Sen. Kennedy Confirms CLARITY Act Vote Next Week

Highlights:

- The Senate Banking Committee will vote on January 16, 2026, on CLARITY Act crypto rules.

- Chairman Tim Scott plans to vote even without full agreement among senators.

- The CLARITY Act names CFTC as the primary regulator and clarifies securities law application.

The Senate Banking Committee will hold a markup vote on crypto market regulation next Thursday, January 16, 2026, Senator John Kennedy confirmed on January 6. This vote will decide how the SEC and CFTC supervise cryptocurrency markets.

CLARITY Act Vote Set Despite Unresolved Crypto Oversight Questions

Kennedy said, “The chairman is gonna have a vote, come hell or high water, on Thursday for next week.” Chairman Tim Scott plans to move forward even if full agreement among senators has not been reached. The CLARITY Act designates the CFTC as the main regulator for spot crypto markets while outlining how securities laws could apply. This is meant to provide clearer rules for an industry that has long lacked guidance.

Several questions remain, including how to regulate DeFi platforms and interest-paying stablecoins. Traditional banks warn that these stablecoins could compete with deposits, creating unfair competition. Regulatory authority is also debated. Giving the SEC primary control could bring back the enforcement-heavy approach seen under former Chair Gary Gensler. Lawmakers are deciding which tokens fall under SEC or CFTC oversight.

Ethics Concerns and Deadlines Put CLARITY Act at Risk

Ethical concerns add pressure, especially regarding President Trump’s crypto ventures. World Liberty Financial, a DeFi platform owned by the Trump family, earned $1 billion in profits by December while holding $3 billion in unsold tokens.

The Trump family receives 75% of the token sale proceeds. There are reports of secret deals with foreign investors, including Chinese-born billionaire Justin Sun, who invested $30 million. Soon after, an SEC investigation into Sun was dropped. Democrats are pushing for minority party representation at the SEC and CFTC to prevent one party from controlling regulatory decisions. This issue complicates negotiations and could affect the bill’s progress.

If the markup is delayed past January, the chances of passing the CLARITY Act drop sharply. The Senate must act by April to keep the bill on track to become law in 2026. The government resolution expires January 30. A shutdown could stall crypto legislation, and the November 2026 midterms might further delay decisions.

The House approved its version, the Digital Asset Market Clarity Act, in July 2025. The Senate must act so that differences can be reconciled and a unified bill sent to President Trump. Industry experts give the bill a 50% to 60% chance of passing this year. If successful, it would follow the GENIUS Act, signed July 18 last year, which requires stablecoin issuers to keep 100% reserves and meet anti-money laundering rules.

Crypto Market Bill Could Be Delayed to 2027, TD Cowen Says

Senate Democrats could delay the CLARITY Act, a key crypto law, until 2027, TD Cowen said Monday. Passing the bill before the November 2026 elections may be hard, as Democrats “are not interested in moving quickly,” the bank said last year. TD Cowen’s team, led by Jaret Seiberg, said Democrats’ plans to win the House could slow progress. The law might not be fully active until 2029.

eToro Platform

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

You May Also Like

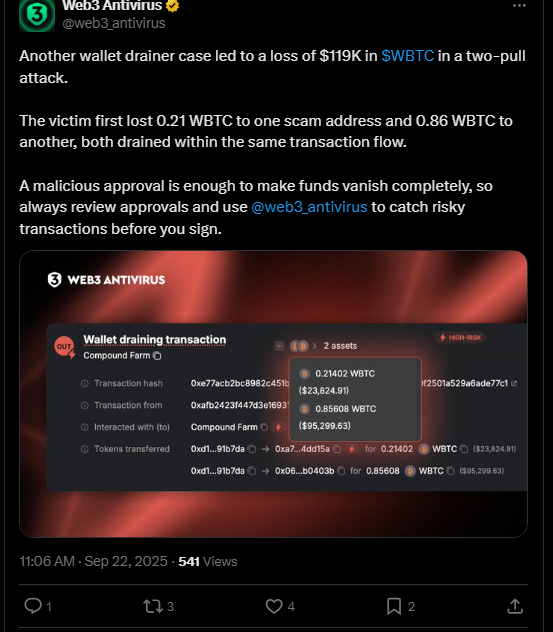

$119K WBTC Drained in Wallet Scam Amid Fake Airdrop Surge

SwayHorizonAi Reviews — Are Their Market Insights Legit? A Quick Overview