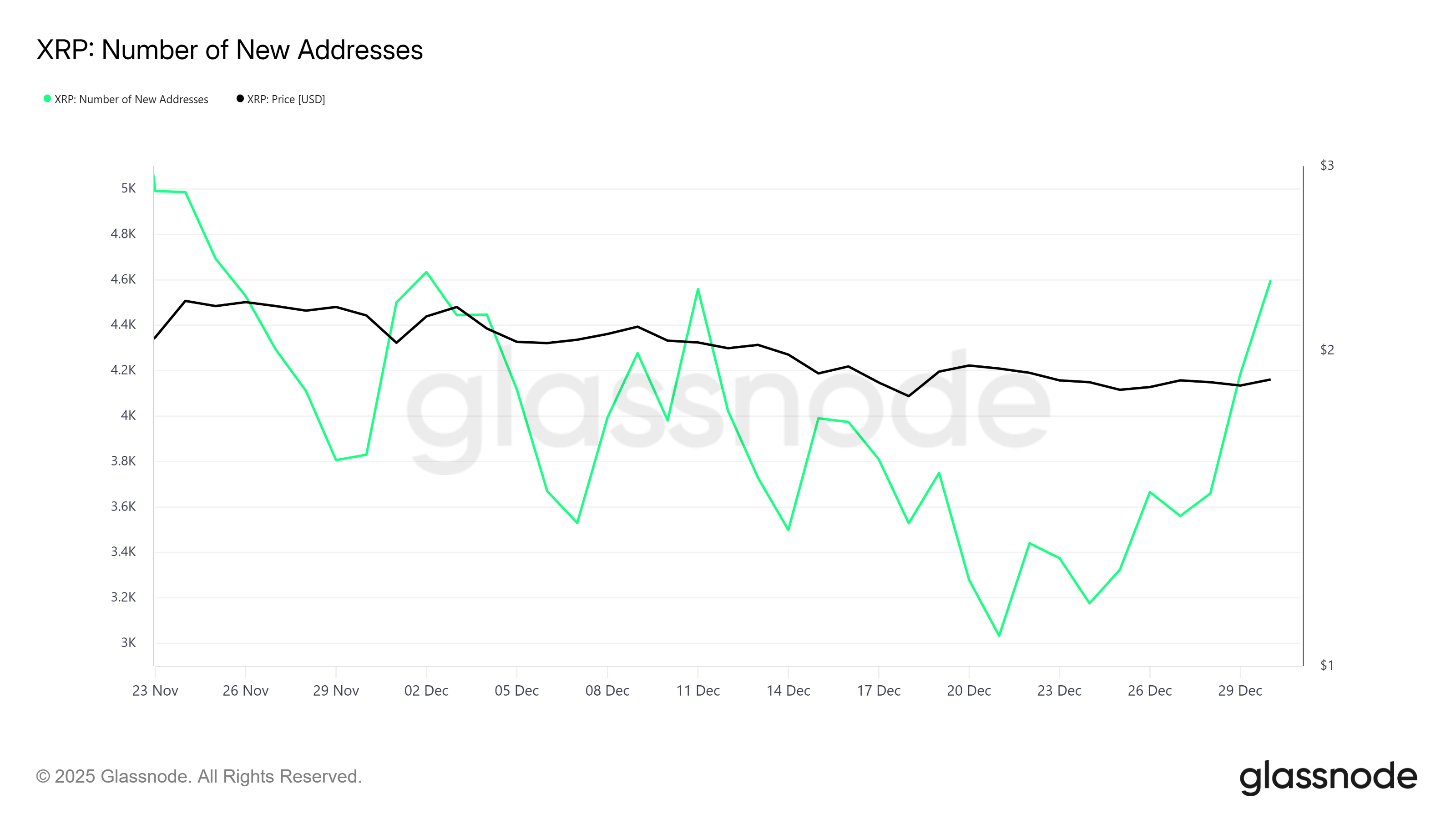

On-chain data points to a shift beneath the surface. The number of new XRP addresses has spiked sharply, reaching a monthly high. This trend likely reflects a new-year influx of participants seeking exposure ahead of potential catalysts, including ETF-related developments.

If these new addresses translate into sustained capital inflows, macro momentum could improve. Fresh participants often bring incremental demand, supporting price appreciation. However, address growth alone does not guarantee bullish outcomes without accompanying transaction volume and retention.

