Bitcoin Holds $95K With US Senate Set To Restart BTC And Crypto Market Structure Hearings

Bitcoin price, after hitting resistance above $97,000, has cooled to trade slightly above $95,500. BTC is trading at $95,699 as of 2:01 a.m. EST, with trading volume down 16% to $55.8 billion, signaling a slump in activity as the price pulled back.

The drop comes amid a decline in overall market capitalization to $3.3 trillion, with BNB being the only top-5 asset to register a positive gain in the day.

The drop comes even as the US Senate is set to restart the BTC and crypto market structure hearings, and data shows that Iranians increased BTC withdrawals amid the ongoing political crisis.

Senate Banking Committee Lawmakers Say Crypto Bill Is Closer

Despite its postponement, US lawmakers struck an optimistic tone on crypto legislation as talks advanced. Posts shared on the social media platform X show that negotiations are advancing toward consensus on market structure rules, signaling confidence that bipartisan legislation to support the digital asset industry is within reach.

As Senate Banking Committee Chairman Tim Scott continues leading negotiations among committee members, the White House, and industry stakeholders on crypto market structure legislation, Senator Cynthia Lummis stated.

“Thanks to Chairman Scott’s leadership, we are closer than ever to giving the digital asset industry the clarity it deserves. Everyone is still at the negotiating table, & I look forward to partnering with him to deliver a bipartisan bill the industry & America can be proud of.”

Meanwhile, Senator Bill Hagerty said he was confident that a consensus product would be reached in short order on Thursday.

If the bill could pass, it would usher in the most consequential regulatory restructuring of US financial markets. The rules set will keep innovation onshore and strengthen long-term economic leadership.

Iran Turns To Crypto Amid Crisis

Meanwhile, according to Chainalysis data, crypto usage in Iran has spiked amid the country’s mass protests, with Iranians withdrawing BTC to preserve value amid instability.

Chainalysis said in a report on Thursday that Iran’s crypto ecosystem reached $7.78 billion in 2025, accelerating amid the ongoing unrest and a substantial increase in daily crypto transfers.

According to the report, BTC’s role in the ongoing crisis is not just confined to capital preservation. Bitcoin has also become an element of resistance, providing liquidity and optionality in an increasingly restricted economic environment.

Will Bitcoin Price Surge To $100K In 2026?

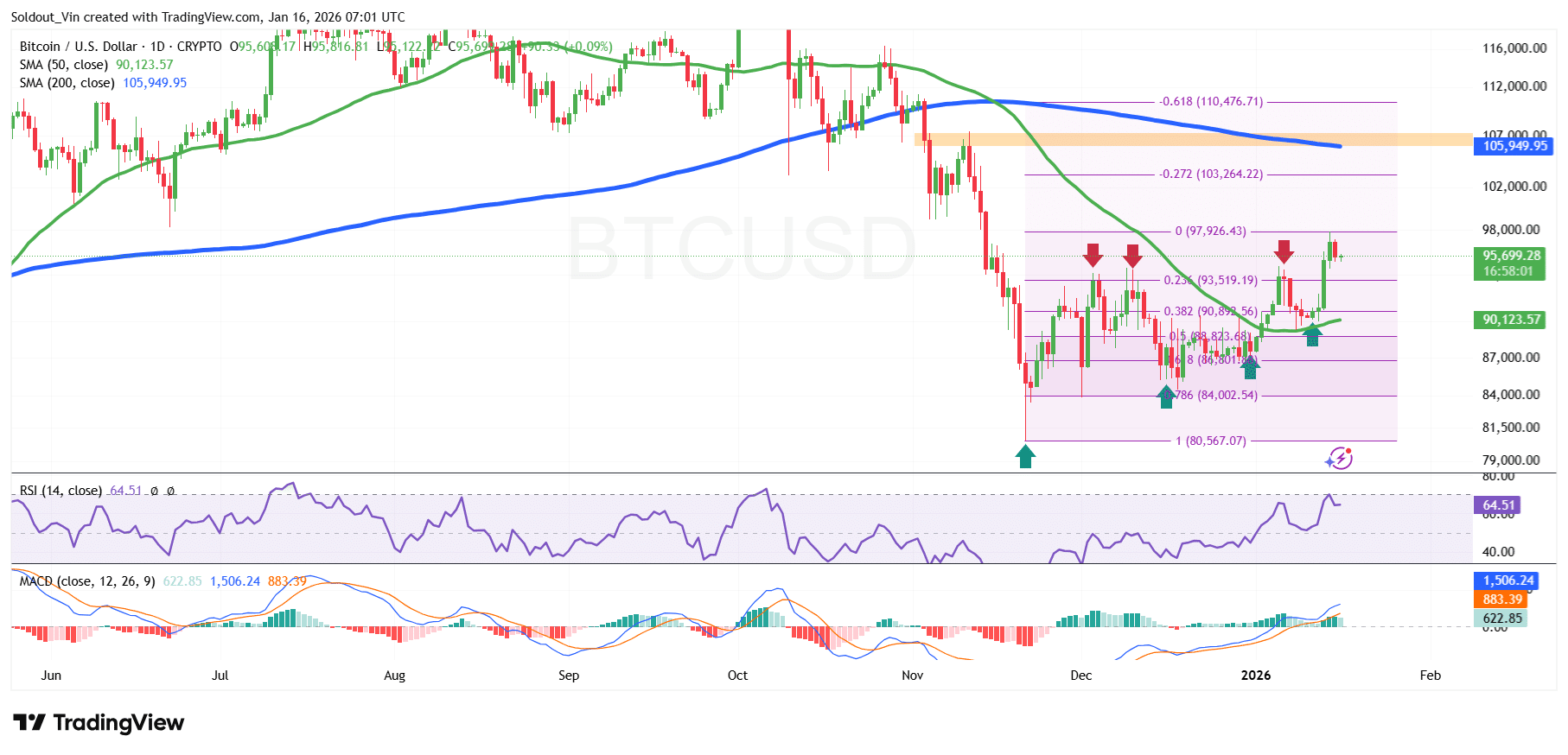

Bitcoin price is holding strong above the $93,500 support and the 0.236 Fibonacci Retracement level. The current jump above this area was pushed by the supply zone around $89,000.

As a result, BTC has jumped above the 50-day Simple Moving Average (SMA) at $90,123, which supports the overall bullish outlook. Meanwhile, the 200-day SMA acts as the overhead resistance at $105,949.

Bitcoin’s Relative Strength Index (RSI) is also near the overbought region, currently at 64.51, which indicates that buyers are in control without the price being overbought. This is a sign that the price still has room to rally again.

Meanwhile, the Moving Average Convergence Divergence (MACD) has also turned positive, with the blue MACD line crossing above the orange signal line.

BTC/USD Chart Analysis Source: TradingView

BTC/USD Chart Analysis Source: TradingView

The 1-day BTC/USD chart analysis shows that Bitcoin price could surge above the 0 Fibonacci level ($97,926), with the next resistance and target at the -0.271 Fib zone at $103,264.

To add to the bullish case, over 17,700 BTC tokens have been accumulated by exchange-traded funds (ETFs) so far this week, which signals a sustained trading activity.

Conversely, as a result of the 5.4% surge in the last week, short-term investors may still take profits, which may push the price down to the $89,000 support.

Related News:

You May Also Like

Trust Wallet issues security alert: It will never ask users for their mnemonic phrase or private key.

Crypto Market Cap Edges Up 2% as Bitcoin Approaches $118K After Fed Rate Trim