ETF Market Registers Highest Inflows So Far This Year As Bitcoin Notches $97k

- Bitcoin ETF inflows reached a new 2026 record of $843.6 million in a single day.

- The total capital flowing into these funds hit $1.7 billion over a three-day period.

- BlackRock and Fidelity dominated the market as investor sentiment turned bullish.

The crypto market is starting the new year with a powerful display of strength.

Recent data shows that Bitcoin ETF inflows have reached their highest levels since the beginning of the year. This surge in capital comes as the price of Bitcoin climbed past the $97,000 level for the first time in months.

Investors are now moving back into the market with fresh energy and many observers believe this is a sign of long-term institutional interest.

Record-Breaking Bitcoin ETF Inflows Lead Market Recovery

The middle of January has become a turning point for digital asset funds. On Wednesday, spot Bitcoin ETF inflows topped $843.6 million in just 24 hours.

According to data from SoSoValue, this is the largest single-day gain of the year so far.

This massive influx even helped erase losses from earlier in the month. Between January 6 and January 9, the market saw outflows of about $1.4 billion. However, the three-day winning streak that followed brought in more than $1.7 billion.

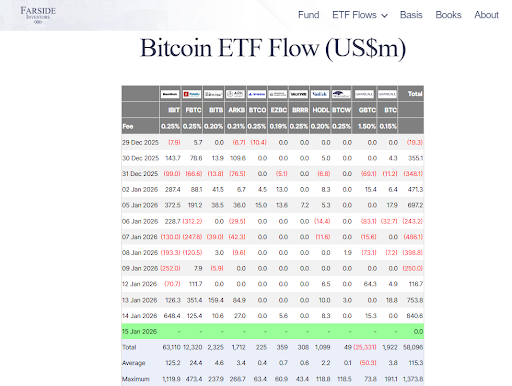

Data shows heavy inflows for the ETF market, source: Farside Investors

Data shows heavy inflows for the ETF market, source: Farside Investors

This recovery shows how quickly the mood can change in the crypto space.

Total net inflows for January have now reached $1.5 billion over just nine trading days. Analysts noted that Tuesday’s activity was also important for its $754 million inflows.

This was the highest total since early October of the previous year.

Institutional Giants Drive New Bitcoin ETF Inflows

While many funds are seeing positive movement, a few big names are leading the charge.

BlackRock is currently the undisputed leader in this space. It’s iShares Bitcoin ETF (known by the ticker IBIT) saw a staggering $648 million in a single day.

This performance set a new record for the fund and IBIT now holds a massive share of the total assets in the spot Bitcoin market.

Other major players are also seeing growth. Fidelity’s Wise Origin Bitcoin Fund (or FBTC) added $125.4 million during the same period and even smaller products are benefiting from the rally.

ARK Invest and its partner 21Shares brought in nearly $30 million for their fund (ARKB).

Meanwhile, the Bitwise Bitcoin ETF, traded as BITB, saw over $10 million in new capital. These numbers show that inflows are spreading across different providers as traders look for liquidity and low fees.

Market Sentiment and the Rally Past $97,000

The price action of Bitcoin is the main engine behind these record flows.

On Wednesday, BTC surged past $97,000 and hit its highest point since mid-November. It briefly touched a peak of $97,957 before settling slightly lower and this price movement seems to have created a “fear of missing out” among institutional buyers.

The Crypto Fear & Greed Index recently jumped to a score of 61.

Bitcoin recently rallied above $97,000, source: CoinMarketCap

Bitcoin recently rallied above $97,000, source: CoinMarketCap

This level indicates that the market is feeling optimistic. In late 2025, many traders were worried about inflation and interest rates.

Now, it seems that those fears are fading. The ongoing stream of inflows thus provides a safety net for the price. Because these funds must buy actual Bitcoin to back their shares, they create constant buying pressure on the open market.

Why This Trend Matters for the Future of Crypto

Many experts believe that we are seeing a change in how Bitcoin is traded.

In the past, the market relied mostly on individual retail traders. Today, regulated funds like those from BlackRock and Fidelity provide a more stable foundation. These products allow pension funds and insurance companies to invest in Bitcoin without holding the actual coins.

This makes the market deeper and more resistant to sudden crashes.

The current wave of inflows also indicates that big investors see Bitcoin as a strategic asset.

Instead of just trying to make a quick profit, they are using it to hedge against the global economy. If these inflows continue at this pace, some analysts predict that ETFs could soon own more than 7% of the total Bitcoin supply.

This would massively change the supply and demand balance for the asset.

The post ETF Market Registers Highest Inflows So Far This Year As Bitcoin Notches $97k appeared first on Live Bitcoin News.

You May Also Like

Tokyo’s Metaplanet Launches Miami Subsidiary to Amplify Bitcoin Income

Will Bitcoin Make a New All-Time High Soon? Here’s What Users Think