Bitcoin Surges Above $93K Following Low CPI Data: What to Expect Next?

The post Bitcoin Surges Above $93K Following Low CPI Data: What to Expect Next? appeared first on Coinpedia Fintech News

The crypto market bounced back after inflation data came in lower than expected. Core inflation rose by 0.2% for the month and 2.6% over the year, both slightly below forecasts. After the news, Bitcoin and the altcoin market saw small gains over the next few hours.

CPI Data Boosts Market Recovery

The stock and the crypto market are on a rise following cooling inflation data. U.S. inflation showed more signs of cooling in December, which has added hopes about the Federal Reserve’s next decision on interest rates. Prices rose more slowly than economists had expected, suggesting inflation pressures may be easing.

Excluding food and energy prices, consumer prices increased 0.2% from the previous month and 2.6% compared to a year earlier, according to government data released Tuesday. Both figures came in slightly below forecasts.

Also read: What to Expect From Bitcoin, Ethereum & XRP Prices Ahead of ‘CPI-Day’

Federal Reserve officials monitor overall inflation closely, but they tend to focus more on core inflation because it gives a clearer picture of longer-term trends.

Looking at all items, including food and energy, prices rose 0.3% for the month, bringing the annual inflation rate to 2.7%. These numbers matched market expectations exactly.

The Federal Reserve aims for inflation to run at about 2% a year, and this report suggests prices are slowly moving closer to that goal, even though inflation is still higher than normal.

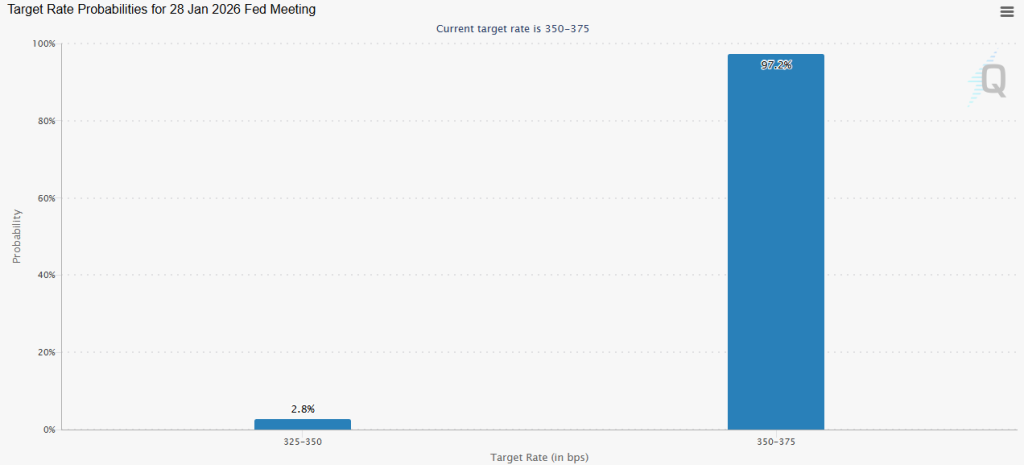

Target Rate Prediction: Fedwatch

Target Rate Prediction: Fedwatch

After the data was released, stock market futures surged significantly. Investors largely stuck with their expectations that the Fed will keep interest rates unchanged at its meeting later this month and probably won’t look at cutting rates again until June, based on CME Group’s FedWatch tool.

President Donald Trump also pointed to the inflation report as he once again urged Fed Chair Jerome Powell and other policymakers to loosen monetary policy.

Since the Federal Reserve is still watching the labor market closely, the December inflation data is not expected to significantly change its policy outlook, unless it shows a clear and unexpected move in either direction.

Bitcoin and Ethereum Touch Weekly Highs

The crypto market showed some bullish trend as investors accumulated heavily following the softer-than-expected core inflation data. Bitcoin climbed about 1.7% over the past 24 hours, trading above the $93,000 mark for the first time in almost a week.

Ethereum also moved higher, approaching $3,200 and staying above the important $3,000 level, even as selling pressure remained heavy throughout the week.

The price swings led to more than $193.5 million worth of liquidations in the past 24 hours, mostly from traders holding short-positions. Short positions accounted for roughly $120.3 million of those liquidations, according to Coinglass.

Meanwhile, U.S. stock markets moved in the opposite direction. The S&P 500 slipped about 0.3% and the Nasdaq Composite fell 0.2% after both indexes opened slightly higher earlier on Tuesday.

You May Also Like

Polygon Tops RWA Rankings With $1.1B in Tokenized Assets

MAXI DOGE Holders Diversify into $GGs for Fast-Growth 2025 Crypto Presale Opportunities