Bitcoin Axed By Top Wall Street Strategist On Quantum Fears

Jefferies strategist Chris Wood has removed Bitcoin from his long-term model portfolio, citing quantum computing as a risk that weakens Bitcoin’s store-of-value framing for pension-style allocations. VanEck head of research Matthew Sigel flagged the change on X, calling it a notable “downgrade” from one of the Street’s most widely followed global strategists.

Veteran Strategist Chris Wood Exits Bitcoin

Wood wrote that he is not positioning for an imminent price shock, but that the long-duration mandate is where the quantum question bites. “While GREED & fear does not believe that the quantum issue is about to hit the Bitcoin price dramatically in the near term, the store of value concept is clearly on less solid foundation from the standpoint of a long-term pension portfolio,” Wood wrote. “For that reason, GREED & fear will remove the 10% allocation to Bitcoin this week with 5% reallocated to gold and 5% reallocated to gold-mining stocks.”

The move is framed as risk management rather than a retrospective performance critique. Wood noted that despite gold’s recent outperformance versus Bitcoin, Bitcoin remained well ahead since his model first added it: Bitcoin had risen 325% since December 17, 2020, while gold bullion was up 145% over the same period.

In a note dated January 15, 2026, Wood described how the quantum discussion has moved from abstract theory into something asset allocators are being asked to underwrite. “GREED & fear is no pure mathematician,” he wrote, adding that he has found himself pulled into conversations about “elliptic curves” because of “the growing focus in recent months on the threat posed to the Bitcoin system by the arrival of quantum computing.”

His core claim is that the perceived timeline is compressing. He referenced rising concern that cryptographically relevant quantum computers could arrive “a few years away rather than a decade or more,” and argued that any credible threat to Bitcoin’s security model is “potentially existential” because it undermines the store-of-value concept that underpins the “digital alternative to gold” narrative.

Wood’s mechanism is straightforward: what is computationally infeasible today could become tractable under CRQCs. He wrote that the current asymmetry, easy to derive a public key from a private key, effectively impossible to reverse, could collapse, with the time to derive a private key from a public key shrinking to “mere hours or days.”

Wood said the industry is already debating potential responses, including whether to “burn” quantum-vulnerable coins to protect system integrity or to do nothing and accept the possibility that vulnerable coins could be stolen by entities with CRQCs. He presented the dispute as a conflict between preserving Bitcoin’s property-rights ethos and avoiding a policy choice that looks confiscatory, adding that one computer scientist he spoke with described the do-nothing stance as a “suicidal delusion.”

Wood said his thinking was informed by discussions with knowledgeable parties and pointed to a Chaincode report as background reading, without treating it as a near-term trading trigger.

VanEck’s Sigel Responds

Sigel’s takeaway was less about whether quantum risk exists and more about how different systems respond. When one user argued that quantum would wipe out bank accounts, email, and brokerage systems as well, Sigel dismissed that as “not a sufficient take anymore,” drawing a sharp distinction between upgrade paths and reversibility.

“Banks upgrade top-down; BTC requires years of consensus,” Sigel wrote. “Banks have an ‘undo’ button; BTC is finality-first.”

Sigel also linked the debate to a familiar fault line inside Bitcoin governance. Asked how representative Wood’s view might be, Sigel said that in the “Adam Back vs. Nic Carter” debate he is “on Nic’s side,” and described Wood’s decision as supporting evidence. At the same time, Sigel emphasized process: he met Wood in New York before the note was published and said that although he disagreed with the conclusion, Wood “came to it honestly.”

On positioning, Sigel said he has “added quantum exposure” previously to VanEck’s Onchain Economy ETF (NODE) and made small hedges, with a preference for “diversified” AI miners over “DATs / leveraged BTC,” while keeping spot BTC via an ETF as the largest holding. He framed the quantum issue as “solvable” and akin to a “wall of worry like blocksize wars,” rather than a thesis-breaker.

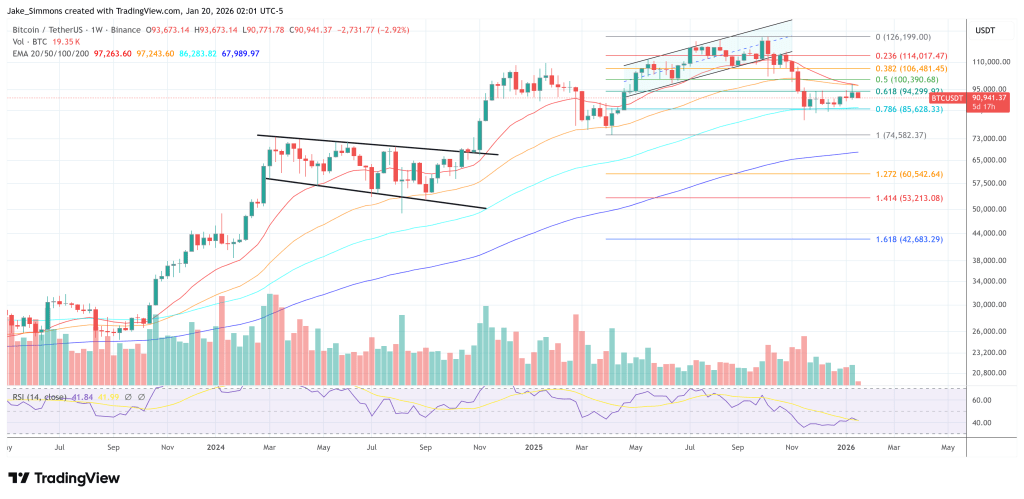

At press time, BTC traded at $90,941.

You May Also Like

Why Bitcoin’s Bear Case Is Suddenly Back on the Table

USD/JPY drops to near 157.80 as US-EU disputes batter US Dollar