Are Traders Moving to XMR Following the ZCash Controversy

Zcash price has come under sharp pressure following internal turmoil within its core development team. The privacy-focused cryptocurrency recorded a steep decline as confidence weakened.

At the same time, market behavior suggests a possible rotation of capital from Zcash into Monero, raising questions about whether XMR could benefit from ZEC’s growing uncertainty.

Zcash Developers Quit

Electric Coin Company CEO Josh Swihart confirmed that the entire ECC team stepped down after what he described as “constructive discharge.” The term refers to circumstances where working conditions change so significantly that employees have no realistic option but to resign.

According to Swihart, decisions taken by the board overseeing ECC altered employment terms in ways that undermined the team’s ability to operate independently.

Zcash Holders Step Back

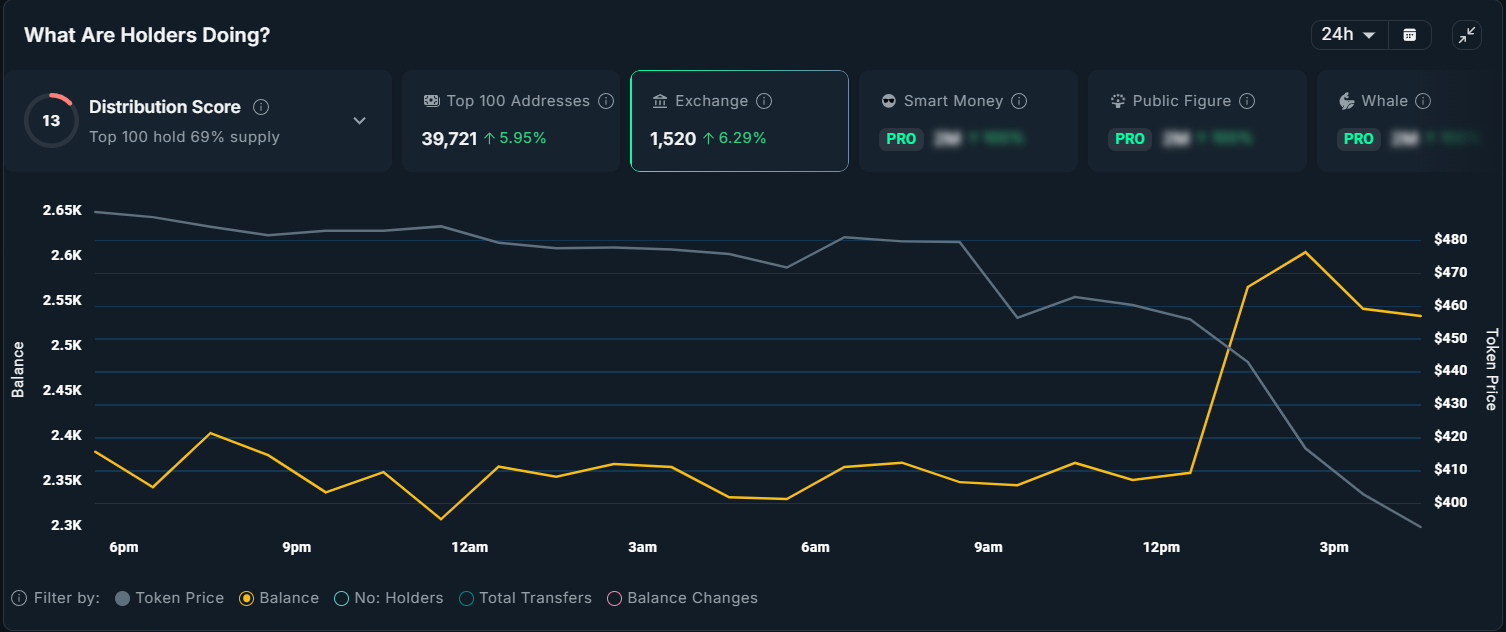

ZEC holders reacted swiftly to the announcement. On-chain data shows a surge in selling activity within hours. Nansen reported a sharp increase in exchange inflows, with ZEC balances on exchanges rising by roughly 7% in 24 hours.

Rising exchange balances typically indicate preparation to sell. This behavior highlights a sudden shift in sentiment among Zcash investors. Confidence eroded quickly as participants reassessed risk tied to leadership and development continuity.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Zcash Exchanges Balance. Source; Nansen

Zcash Exchanges Balance. Source; Nansen

Such rapid selling suggests skepticism rather than patience. When governance shocks occur, short- and mid-term holders often reduce exposure first. This response adds downward pressure during already volatile conditions.

XMR Gains From ZEC’s Loss

Capital flow data suggests potential rotation away from ZEC toward Monero. While not definitive, indicators point to divergent trends between the two privacy coins. Zcash’s Chaikin Money Flow turned negative, signaling net outflows.

During the same period, Monero’s CMF spiked upward, reflecting growing inflows. These opposing signals coincide with price action. Zcash price fell 16.7%, trading near $398, while XMR price climbed roughly 5% over the same window.

ZEC vs XMR CMF. Source: TradingView

ZEC vs XMR CMF. Source: TradingView

The timing suggests investors may be reallocating within the privacy sector rather than exiting it entirely. When uncertainty hits one project, capital often migrates toward perceived stability within the same narrative category.

XMR Could Reach Its ATH

Momentum indicators further support Monero’s improving outlook. XMR’s Money Flow Index surged sharply in the early hours following the Zcash announcement. MFI tracks buying and selling pressure using both price and volume.

A rising MFI indicates strong demand entering the market. In Monero’s case, the uptick suggests buyers are stepping in with conviction. This demand may reflect investors seeking exposure to privacy coins without governance disruption.

XMR MFI. Source: TradingView

XMR MFI. Source: TradingView

XMR currently trades near $456, placing it about 13.5% below its all-time high of $518.99. Sustained buying pressure could act as a catalyst. If capital continues shifting from ZEC, Monero may gain the momentum needed to challenge its previous peak.

You May Also Like

Headwind Helps Best Wallet Token

SEC Postpones Decision on Truth Social Bitcoin ETF