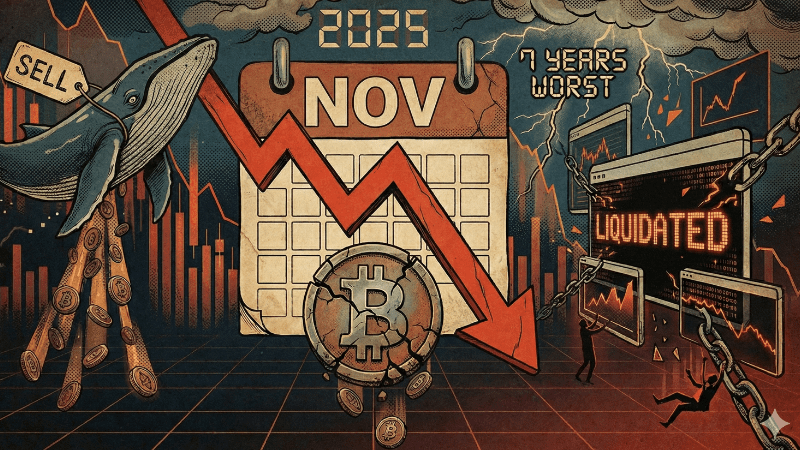

Bitcoin eyes $100,000 mark after reaching highest feat since November 2025

Bitcoin has continued its upward trend in 2026, rising above the $96,000 mark for the first time since November. That move came as spot market demand intensified, drawing fresh interest from investors and traders alike.

In the last 24 hours alone, BTC has appreciated more than 4.5 per cent, underlining renewed bullish momentum in what has been a tentative start to the year. This resurgence has once again stoked debate over when, not if, Bitcoin will breach the widely watched $100,000 threshold.

This rally looks different from some earlier runs. Buying has been concentrated in spot markets rather than driven by futures and leverage. Spot demand represents actual capital moving into the asset, not just leveraged bets on its direction. Market data also shows over $600 million in short liquidations after prices pushed through key resistance.

That forced bearish positions to close and added fuel to the advance.

Bitcoin price surge

Bitcoin price surge

The $100,000 milestone seems very achievable in days or weeks. It is part psychological and part market signal. Breaching it would amplify positive sentiment and could draw further interest from both retail and institutional participants.

For many investors, a move above six figures would set the tone for a possible bull run.

Bitcoin: Technical and market picture

Technically, Bitcoin looks well supported. The price sits above major moving averages. It has cleared resistance in the roughly $94,500–$96,800 zone that held it back in recent weeks. Analysts say staying above those levels increases the chance of more upside.

Buyers are stepping in on dips. Market observers, including Michaël van de Poppe, founder of MN Trading Capital, have noted that pullbacks are being treated as buying opportunities rather than triggers for selling. That behavioural change tends to reduce short-term volatility and sustain upward pressure.

Institutional flows are also turning constructive. Spot Bitcoin ETFs in the United States have seen inflows recently. Those flows reverse the outflows that weighed on the market through late 2025. Inflows into regulated products point to real, cautious capital entering Bitcoin, which supports a more durable path to higher prices.

Prediction markets are pricing in a near-term test of $100,000. Polymarket data shows traders assigning roughly a 50 per cent probability that Bitcoin will retest or exceed $100,000 by early February. That suggests the market increasingly treats the rally as more than a short-lived bounce.

Yet, despite the positive signals, caution remains important. Bitcoin still trades below its late-2025 all-time high of over $126,000. Liquidity shifts, regulatory developments and geopolitical tensions, like the ongoing unrest in Iran, can change sentiment quickly. Sharp reversals are less likely while the trend remains supported by spot buying, but they are not impossible.

If spot demand continues and the market holds above key support zones, a break above $100,000 appears plausible within weeks rather than months. The next few sessions will be telling.

Holders and new entrants will watch whether the market can sustain its footing on dips. If it can, the path to six figures will look increasingly clear.

The post Bitcoin eyes $100,000 mark after reaching highest feat since November 2025 first appeared on Technext.

You May Also Like

Crypto News: Donald Trump-Aligned Fed Governor To Speed Up Fed Rate Cuts?