What’s Behind the 18% SUI Price Rally?

SUI SUI $1.98 24h volatility: 18.1% Market cap: $7.53 B Vol. 24h: $2.10 B is drawing market attention again, rising 18% in the last 24 hours and moving closer to $2.

On the weekly chart, SUI is outperforming many top crypto assets, including XRP XRP $2.38 24h volatility: 11.9% Market cap: $144.57 B Vol. 24h: $8.98 B , DOGE DOGE $0.15 24h volatility: 2.8% Market cap: $25.44 B Vol. 24h: $1.81 B , and ADA ADA $0.42 24h volatility: 5.8% Market cap: $15.50 B Vol. 24h: $940.47 M , with a 38% gain.

On-chain and derivatives data indicate a significant improvement, pushing the altcoin to a two-month high.

SUI’s Price Hits Two-Month Highs With Improving Market Sentiment

SUI has started the year 2026 on a very solid footing after breaking out from the falling wedge pattern in the last week of December.

The daily trading volume for SUI has surged by 97% to over $1.8 billion, showing strong bullish sentiment among traders.

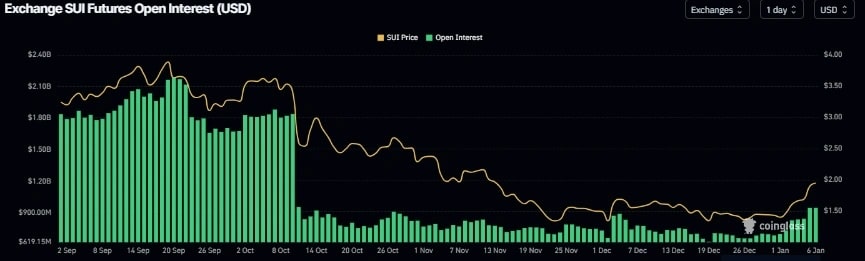

On the derivatives side, Coinglass shows a sharp rise in SUI futures activity.

Open interest across exchanges climbed to $947.26 million on December 6, up from $685 million a day earlier, which is the highest level since October 10.

SUI futures open interest. | Source: Coinglass

The increase in open interest indicates fresh capital entering the market. Analysts note that such an expansion in futures exposure often reflects rising buying interest.

Data from crypto intelligence platform DefiLlama shows that Sui’s total value locked (TVL) has been on a steady upward trajectory since late December, reaching $1.04 billion on Jan. 6.

The sustained rise in TVL points to increasing activity across the Sui ecosystem.

SUI DeFi TVL. | Source: DefiLlama

On the other hand, asset managers like Bitwise are pushing ahead for a spot SUI ETF.

In mid-December, Bitwise submitted an S-1 filing to the U.S. Securities and Exchange Commission (SEC) for an ETF that tracks the SUI native token.

Promoting Privacy Tech

Mysten Labs, the primary developer behind the Sui blockchain, recently explained how modern blockchains can integrate privacy features without fully adopting the architectures used by legacy privacy coins.

They released a paper that offers an academic survey of existing privacy approaches rather than proposing a single new protocol.

It introduces a structured framework for comparing privacy models across blockchains, defining multiple levels of privacy.

This ranges from basic confidentiality, such as hiding transaction amounts, to more advanced models like k-anonymity and full anonymity.

Within this framework, Sui is positioned as an account-based blockchain, alongside networks such as Ethereum ETH $3 238 24h volatility: 2.2% Market cap: $390.89 B Vol. 24h: $26.91 B

and Solana SOL $139.1 24h volatility: 2.9% Market cap: $78.41 B Vol. 24h: $5.75 B .

Bitcoin Hyper Presale Tops $30M, Bringing Smart Contracts to Bitcoin

Bitcoin Hyper, the Layer-2 scalability solution, is gaining momentum again, having raised over $30 million in its presale. The project aims to bring smart contract functionality to Bitcoin through a Layer-2 network built on Solana’s Virtual Machine.

Bitcoin Hyper plans to enable cross-chain compatibility with Ethereum, Solana, and other major blockchains. This could help expand Bitcoin’s use cases far beyond simple transfers, opening the door to more complex decentralized applications.

Tokenomics of Bitcoin Hyper

- Ticker: HYPER

- Price: $0.013535

- Presale Raise: $30.1 million/

The team is focused on overcoming Bitcoin’s current limitations, including transaction speed, while also introducing DeFi capabilities. Interested in joining the presale? Feel free to check out our guide on how to buy Bitcoin Hyper.

nextThe post What’s Behind the 18% SUI Price Rally? appeared first on Coinspeaker.

You May Also Like

Another Nasdaq-Listed Company Announces Massive Bitcoin (BTC) Purchase! Becomes 14th Largest Company! – They’ll Also Invest in Trump-Linked Altcoin!

WorkJam Raises the Bar for Frontline Operations Platforms with Major Release