Sui (SUI) Surges by 18% Daily: New ATH Knocking on the Door?

The cryptocurrency market extended its rally today (January 6), with Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), and many other leading digital assets posting additional gains.

Sui (SUI) has witnessed an even more impressive increase, with its price surging by almost 20% over the past 24 hours. Numerous analysts now believe it could be on the verge of a major bull run that might result in a new all-time high.

The Next Targets

SUI’s price currently trades just below $2, the highest level since mid-November. Its market capitalization soared above $7.5 billion, making it the 27th-largest digital asset, bigger than Litecoin (LTC), Hyperliquid (HYPE), and other popular altcoins.

X user Crypto Winkle noted SUI’s recent uptrend, arguing the price has initiated a “clean break” above $1.80 with “strong structure.” The analyst also claimed that on-chain activity has substantially increased since late November, usage has been growing, whereas the ETF filings “add institutional context, not just hype.”

X users Crypto Catalysts and MOON JEFF gave their two cents, too. The former set the ambitious target of at least $8 in the coming weeks, whereas the latter described SUI as “underrated” and said he won’t be surprised if its market capitalization explodes to $30 billion “in a good altseason.”

Lucky, who has almost 2 million followers on X, is also bullish. At the start of 2026, the analyst suggested SUI might be gearing up for a positive first quarter, envisioning a rise to approximately $4.44.

High-Risk Area?

While most analysts who have touched on SUI forecast further gains in the short term, some think an impending correction could also be an option. X user Chill Trader claimed the asset currently represents a “high-risk area,” arguing that a pullback won’t be surprising.

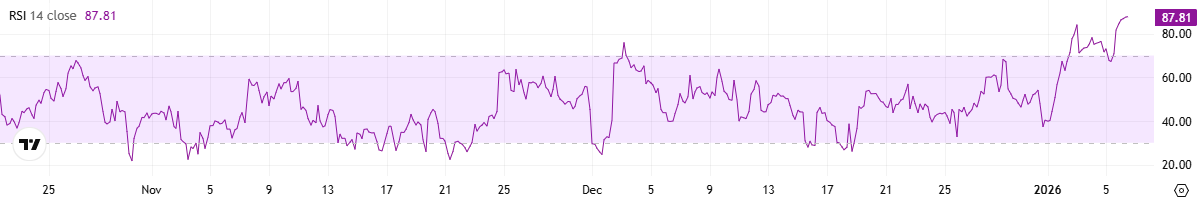

SUI’s Relative Strength Index (RSI) should also serve as a warning to investors. Traders use the technical analysis tool to spot possible trend reversals, as it indicates when the token is overbought or oversold. It ranges from 0 to 100, and anything above 70 suggests the price has increased too much in a short period and could be due for a plunge. On the other hand, ratios below 30 are considered buying opportunities.

Just recently, SUI’s RSI climbed to 87, the highest point witnessed since July last year.

SUI RSI, Source: CryptoWaves

SUI RSI, Source: CryptoWaves

The post Sui (SUI) Surges by 18% Daily: New ATH Knocking on the Door? appeared first on CryptoPotato.

You May Also Like

Bitcoin ETFs Surge with 20,685 BTC Inflows, Marking Strongest Week

Best Crypto to Buy as Saylor & Crypto Execs Meet in US Treasury Council