CME Group to Launch Cardano, Chainlink, Stellar Futures on Feb 9

CME Group announced plans on Jan. 15 to launch futures contracts for Cardano ADA $0.40 24h volatility: 5.8% Market cap: $14.61 B Vol. 24h: $730.30 M , Chainlink LINK $13.90 24h volatility: 3.2% Market cap: $9.84 B Vol. 24h: $638.47 M , and Stellar (Lumens) XLM $0.23 24h volatility: 4.7% Market cap: $7.47 B Vol. 24h: $213.82 M on Feb. 9, pending regulatory review.

The new products will include both standard and smaller micro-sized contracts for each asset, according to CME Group’s announcement. Standard contract sizes are 100,000 ADA, 5,000 LINK, and 250,000 XLM. Micro contracts at one-tenth the size will also be available for traders seeking smaller positions.

Futures allow traders to bet on future prices without holding the actual tokens, and CME’s regulated contracts give institutional investors a compliant way to gain exposure.

Giovanni Vicioso, CME Group Global Head of Cryptocurrency Products, said clients are seeking trusted, regulated products to manage price risk following the asset class’s record growth.

Record Growth Drives Expansion

CME’s cryptocurrency business recorded 139% year-over-year growth in 2025, as previously reported by Coinspeaker. Average daily volume reached 278,300 contracts worth $12 billion. Outstanding contracts averaged 313,900 with a value of $26.4 billion.

The February launch continues CME’s expansion into alternative cryptocurrencies beyond Bitcoin BTC $96 684 24h volatility: 0.8% Market cap: $1.93 T Vol. 24h: $64.41 B and Ethereum ETH $3 325 24h volatility: 1.7% Market cap: $401.29 B Vol. 24h: $32.04 B . The exchange launched Solana SOL $143.1 24h volatility: 3.2% Market cap: $80.86 B Vol. 24h: $5.77 B futures on March 17 and XRP XRP $2.09 24h volatility: 3.6% Market cap: $126.84 B Vol. 24h: $3.66 B futures on May 19. Options on both products followed on Oct. 13. CME first launched Bitcoin futures in December 2017 and Ethereum futures in February 2021.

Market Activity and Related Developments

All three tokens have shown elevated trading activity in recent sessions. Cardano recorded $703 million in 24-hour volume on Jan. 15, according to CoinGecko data. Chainlink posted $641 million while Stellar recorded $211 million. Seven-day volume trends exceeded 59% for all three assets. ADA traded at $0.40, LINK at $13.92, and XLM at $0.23 on Jan. 15.

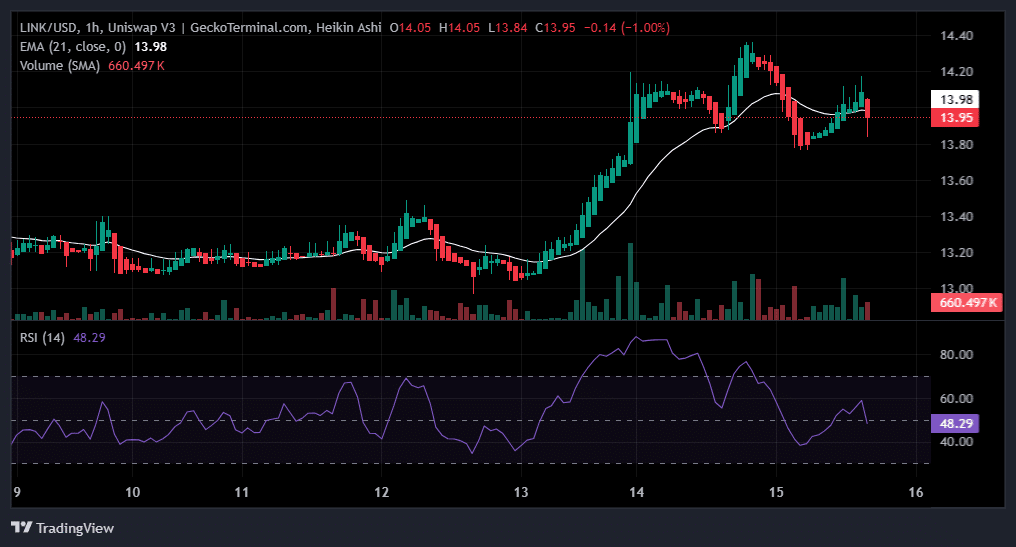

LINK/USD 7-day price chart showing rally above $14 on Jan. 14 following the Bitwise ETF launch | Source: TradingView

The Chainlink futures launch arrives one day after Bitwise launched its Chainlink exchange-traded fund (ETF) on NYSE Arca on Jan. 14. The fund trades under the ticker CLNK and competes with Grayscale’s existing GLNK product. LINK posted a seven-day gain of 6.07%.

Cardano is also developing its ecosystem. The network recently ratified a governance proposal to bring more stablecoins to its blockchain through a 70 million ADA community fund.

nextThe post CME Group to Launch Cardano, Chainlink, Stellar Futures on Feb 9 appeared first on Coinspeaker.

You May Also Like

CME Group to Launch Solana and XRP Futures Options

Pump.fun CEO to Call Low-Cap Gem to Test New ‘Callouts’ Feature — Is a 100x Incoming?