Crypto Market Alert: We’re Entering an Ethereum Boom — Expert Analysis

Ethereum’s Price Trends Signal Renewed Confidence Amid Market Fluctuations

Ethereum’s native cryptocurrency, Ether, appears to be on a recovery path following a bottoming out in April 2025. Market analysts observe that the recent price movements mirror the 2019 cycle, hinting at a potential bullish phase. Increased on-chain activity, particularly in stablecoins and tokenized assets, coupled with a resurgence in developer engagement, bolster optimism about Ethereum’s near-term prospects.

Key Takeaways

- Stablecoin supply on Ethereum has surged over 65% in 2025, reaching historical highs, signaling robust on-chain activity.

- The total stablecoin market capitalization exceeds $163.9 billion, with Tether’s USDt accounting for roughly half of the market.

- Ethereum processed over $8 trillion in stablecoin transfers in Q4 2024, underscoring increasing utility and transaction volume.

- The ETH-BTC ratio, a key indicator of relative strength, has rebounded from April lows, suggesting a potential shift in market sentiment.

Tickers mentioned: Ether, Ethereum, Bitcoin, Tether

Sentiment: Bullish

Price impact: Positive. The rise in stablecoins and on-chain activity points toward renewed investor interest and confidence.

Market Dynamics and Technical Insights

After briefly surpassing the $3,300 mark, Ether’s price retreated to approximately $3,100 at the time of publication. Despite the dip, experts interpret this price action as a healthy correction within an ongoing bullish cycle. Maintaining above its 365-day moving average, Ether’s recent climb above this resistance level signals potential for further gains.

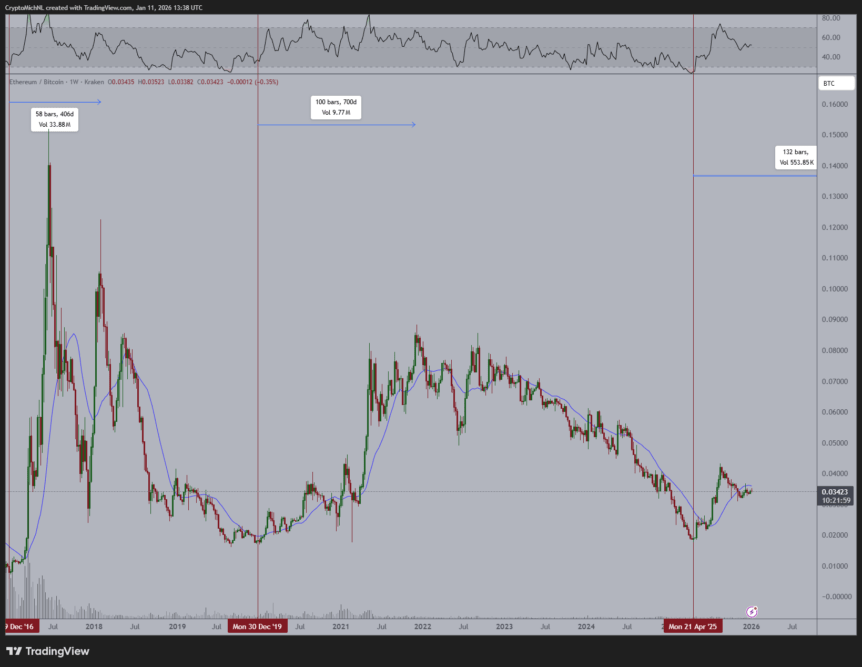

The stablecoin market cap on Ethereum. Source: DeFiLlamaFurthermore, the Ethereum-Bitcoin (ETH-BTC) ratio, a vital metric for assessing relative strength, has shown signs of recovery after bottoming out at 0.017 in April. The ratio surged to a high of 0.043 in August, before retracting slightly to 0.034, amid broader market turbulence in October.

The ETH-BTC ratio bottomed in April 2025 and has since rallied, indicating increasing relative strength. Source: Michael Van De Poppe

The ETH-BTC ratio bottomed in April 2025 and has since rallied, indicating increasing relative strength. Source: Michael Van De Poppe

According to sentiment analysis from Santiment, current investor confidence in Ethereum aligns with historically bullish patterns preceding significant price rallies. This suggests that the market may be approaching a new phase of growth, driven by positive on-chain indicators and renewed demand.

This article was originally published as Crypto Market Alert: We’re Entering an Ethereum Boom — Expert Analysis on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

Now Supports Coinbase’s Crucial Crypto Futures For Institutions

Banco Santander Launches Retail Crypto Trading via Openbank in Germany