Global banking wars: How Digitap disrupts $2.07 XRP as the leading crypto to watch now

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

While XRP remains the leading institutional payment token, the market is quickly shifting toward projects like Digitap that are onboarding new retail users.

- While XRP continues to dominate institutional cross-border payments, attention is moving toward consumer-facing, digital-first platforms that drive retail stablecoin adoption.

- Ripple focuses on banks and institutions, whereas Digitap targets everyday users with an app-based omnibank model that abstracts crypto rails and emphasizes usability.

- The narrative is shifting from payment infrastructure tokens to products with clear revenue capture and user growth, highlighting a broader change in how the market evaluates payment-focused crypto projects.

Ripple’s XRP remains one of the leading altcoins to buy for cross-border payment. However, in January 2026, the market is quickly shifting towards projects that onboard new retail users, rather than those targeting institutions only.

As demand for stablecoins continues to skyrocket, the next wave of adoption will come from projects that have excellent money products. This means that Digital-first apps will lead the way. And this explains why the Digitap (TAP) presale raised over $4 million in just weeks. It shows the market is already choosing applications over infrastructure.

Among the best cryptos to buy now are those that feel like fintech products. Easy to use with simple interfaces, have better outcomes, but more importantly, those that have tokens that capture value as they scale. Here’s how Digitap is outshining XRP in the 2026 payment race.

Ripple continues to attract institutional payment trade

Ripple has the best legacy in crypto, and it is for a good reason. The platform was built to modernize cross-border payments. Since 2012, the aim has been to move funds anywhere in the world with less friction.

While this is normal in crypto rails, allowing users to send stablecoins, in TradFi, legacy rails are still slow and costly, with transfers taking multiple business days. Ripple has quickly resolved this pain point, which explains why it has raised over $130 billion in market capitalization.

But, more importantly, it is attracting institutional adoption. Recently, Bank of America began processing Ripple (XRP) transactions to redefine how money is transacted. Adding blockchain technology to traditional finance could enhance efficiency and reduce transactional costs.

However, this innovation has its challenges related to regulatory approvals. In any case, Ripple innovations and partnerships will help bridge the gap between traditional finance and cryptocurrency. And explains why many traders still consider it among the best altcoins to buy now.

XRP price shows signs of life

Typically, when banking narratives heat up in the market, XRP is usually the first token to move. The bulls have been battling an entrenched bearish trend. The altcoin has been hovering around $1.90, after peaking at $2.40 in early January.

This rally, which made the price jump from $1.85 to $2.40, appears to have been a distribution rather than an accumulation. Many large holders sold into strength, and now the price has dropped. Its chart shows lower highs and lower lows, signaling a downtrend and not a consolidation.

XRP volume has also dried up, highlighting weak buying interest. This means it could be creating a bear flag rather than a reversal pattern. While XRP remains the best crypto to buy, the headwind this year is the payment race shifting from institutions to stablecoin distributions and consumer adoption.

Until the XRP price moves above $2.32, it could continue the bearish trend.

Ripple went after institutions first: Digitap is going after users first

The payment sector is a grassroots business. Remittance, family transfers, freelance payouts, and cross-border spending. All these flows are influenced by everyday behavior. Digitap emerges as the world’s first omnibank, bridging the gap between fiat and cryptocurrency.

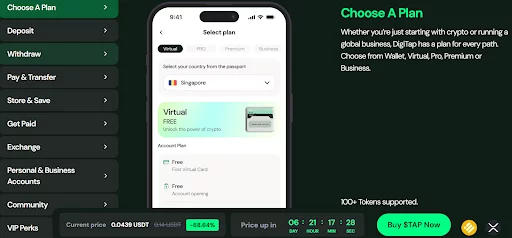

The app, which is available on iOS and Android, has integrated a modern banking interface as stablecoins and blockchains do the heavy lifting behind the scenes. The next wave of adoption typically wants crypto rails to be more visible. People don’t want to think about rails. They want money to arrive fast, efficiently, and at a low cost.

Digitap’s multi-rail settlement allows transfers in the most efficient route available. It could be via traditional banking rails powered by TAP banking partners or blockchain rails if the transfer crosses borders.

This upgrade resolves a real pain point in the global payments sector. This explains why Digitap’s crypto presale has become the fastest-growing consumer application this year.

Excellent tokenomics: Why TAP ranks as a leading cryptocurrency to buy in 2026

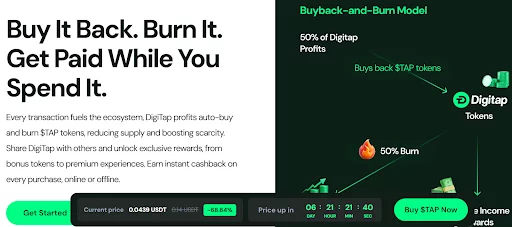

Governance tokens are losing attention. And in this cycle, if a token does not capture value, investors lose interest. Most attention-grabbing tokens are those that share revenue with holders, with a massive token burn campaign.

TAP ranks among the best cryptos to buy now because it uses 50% of its revenue to buy TAP in the open market. These tokens are then split between staking rewards and burns. This means that as the altcoin scales and attracts new users, holders will participate on the upside.

The project is attracting the proper market attention, having sold more than 191 million tokens since launching its presale campaign. TAP is selling for $0.0439 today, but it is scheduled to rise to $0.0454 in just a few days.

With a confirmed listing price of $0.14, Digitap has a massive upside potential for investors buying today.

Can Digitap outshine XRP in the payment race in 2026?

XRP remains popular in the payment sector, but appears to be losing dominance as the market evolves. Stablecoin growth is accelerating, and projects with digital-first apps are at the center of this adoption curve. This shift is making projects like Ripple, which are institutional-focused, appear undervalued.

Use the code “TAPPER20” for 20% off first-time purchases.

Digitap has a live product, widespread adoption, and tokenomics that reward holders as TAP scales. XRP could rally to $2.50 when the market flips back to bullish ways. But the potential upside difference between the two tokens is huge.

TAP’s valuation is still small, meaning it does not need billions in inflows to deliver more substantial returns. This makes it a hidden crypto to buy now. Even modest adoption can materially impact the price, especially during early distribution.

To learn more about Digitap, visit its presale, website, socials, and Win $250k.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

You May Also Like

Solana Treasury Stocks: Why Are These Companies Buying Up SOL?

Raoul Pal Predicts Bitcoin’s Correlation With ISM Index