Flowfinity Update Embeds AI Assistants into Workflows with Strengthened Access Control

VANCOUVER, BC, Jan. 8, 2026 /PRNewswire/ — Flowfinity, a leading business process management platform, today announced the release of a major update designed to help organizations modernize operations with AI-enhanced workflows, stronger security controls, and more intuitive data visualizations to help clients improve their workflows.

Now you can embed AI directly into your existing business processes using your own dedicated Model Context Protocol (MCP) servers using no-code tools. Teams can use AI assistants to summarize information, generate reports, update records, and provide recommendations based on reliable, governed data stored securely in Flowfinity.

Unlike standalone AI tools, Flowfinity enables businesses to integrate AI into the workflows where work already happens, ensuring outputs are contextual, reliable, and aligned with internal data policies. This allows organizations to experiment with AI confidently, delivering productivity gains without compromising control or data ownership.

Security remains a top priority for organizations managing sensitive data, that’s why Flowfinity now provides built-in multi-factor authentication (MFA) using time-based one-time passwords (TOTP). This significantly reduces the risk of unauthorized access through the now-familiar process of requiring a secondary 6-digit code from an authenticator app or hardware device.

Additionally, updated data visualizations in dashboard maps, calendars, and charts make it easier to understand what’s happening across operations at a glance. Improved visual clarity helps teams spot trends, track activity, and prioritize action for better decision-making and quicker response times in the event of an anomaly.

“Flowfinity has always been about helping business users achieve continuous improvement,” said Larry Wilson, VP. “Now we’re giving organizations new ways to enhance workflows with AI, strengthen access control, and gain better visibility into operations, all on one platform without the need to manage and integrate multiple tools.”

Flowfinity’s latest release reinforces their core promise: enabling business users to continuously improve processes without disruption to daily operations. By combining no-code flexibility, AI-ready workflows, enterprise-grade security, and intuitive analytics, Flowfinity is empowering organizations to adapt as their technology needs evolve.

To learn more or test drive the platform yourself, visit: www.flowfinity.com

About Flowfinity

Flowfinity provides a business process improvement platform designed to make it easier for companies to deliver workflow automation solutions efficiently and effectively. For over 25 years, our software has helped leading organizations, including Fortune 500 companies, public sector agencies, and forward-thinking SMBs innovate and grow.

Contact:

Alex Puttonen

604-878-0008

407076@email4pr.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/flowfinity-update-embeds-ai-assistants-into-workflows-with-strengthened-access-control-302655212.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/flowfinity-update-embeds-ai-assistants-into-workflows-with-strengthened-access-control-302655212.html

SOURCE Flowfinity Inc.

You May Also Like

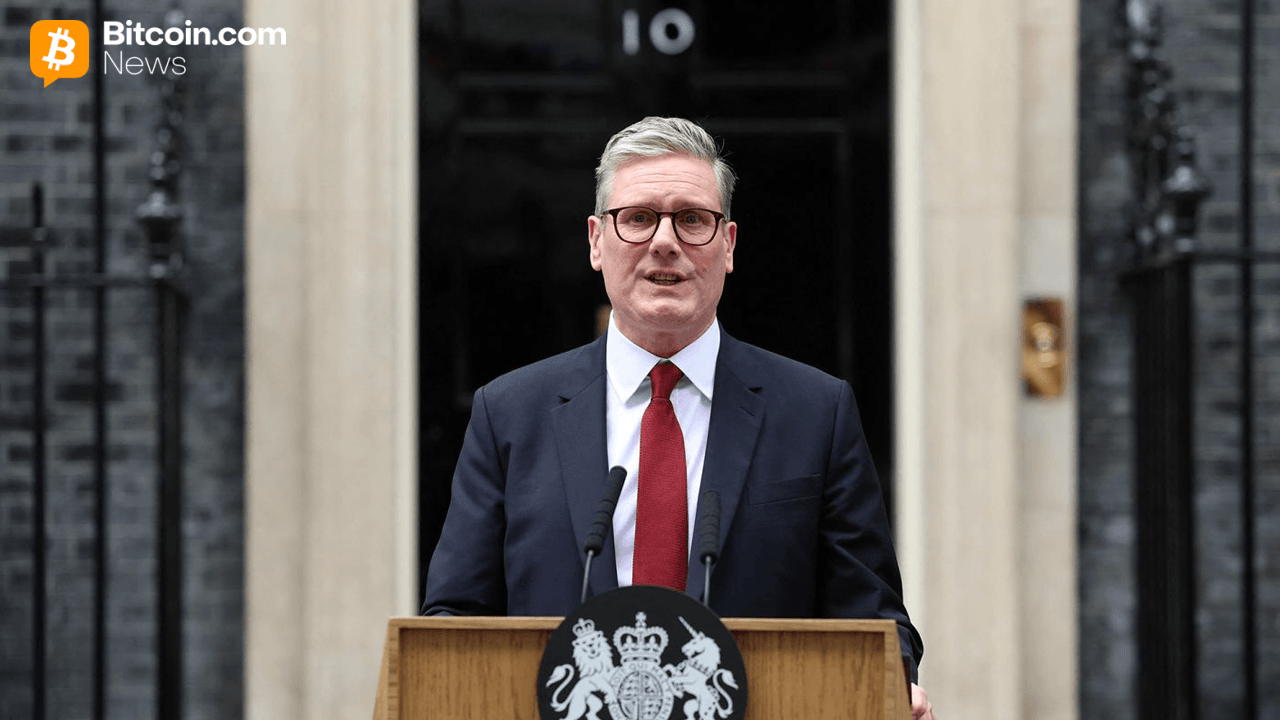

UK Lawmakers Push Starmer to Ban Crypto Donations Amid Foreign Interference Fears

SEC Approves Generic Listing Standards for Crypto ETFs