XRP New Addresses. Source: Glassnode

XRP New Addresses. Source: Glassnode

XRP Price Recovery Will Be Slow

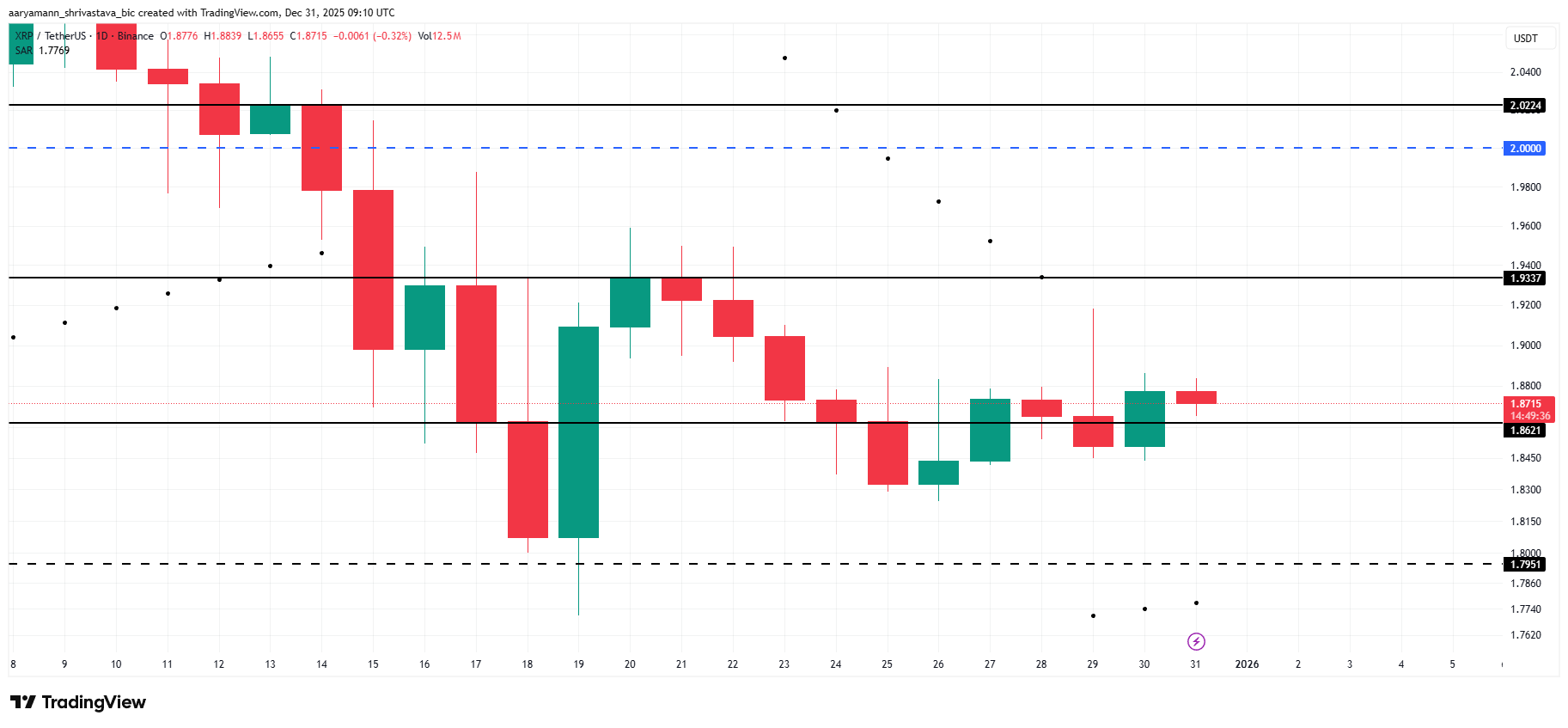

XRP trades at $1.87 at the time of writing, holding just above the $1.86 support level. Price has hovered around this zone for several sessions, suggesting a balance between buyers and sellers. This range-bound behavior reflects ongoing indecision across the market.

A renewed rally depends on accumulation returning alongside continued inflows from new investors. For XRP to challenge $2.00, the price must first clear resistance near $1.93. A sustained move above that level would signal improving momentum and strengthen short-term bullish expectations.

XRP Price Analysis. Source: TradingView

XRP Price Analysis. Source: TradingView

Downside risk remains if sentiment deteriorates. Failure to hold $1.86 could expose XRP to a pullback toward $1.79. Such a move would invalidate the bullish thesis and reinforce the broader consolidation narrative until stronger demand reappears.

You May Also Like

Ethereum unveils roadmap focusing on scaling, interoperability, and security at Japan Dev Conference

Michaël van de Poppe voorspelt grote rotatie naar Bitcoin: BTC-goudratio geeft bullish signaal