Image by Pexels from Pixabay

Uniswap Founder Slams NYC Token as Liquidity Concerns Trigger Backlash

On-chain signals and criticism from DeFi leaders are raising doubts about the NYC token and politically linked memecoins.

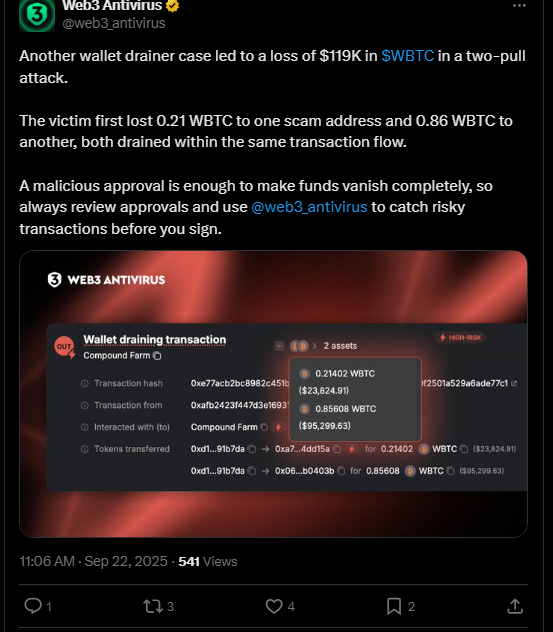

Public criticism from a leading DeFi figure has intensified scrutiny around Eric Adams’ newly launched NYC Token. Hayden Adams, founder of the Uniswap protocol, reacted sharply after on-chain data raised concerns about liquidity withdrawals tied to the memecoin. His remarks added weight to a growing backlash from traders and analysts questioning how political figures are using blockchain-based assets.

Liquidity Concerns Cloud NYC Token as Trust Issues Surface

Adams’ comments landed shortly after reports surfaced alleging that liquidity linked to the NYC Token had been pulled soon after launch. The former New York City mayor Eric Adams promoted the project as a civic-focused crypto effort. But critics say early activity tells a different story.

Adams’ reaction shifted the focus from price action to broader issues around transparency and public trust. Reacting to the incident in an X post, the Uniswap founder called the situation irresponsible and poorly handled. He stressed that celebrities and politicians have multiple ways to monetize their public profiles without putting users at risk.

In the same post, Adams said public figures can launch tokens without engaging in rug pulls. He stressed that liquidity should remain untouched and that transparency is essential.

“Be upfront with people about what they’re buying into, don’t make promises you can’t fulfill (like solving antisemitism wtf), only sell slowly over time if the utility is working out.”

Hayden Adams said.

Adam’s also noted that projects can include simple forms of utility, as long as risks and limitations are clearly stated. According to him, unrealistic promises often lead to failure and potential legal issues.

The Uniswap founder contrasted those mistakes with the practical use of blockchain technology today. He noted that blockchains already support large-scale coordination, payments, and value transfer. Moreover, millions of users and active businesses now operate on-chain.

He also criticized celebrity-backed token launches, arguing that many ignore basic transparency despite all transactions being publicly visible.

On-Chain Data Puts Political Memecoin Under Industry Spotlight

Promoted by former mayor Eric Adams, the NYC token launched during a Times Square event and runs on the Solana chain. Project materials list a total supply of one billion tokens, with only a fraction initially available for trading. A large share remains reserved and outside circulation.

Shortly after trading began, blockchain trackers flagged heavy liquidity movements linked to the NYC token. Analysts said millions of dollars appeared to leave liquidity pools within hours, sparking fears of a rug pull.

Adams has not directly addressed those claims. At launch, he said revenue from the memecoin would fund an unnamed nonprofit tied to causes such as fighting antisemitism, a claim that also drew criticism online.

Reactions like Hayden Adams’ reflect deeper frustration across the crypto space. Builders argue that poorly handled, high-profile launches hurt trust and distract from projects focused on long-term use.

His post also outlined what responsible token launches could look like in practice:

- Leave liquidity pools intact and avoid sudden withdrawals.

- Add a clear utility that users can understand.

- Be upfront about risks and avoid promises that cannot be kept.

- Sell tokens slowly and only if the project shows real traction.

Adams’ points circulated widely as traders reassessed the NYC Token’s outlook. Some observers noted that memecoins tied to political figures often attract fast attention but carry added reputational risk. When issues surface, fallout can extend beyond holders to the wider ecosystem.

The post Uniswap Founder Slams NYC Token as Liquidity Concerns Trigger Backlash appeared first on Live Bitcoin News.

You May Also Like

$119K WBTC Drained in Wallet Scam Amid Fake Airdrop Surge

SwayHorizonAi Reviews — Are Their Market Insights Legit? A Quick Overview