Blockchain Adoption Ready for Liftoff, Says XDC Network Co-Founder

TLDR:

- Retail users are now driving institutional blockchain adoption rather than the traditional top-down approach.

- XDC Network embeds ISO 20022 compliance directly into infrastructure to ease institutional integration.

- Khekade compares blockchain’s current state to a rocket on the launch pad ready for major breakthrough.

- Favorable 2026 regulatory environment creates opportunities for mainstream blockchain market integration.

Blockchain adoption has reached a critical inflection point, according to Atul Khekade, co-founder of XDC Network.

Speaking at the New York Stock Exchange, Khekade outlined how institutional interest and regulatory clarity are propelling the technology forward.

Banking Pain Points Drive Blockchain Innovation

Khekade’s journey into blockchain stemmed from years of frustration with traditional banking systems. Cross-border payments remained painfully slow while trade finance processes required excessive paperwork.

These inefficiencies created obvious opportunities for technological disruption through distributed ledger solutions.

The XDC Network emerged as a direct response to these challenges. Originally called “Exchange Infinite Digital Coin,” the platform evolved through community collaboration.

The network now focuses on bridging traditional finance with decentralized finance through real-world asset tokenization.

Trade finance represents a particularly compelling use case for the platform. Transactions that once took days or weeks can now complete in minutes.

Transparency increases while costs decrease, creating value for all participants in the financial ecosystem.

Retail users are driving institutional adoption rather than the reverse. Financial institutions now respond to customer demands for blockchain-based services.

This shift reverses the traditional top-down approach where institutions led innovation efforts independently.

Institutional Adoption and Regulatory Tailwinds

Interoperability stands at the core of XDC’s technical strategy. The network maintains compliance with ISO 20022 standards, ensuring alignment with existing regulatory frameworks.

This approach eases integration for traditional financial institutions exploring blockchain solutions.

Compliance gets embedded directly into the network’s infrastructure rather than added as an afterthought. This design choice builds trust with regulated entities and simplifies the transition process.

Financial institutions can adopt the technology without overhauling their entire compliance apparatus.

Last-mile connectivity ensures smooth integration into everyday transactions. The platform removes complex procedural barriers that historically slowed blockchain adoption.

Transaction banking and digital asset management become more efficient through these streamlined processes.

Major financial institutions and corporations are showing increased interest in partnerships. The growing recognition from established players validates XDC’s approach to solving real-world problems.

Trust in the technology continues building as more entities explore practical applications.

The regulatory environment in 2026 appears increasingly favorable for blockchain expansion. Governments are taking more proactive stances toward digital assets and decentralized technologies.

This shift creates opportunities for broader market integration across multiple jurisdictions.

Khekade compared the current state of blockchain adoption to a rocket on the launch pad. Years of groundwork have positioned the technology for a major breakthrough.

Both institutions and consumers are embracing cryptocurrency solutions, suggesting the industry has moved past experimental phases into mainstream implementation.

The post Blockchain Adoption Ready for Liftoff, Says XDC Network Co-Founder appeared first on Blockonomi.

You May Also Like

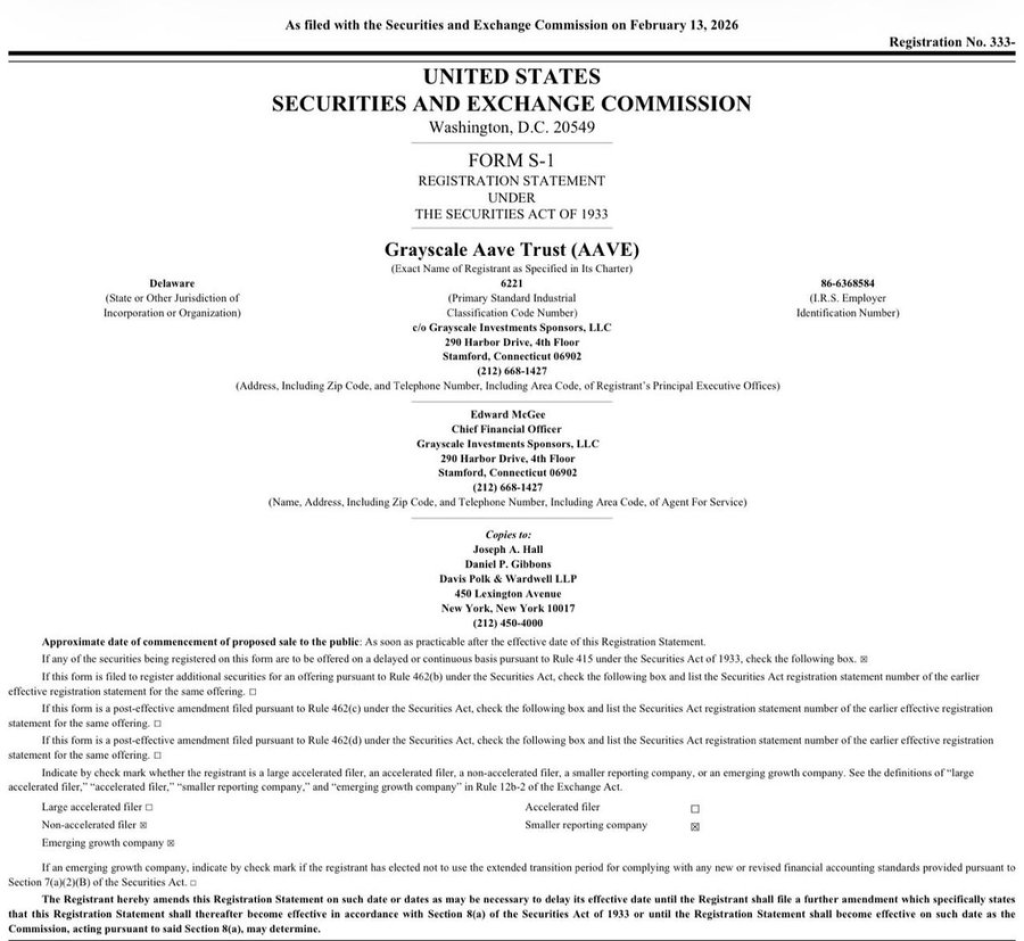

Will SEC Approve the First DeFi ETF? AAVE Filing Sparks Big Question

Bitcoin Maintains Edge in Market Fluctuations