Bitcoin Price Drops 1% in New Year’s Eve: Here is a Critical Level to Watch in 2026

The post Bitcoin Price Drops 1% in New Year’s Eve: Here is a Critical Level to Watch in 2026 appeared first on Coinpedia Fintech News

Bitcoin (BTC) price has closed 2025 trading below crucial support levels around $100k and 90k. The flagship coin dropped over 1% in the past 24 hours to trade at about $87,255 at press time.

Key Midterm Level To Watch for Bitcoin

After closing 2025 in a choppy consolidation, Bitcoin will begin 2026 on a high bullish note. The strong fundamentals for 2025, including the impressive performance of spot BTC ETFs and treasury companies, are expected to fuel bullish sentiment in the coming months.

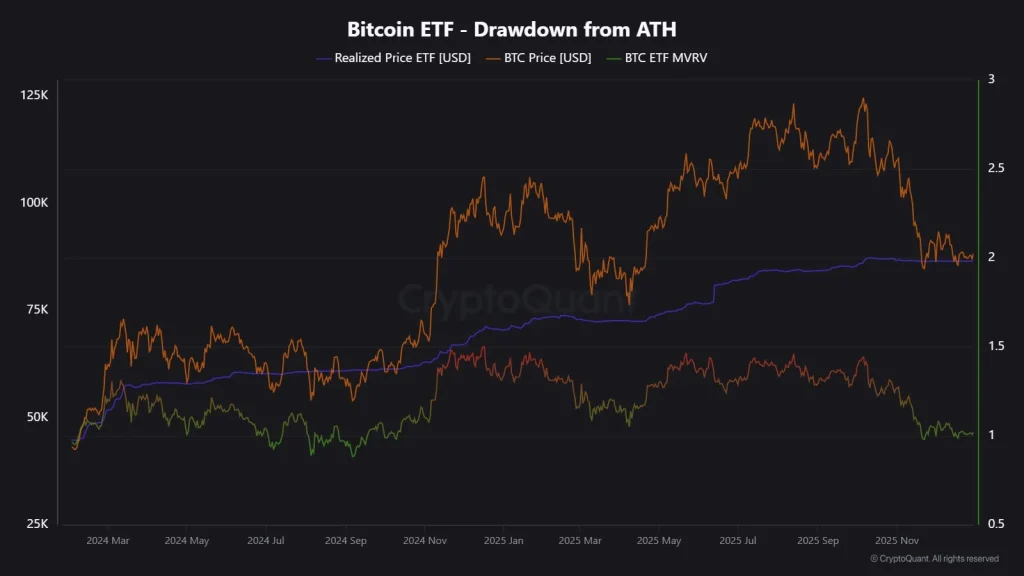

From a technical analysis standpoint, CryptoQuant’s data showed that BTC price has been retesting a crucial support level around $86.5k. According to CryptoQuant, this support level is the average cost basis for spot Bitcoin ETF buyers.

With U.S. spot BTC ETFs recording a cumulative net cash inflow of over $56 billion, the support level around $86.5k is well positioned to hold in 2026.

Source: X

Wall Street Anticipates a Bullish Outlook in 2026

2025 was marked by a significant adoption of crypto by institutional investors catalyzed by regulatory clarity. However, the wider crypto market closed 2025 in losses, thus underplaying the robust fundamentals.

However, Tom Lee, Chairman of BitMine, believes that 2026 will be bullish for crypto after underperforming the precious metals industry in 2025. Lee stated that Gold moves lead crypto, based on the liquidity flow during prior bull markets.

The upcoming regulatory clarity in the United States through the Clarity Act is expected to further attract more capital to the crypto market. With the ongoing global cash printing amid monetary policy easing, Bitcoin is well-positioned to rally exponentially in 2026.

You May Also Like

Craft Ventures Opens Austin Office

Crypto Market Cap Edges Up 2% as Bitcoin Approaches $118K After Fed Rate Trim