Ripple’s GTreasury Acquires Solvexia to Expand Compliance and Automation Capabilities

- Ripple’s GTreasury acquires Solvexia to strengthen governance, audit controls, and regulatory monitoring automation.

- As the acquisition bridges traditional finance and crypto.

- XRP Trades Lower Despite the Acquisition.

Fintech company Ripple has started its first acquisition of 2026 through its corporate treasury management company, GTreasury, as it acquires Solvexia. This approach deepens the connection between traditional finance and the crypto industry by automating transaction verification, compliance, and regulatory oversight, with XRP and RLUSD playing important roles.

GTreasury’s X handle post confirms that it has acquired Solvexia, a low-code automation company, on January 7th, which helps in automating reconciliation and regulatory reporting workflows.

As per the GTreasury official post, Renaat Ver Eecke, CEO of GTreasury, said, “The integration of GTreasury’s capabilities with Solvexia’s automation platform delivers unprecedented visibility and control across the entire finance function, protecting CFO’s reputation while ensuring governance and regulatory compliance.”

When GTreasury and Solvexia work together, they help organizations stay compliant and embed governance, audits, and lower regulatory risks. As the combination includes both fiat and digital asset transactions.

Ripple acquired GTreasury for $1 billion in October 2025, but the latest Solvexia purchase figures were not released.

GTreasury, currently a part of Ripple, and the latest inclusion of Solvexia make it simple for traditional financial institutions to use cryptos without disturbing their existing infrastructure. Ripple’s expansion allows it to integrate deeper into TradFi.

XRP Price Slips Despite the Acquisition

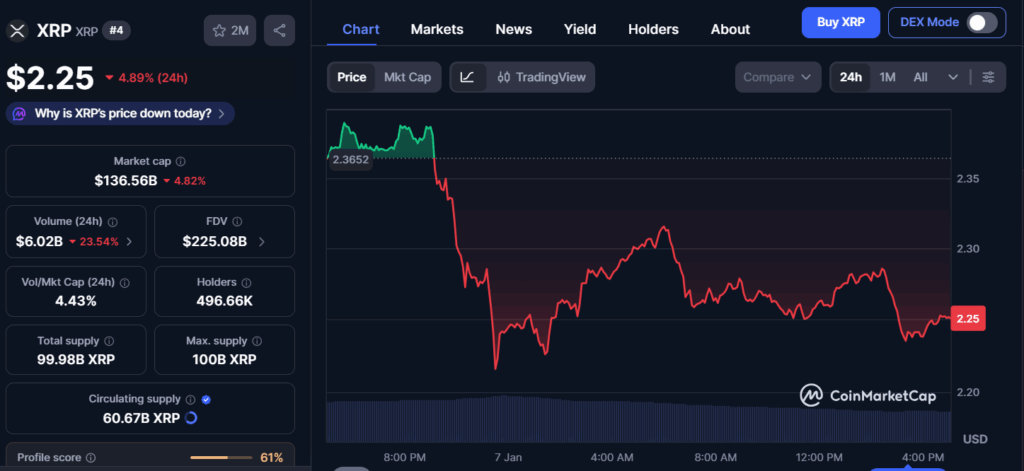

Source: CoinMarketCap

Source: CoinMarketCap

Even after this new acquisition, XRP is trading at $2.25, which is down 4.8%, after yesterday’s surge to $2.40. Also, the 24-hour trading volume has declined 23.24% and stands at $6.03 billion, which reflects that investors’ interest has been down as the market pauses to assess the impact of the development and looks for clearer price signals.

Highlighted Crypto News Today:

BNB Price Tension Builds: Can Bulls Reclaim Control, or Are They Facing a Pullback?

You May Also Like

Gold Hits $3,700 as Sprott’s Wong Says Dollar’s Store-of-Value Crown May Slip

CEO Sandeep Nailwal Shared Highlights About RWA on Polygon