Top Crypto for 2026: Zero Knowledge Proof Outshines Hedera, Monero & Ethereum Classic

| Sponsored Post Disclaimer: This publication was produced under a paid arrangement with a third-party advertiser. It should not be relied upon as financial or investment counsel. |

The crypto market in 2026 has moved past hype and speed alone. Buyers now care about privacy, real world applications, and networks that fix actual problems. This shift is deciding what many consider the top crypto for 2026, where true usefulness beats catchy phrases and quick thrills.

This breakdown covers four projects picked for completely different reasons. One builds a privacy-first AI and data network. The others are well-known names with loyal followers and proven track records. Put together, they reveal where crypto is going and why these projects are drawing serious eyes.

1. Private AI Built for Everyone: Zero Knowledge Proof

Zero Knowledge Proof (ZKP) centers on one simple belief: people should profit from their data while keeping it private. The network applies zero-knowledge cryptography to confirm data and AI tasks without showing the actual details. Built using Substrate, the same framework powering Polkadot, ZKP crypto brings together blockchain, encrypted storage, and AI-based checks in one place. This setup makes it a leading pick for the top crypto for 2026 as privacy and AI grow closer together.

The project brings Proof Pods to market. These low-power machines cost $249 and create zero-knowledge proofs. They use roughly 10 watts of power and work as plug-and-earn devices, making them simple for everyday users. Based on presale pricing, basic rewards sit at about $1 daily, with bigger payouts available through more Zero Knowledge Proof purchases. Returns change with market shifts, but the system runs on helpful calculations rather than wasted electricity.

ZKP also plans a decentralized data marketplace launching in 2026. Users can upload encrypted files, control who gets access, and keep up to 80% of earnings. Buyers check data quality through tiny cryptographic proofs that verify in milliseconds. With a fair daily presale model and a long-term plan reaching into AI and post-quantum protection, ZKP is being placed as a serious top crypto for 2026 pick.

2. Proof-of-Work That Never Quits: Ethereum Classic (ETC)

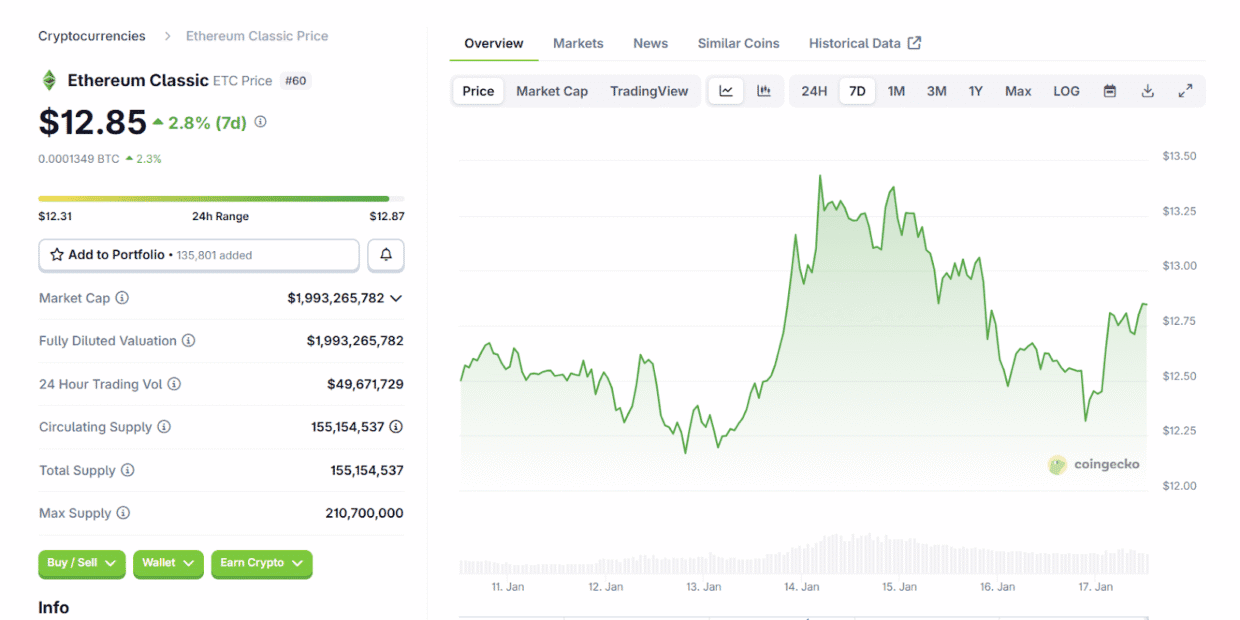

Ethereum Classic still carries the original Ethereum dream of unchangeable records and proof-of-work safety. As of mid-January 2026, ETC sits in the $12–$13 range, showing steady but careful market interest. It does not move as quickly as newer chains, but it still pulls in miners and users who like fixed rules and no sudden protocol shifts.

Source- CoinGecko

Source- CoinGecko

ETC has caught fresh attention thanks to stable network use and talks about upgrades that could fix fee systems and decision-making processes. Its proof-of-work design ties it closely to wider mining trends, which many view as a plus rather than a minus. For people looking past short-term price swings, ETC offers a trusted and battle-hardened network that still matters in talks about the top crypto for 2026.

3. Privacy That Never Turns Off: Monero (XMR)

Monero remains the gold standard for privacy-focused cryptocurrencies. In January 2026, XMR trades between $620–$640 after hitting fresh highs earlier this month. Its price moves show rising demand for private transactions as surveillance and rules tighten across the globe.

What makes Monero special is that privacy comes built in. Transactions, balances, and sender details stay hidden using ring signatures and stealth addresses. This makes XMR valuable for people and groups needing financial privacy without trusting anyone else. Even with exchange removals in certain areas, usage stays strong, and the network keeps running exactly as planned. This toughness explains why Monero holds a spot in any real top crypto for 2026 conversation.

4. Built for Big Business: Hedera (HBAR)

Hedera walks a different road by going after enterprises and large organizations. Using hashgraph consensus instead of standard blockchain, the network chases speed, cheap fees, and reliable results. In mid-January 2026, HBAR trades close to $0.12, with market mood linked tightly to network updates and business activity.

Recent moves include mainnet changes, a bigger presence at worldwide business events, and growing interest in real-world uses like ticketing and tracking assets. Hedera’s governing council setup appeals to companies wanting stability and rule-friendly systems. While it does not try to be fully open to everyone, its push for actual adoption keeps it useful as a practical choice among the top crypto for 2026 options.

Closing Thoughts on 2026’s Crypto Front-Runners

These four projects prove how different crypto approaches can thrive at the same time. Zero Knowledge Proof is designed around privacy, AI, and helping users profit from their own data. Ethereum Classic sticks with proof-of-work and lasting network strength, calling to users who prize dependability. Monero keeps guarding transaction privacy by default, giving users solid financial secrecy without any trade-offs.

Hedera follows a more business-focused direction, delivering fast speeds, low costs, and steady results. Together, they show that the top crypto for 2026 is not about chasing one single pattern. It is about creating helpful systems that address real issues and can drive long-term growth.

| Disclaimer: The text above is an advertorial article that is not part of CoinLineup editorial content. |

You May Also Like

CME Group to Launch Solana and XRP Futures Options

Bitcoin ETFs Outpace Ethereum With $2.9B Weekly Surge