Analysts: Decreasing selling pressure from OG holders is propelling BTC into a breakout phase, potentially pushing it towards the $107,000 target price in the short term.

PANews reported on January 17th, citing Cointelegraph, that Cryptoquant analyst Dark Frost stated that selling pressure from OG holders has significantly decreased. The 90-day average of spent UTXOs has dropped from a cycle high of approximately 2300 BTC to around 1000 BTC, with the current trend favoring holding. This trend aligns with the largest net outflow of Bitcoin from exchanges since December 2024. Analysis suggests Bitcoin has entered a breakout phase and may challenge the $107,000 target price, driven by factors including technical indicators, reduced selling pressure from long-term holders, and continued BTC outflows from exchanges. On the macro front, the correlation between Bitcoin and gold has turned negative; historical data shows that in such situations, BTC typically rises by an average of 56% within approximately two months.

You May Also Like

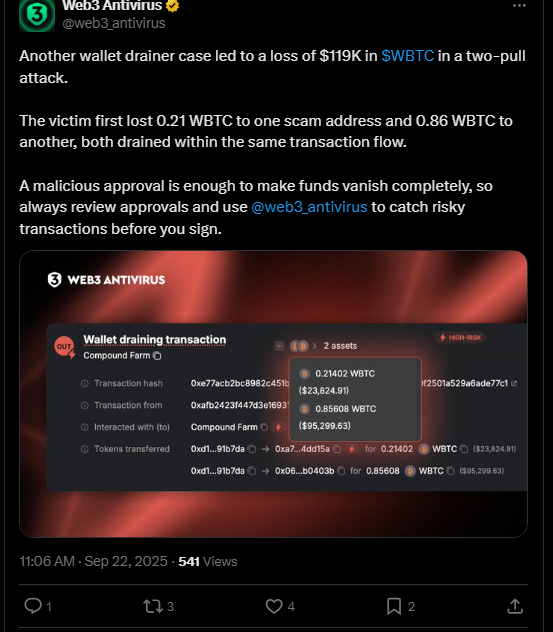

$119K WBTC Drained in Wallet Scam Amid Fake Airdrop Surge

SwayHorizonAi Reviews — Are Their Market Insights Legit? A Quick Overview