Bitcoin Tops $92,000 As DOJ Subpoenas Escalate Trump-Powell Fight

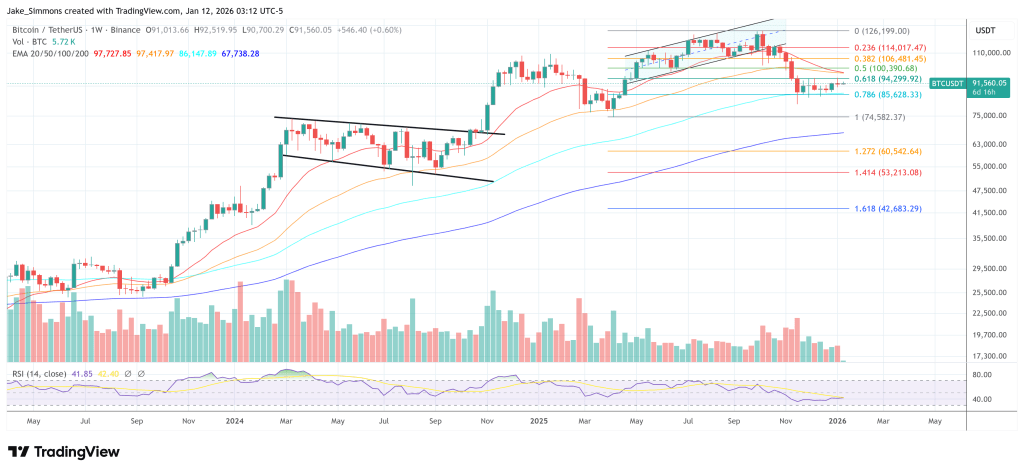

Bitcoin pushed above the $92,000 level late-Sunday as a legal escalation around Federal Reserve Chair Jerome Powell became public. The catalyst was Powell’s decision to publicly address Department of Justice subpoenas and a criminal probe he characterized as political pressure tied to the administration’s rate preferences.

In a video released Sunday evening, Powell directly addressed US President Donald Trump: “The threat of criminal charges is a consequence of the Fed setting rates based on our best assessment of what will serve the public, rather than following the preferences of the President.”

Bitcoin Community Reacts To The News

The Bitcoin and broader crypto market responded immediately with a decent push higher, while “metals [were] blasting to new highs,” as analyst Will Clemente wrote via X.

The timing matters for crypto traders: the Fed is heading into its January 28 meeting with the market increasingly primed for a pause in cuts, amplifying sensitivity to any perception that monetary policy is being pulled into partisan conflict.

For Bitcoin-native observers, the episode read like a real-time stress test of institutional trust: one that flatters Bitcoin’s pitch. Clemente added via X: “This environment is literally what Bitcoin was created for. The President is coming after the Fed chair. Metals are ripping as sovereigns diversify reserves. Stocks & risk assets at record highs. Geopolitical risk rising.”

Alex Thorn, head of firmwide research at Galaxy, put the contrast in monetary regimes front and center, arguing that Bitcoin’s “credibly neutral, predictable, transparent, and censorship resistant monetary policy looks pretty good here,” after flagging Powell’s view that the subpoenas are “pretexts” for administrative meddling in monetary policy.

Others used the moment to widen the indictment beyond any single personality. Bitwise advisor Jeff Park argued that “independence alone cannot be a virtue when the institution at its core is incompetent,” adding that “the age of Bitcoin is drawing nearer.” Walker, a prominent pro-Bitcoin voice, framed it as a structural problem: “The problem isn’t President Trump or Jerome Powell. The problem is a centralized cabal of unelected banker-bureaucrats set the price of money and print it out of thin air.”

Notably, the bullish reflex wasn’t rooted in sympathy for Powell. Strive CEO Matt Cole wrote he had “zero sympathy” for the Fed chair and accused the central bank of “gaslight[ing] the American people” on independence, concluding: “Bitcoin is even more underpriced than we realized…”

Bitcoin’s move through $92,000 puts that narrative onto a price chart, but the same political-legal feedback loop that fuels the “neutral money” thesis can also intensify volatility. “For the first time ever, Fed Chair Powell is fighting back: Over the last 12 months, Fed Chair Powell has remained silent amid President Trump’s criticisms,” The Kobeissi Letter wrote via X, adding: “Today, that changed. […] Trump vs Powell will result in even more volatility.”

At press time, Bitcoin traded at $91,560.

You May Also Like

American Bitcoin’s $5B Nasdaq Debut Puts Trump-Backed Miner in Crypto Spotlight