$3.8M is Flooding into Digitap ($TAP) While XRP Chases $2.50: Which is the Best Crypto to Buy Now for Payments?

The post $3.8M is Flooding into Digitap ($TAP) While XRP Chases $2.50: Which is the Best Crypto to Buy Now for Payments? appeared first on Coinpedia Fintech News

$3.8 million flowing into the Digitap ($TAP) crypto presale while XRP bulls target $2.50 in the coming week tells the real story of 2026. Payments are back in the spotlight, and the market is already picking winners for the coming banking bull run.

But which is the best crypto to buy now for payments? XRP has institutional adoption, and ETF volumes are impressive. But at a $130 billion valuation, XRP is already priced as if it were a finished product with global adoption.

Digitap is the opposite—it is about to enter its growth and scaling phase. With a user-first banking stack, a live app, and a presale price, $TAP is quickly becoming one of the hottest trades of 2026. As payments begin to dominate, investors need to start paying attention to the leading altcoins to buy in the banking race.

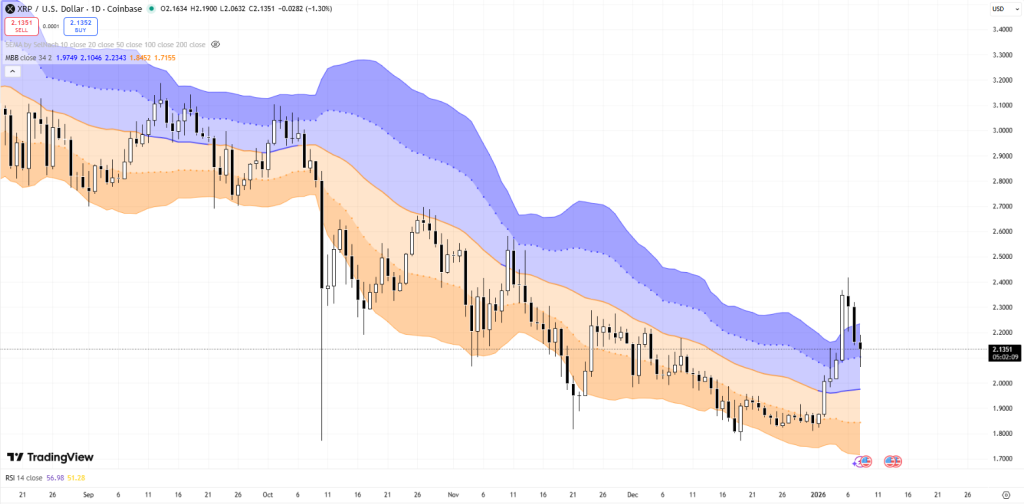

XRP Bulls Aim for $2.50 Next

XRP has been an excellent trade for anyone who bought it early, and now, for the first time in months, the chart is showing signs of life with a breakout. When the market wants a payments token, XRP is the first name that comes to mind, and a rally in XRP is a bullish sign for the rest of the sector.

The cross-border use case for crypto is very real. Legacy rails are slow, expensive, and full of friction. Blockchain settlement is much better at moving value across borders in terms of speed and cost. XRP’s $130 billion market cap is proof.

Now that XRP has broken back above $2, traders are aiming for $2.50 next, with a $3 target becoming consensus before the end of 2026. If Ripple can meaningfully break out and attention floods back to banking and payment tokens, the smaller caps in this sector could go on an aggressive rally in the coming weeks. And that’s why Digitap is attracting massive crypto presale inflows right now.

Digitap: Omni-Banking Built for the Consumer

Digitap is the world’s first omni-bank. A global money app that blends stablecoins, crypto, and fiat into one banking experience. It lets users move value on the fastest and cheapest rail available, whether that’s crypto or legacy banking rails. Today, anyone can download this app and unlock a new digital-first banking experience.

In many ways, Digitap is built to make crypto rails usable for people who are not crypto natives. Its neobanking style interface makes everything familiar while stablecoins and blockchains do the work in the background.

This is why this crypto presale is being framed as one of the fastest horses in the banking race. It is going after the consumer first and scaling through real-world adoption.

$TAP’s Non-KYC Visa Card & Multi-Rail Engine

Digitap’s non-KYC Visa card is arguably the biggest adoption driver right now, with thousands of sign-ups already. This Visa card turns on-chain balances into cash in the real economy and solves the last-mile problem.

The card also makes Digitap useful to two different user groups at once. Crypto natives get spending power with zero friction. Non-crypto users get a familiar payment experience, with improved settlement. This is how the next cohort is onboarded.

Digitap’s products also include multi-rail settlement, which is a serious plumbing upgrade. Funds can be routed via legacy rails or blockchain rails, depending on the most efficient option. And on the Digitap app, money just works better.

Offshore Banking & Global accounts

Digitap’s Premium and Pro tiers offer offshore banking and multiple global accounts. This is starting to matter much more in 2026 as financial restrictions tighten and compliance friction increases. Many users want options, and that’s what Digitap delivers.

These accounts offer multi-currency IBANs designed for enhanced privacy and asset protection. Ideal for users who live across borders.

XRP vs. $TAP: Which Altcoin to Buy Offers Better Tokenomics?

Tokenomics is the biggest decider in 2026. Investors don’t want useless governance tokens, and if a token does not capture value, it will likely underperform this year.

Digitap is leaning into this new reality, and the native $TAP token is an ownership layer tied to platform activity. 50% of platform profits fund the token flywheel, which includes token burns and staking rewards. That means as the platform scales, token holders share this success, and the current price of $0.0411 looks very undervalued, especially with a confirmed listing price of $0.14.

XRP should go to $2.50 and be a solid trade, but it cannot match $TAP’s upside potential. If XRP rally and payments become a leading narrative this year, $TAP could easily deliver 10X returns. This crypto presale already looks like a payments front-runner, and is easily one of the most interesting altcoins to buy this year.

Discover the future of crypto cards with Digitap by checking out their live Visa card project here:

- Presale https://presale.digitap.app

- Website: https://digitap.app

- Social: https://linktr.ee/digitap.app

- Win $250K: https://gleam.io/bfpzx/digitap-250000-giveaway

You May Also Like

Which Altcoins Stand to Gain from the SEC’s New ETF Listing Standards?

Doorbraak voor altcoins: SEC keurt Grayscale’s GDLC ETF goed