Coinbase Exec Warns Quantum Computing Threatens 33% of Bitcoin Supply – Here’s Why

A warning from a senior Coinbase executive has reignited concerns about how quantum computing could one day reshape Bitcoin’s security, with new estimates suggesting that roughly a third of the network’s total supply could be exposed under certain conditions.

David Duong, Global Head of Investment Research at Coinbase, said in a recent post that Bitcoin may be entering a “new regime” as quantum computing advances, even if the threat is not immediate.

Duong pointed to growing institutional awareness of the issue, including BlackRock’s decision to flag quantum risks in the amended prospectus for its iShares Bitcoin Trust ETF in May 2025 and guidance from U.S. and EU authorities urging critical infrastructure to migrate to post-quantum cryptography by 2035.

Why Researchers Say a Third of Bitcoin Could Face Quantum Risk

At the center of the concern is what researchers often call “Q-day,” the point at which cryptographically relevant quantum computers become powerful enough to undermine today’s public-key systems.

Bitcoin relies on elliptic curve cryptography to secure wallets and on SHA-256 for mining.

Duong said quantum machines capable of running Shor’s algorithm could theoretically derive private keys from exposed public keys, allowing attackers to steal funds, while Grover’s algorithm could eventually make mining more efficient.

For now, signature security is viewed as the more urgent issue.

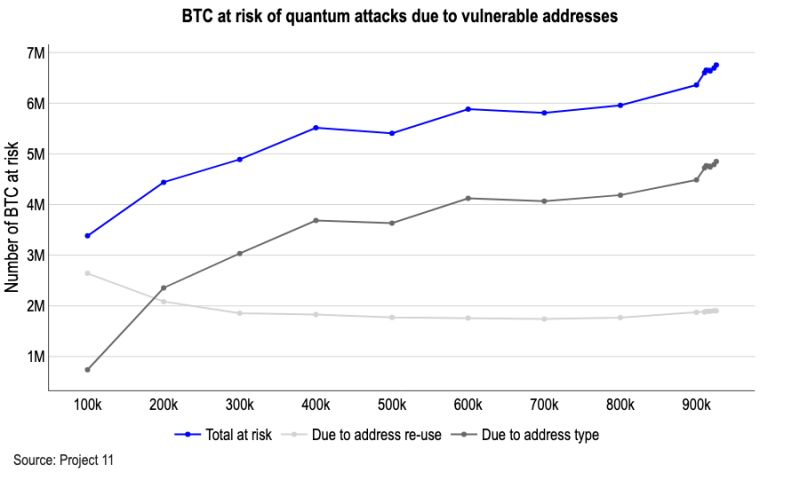

Based on on-chain data through block 900,000, Duong estimated that about 6.51 million BTC, or roughly 32.7% of the total supply, sits in address types that are more vulnerable to long-range quantum attacks.

Source: David Duong

Source: David Duong

These include legacy Pay-to-Public-Key outputs, bare multisig scripts, and some Taproot constructions where public keys are already visible on-chain. Satoshi-era coins are a well-known subset of this category.

In addition, Duong noted that every Bitcoin transaction briefly exposes a public key at the moment of spending, creating a short-range attack window if a sufficiently advanced quantum computer were ever available.

The warning builds on a broader industry debate that has intensified over the past year. On-chain analysts have highlighted that a large share of Bitcoin has remained dormant for long periods, with data showing more than 30% of supply unmoved for at least five years.

Some researchers argue that those coins would be the first targets if quantum attacks became feasible, while others say the larger challenge would be coordinating how the network responds.

Bitcoin’s Quantum Debate Moves From Theory to Planning

Not everyone agrees on the urgency, as in December, Blockstream CEO Adam Back pushed back against claims that Bitcoin faces an imminent quantum crisis, saying developers are already working quietly on long-term protections without inflaming markets.

Venture investor Nic Carter disagreed, arguing that too many in the ecosystem remain in denial and pointing to government preparations and rising investment in quantum firms as signs the risk deserves more attention.

The divide extends to timelines, with Capriole Investments founder Charles Edwards warning that quantum threats could materialize within a decade without upgrades, while others place the risk further out.

Strategy executive chairman Michael Saylor has taken a more optimistic view, saying that a quantum breakthrough would ultimately “harden” Bitcoin as active coins migrate to new standards and inaccessible coins remain frozen, reducing effective supply.

Despite differing opinions, preparations are underway. Bitcoin developers have discussed post-quantum signature schemes, and the U.S. National Institute of Standards and Technology finalized several quantum-resistant standards in 2024.

Implementing them on Bitcoin would require broad consensus and likely a hard fork, a process complicated by inactive wallets and the network’s decentralized governance.

Researchers continue to warn that adversaries may already be collecting blockchain data today in anticipation of future breakthroughs.

You May Also Like

Fed Decides On Interest Rates Today—Here’s What To Watch For

Best Crypto to Buy as Saylor & Crypto Execs Meet in US Treasury Council