Barclays steps into stablecoin infrastructure with Ubyx investment

- Ubyx focuses on clearing and reconciling stablecoins issued by different providers.

- Barclays is prioritising regulated tokenised money rather than issuing its own stablecoin.

- The stablecoin market continues to be dominated by Tether, with most usage confined to crypto trading.

Barclays has taken its first direct step into the stablecoin sector by investing in US-based settlement firm Ubyx, marking a shift in how the British lender is approaching digital money.

The move, as reported by Reuters, comes as global banks cautiously test how blockchain-based payment systems could be integrated into regulated finance.

Rather than issuing a token of its own, Barclays is backing market infrastructure that sits behind stablecoins.

The investment also reflects renewed institutional interest in crypto-linked systems after a sharp rebound in digital asset markets and a more supportive stance from US President Donald Trump toward the sector.

What Ubyx does

Ubyx, launched in 2025, operates as a clearing and settlement layer for stablecoins.

Its core function is to reconcile tokens issued by different stablecoin providers, allowing them to move more smoothly across platforms.

Stablecoins are cryptocurrencies designed to track mainstream currencies on a one-to-one basis, most commonly the dollar.

While they are widely used within crypto trading, their fragmented issuance model has limited broader interoperability.

Ubyx aims to address that fragmentation by acting as a neutral clearing system rather than a token issuer.

Barclays has not disclosed the size or valuation of its stake, but confirmed it is the bank’s first investment in a stablecoin-related company.

Other backers of Ubyx include the venture capital arms of Coinbase and Galaxy Digital, according to PitchBook data.

Why banks are paying attention

Over the past year, banks and financial institutions have revived discussions around stablecoins and tokenised assets.

This renewed momentum has been driven by rising crypto prices and political signals in the US that are perceived as more favourable to the sector.

Stablecoins are increasingly viewed as a potential bridge between traditional finance and blockchain systems, particularly for settlement and cross-border transfers.

Despite this interest, most bank-led blockchain initiatives remain at an early stage. Institutions are still assessing regulatory boundaries, operational risks, and real-world demand.

Barclays has framed its involvement with Ubyx as part of a broader effort to explore tokenised money that remains within existing regulatory frameworks, rather than operating in parallel systems outside them.

Regulatory perimeter focus

A key element of the Barclays-Ubyx relationship is its emphasis on regulation.

The bank has said the collaboration is intended to support the development of tokenised money within the regulatory perimeter.

This approach aligns with how major lenders are positioning themselves in the digital asset space, prioritising compliance and supervisory clarity over speed.

In October, Barclays was among 10 banks, including Goldman Sachs and UBS, that announced a joint initiative to explore issuing a stablecoin linked to G7 currencies.

That project highlighted growing coordination among large banks, even as concrete launches remain some way off.

Stablecoin market context

The stablecoin market has expanded rapidly in recent years.

The sector is dominated by Tether, which has about $187 billion worth of tokens in circulation.

Despite their size, stablecoins are still primarily used for transferring funds within crypto markets rather than for everyday payments or corporate settlement.

By investing in Ubyx, Barclays is targeting the infrastructure that could support wider adoption if stablecoins move beyond their current niche.

The strategy suggests that major banks are preparing for multiple future scenarios, even as the practical use of stablecoins in mainstream finance remains limited for now.

The post Barclays steps into stablecoin infrastructure with Ubyx investment appeared first on CoinJournal.

You May Also Like

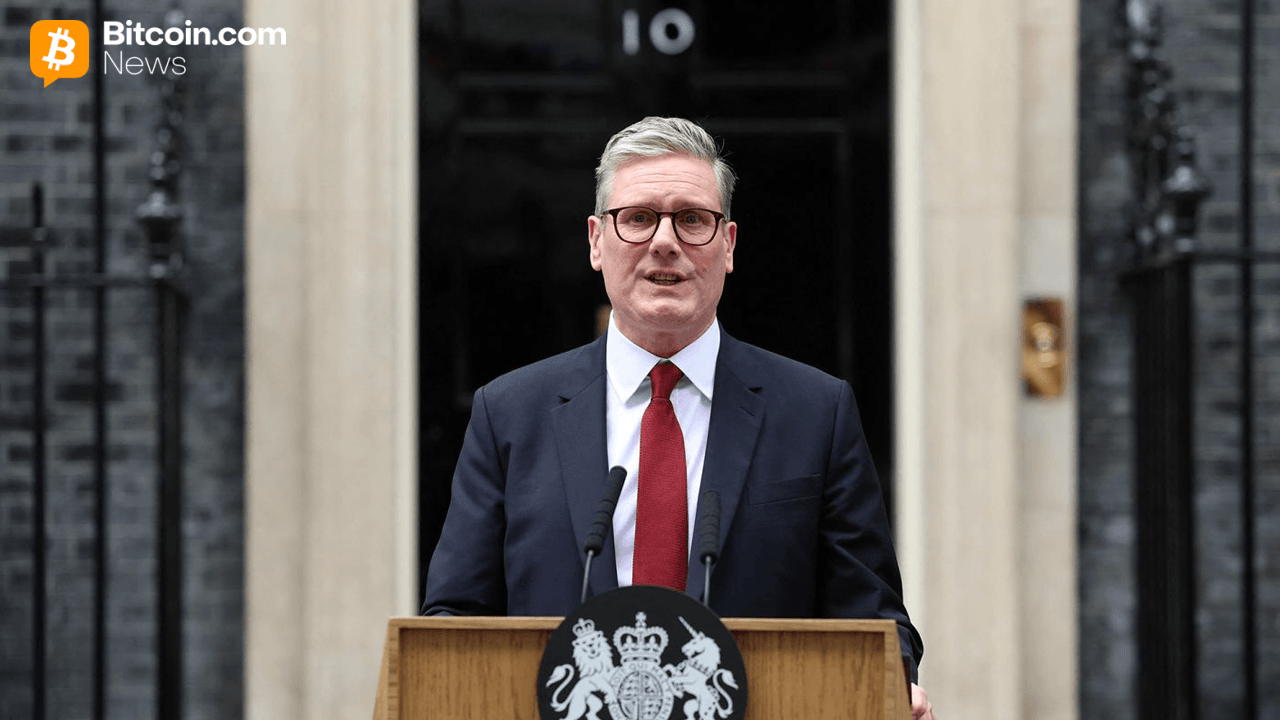

UK Lawmakers Push Starmer to Ban Crypto Donations Amid Foreign Interference Fears

SEC Approves Generic Listing Standards for Crypto ETFs