Coinbase CEO Calls 4 Billion People “Unbrokered” and Wants to Fix It

Coinbase CEO Brian Armstrong unveiled a sweeping vision to democratize global capital markets through blockchain tokenization, targeting roughly 4 billion adults worldwide who lack access to equity and bond investments despite the accelerating divergence between capital and labor income growth.

The exchange published a comprehensive policy paper titled “From the Unbanked to the Unbrokered: Unlocking Wealth Creation for the World,” arguing that technological barriers and cost structures have systematically excluded two-thirds of the global adult population from wealth-building opportunities.

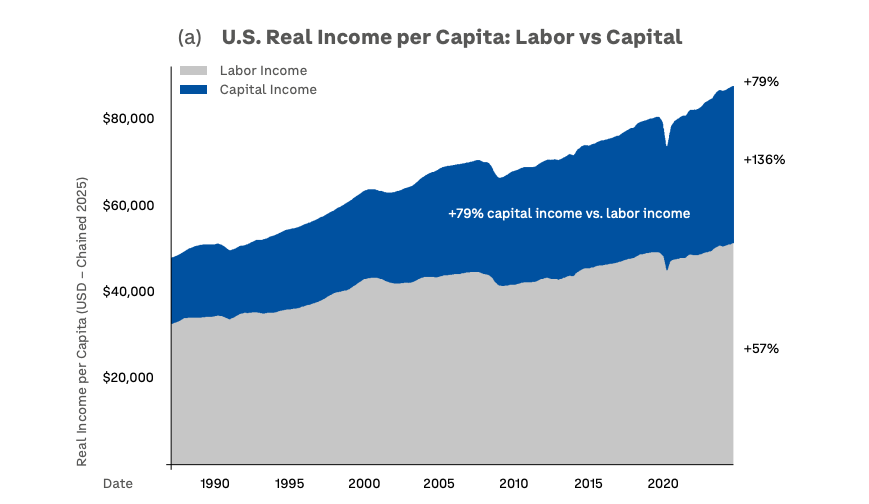

In the United States, labor income has grown by 57% since 1987, while capital income has surged by 136%, creating what Armstrong describes as a structural impediment to broad-based prosperity.

Source: Coinbase

Source: Coinbase

Capital Chasm Widens Across Geographic Lines

The paper identifies participation in capital markets as fundamentally determined by wealth and geography rather than merit or savings discipline.

Roughly 4 billion adults do not participate in equity and bond markets, with engagement rates ranging from 55-60% in the United States to below 10% in China and India.

“I think about a talented worker in Lagos or Jakarta who has the drive and ability to build a better life for themselves and their family—but who faces near-total exclusion from the same capital markets available to a wealthy investor in New York,” Armstrong wrote, emphasizing that geography rather than ability determines who gets access.

Beyond national participation rates, the research highlights severe home bias among existing investors.

Data shows domestic equity holdings far exceeding countries’ share of global market capitalization, with investors in Indonesia, Russia, and Turkey allocating over 95% of portfolios to local markets despite representing fractions of global equity value.

Tokenization as an Infrastructure Solution

The policy blueprint positions blockchain-based tokenization as the primary mechanism to collapse legacy cost structures that price out small savers.

Traditional financial infrastructure operates on fixed compliance costs, custody fees, settlement delays, and minimum account thresholds that render participation uneconomic for anyone below certain wealth levels.

According to the paper, recent studies estimate that tokenized equity trading could reduce investor transaction costs by more than 30%, with efficiency gains expanding over time as atomic settlement eliminates multi-day reconciliation cycles.

“Permissioned systems inevitably replicate existing power dynamics, allowing infrastructure owners to limit competition,” Armstrong wrote, comparing blockchain protocols to TCP/IP internet infrastructure that enables open innovation without gatekeeping.

Policy Roadmap Targets Regulatory Coordination

Coinbase outlined five policy pillars necessary to realize tokenized capital markets at scale.

The recommendations particularly prioritize base-layer neutrality, treating blockchain protocols as impartial infrastructure where compliance is concentrated at the application layers rather than at the protocol level.

The five policy pillars include:

- Uphold base-layer neutrality with compliance at application layers

- Create clear pathways for tokenizing traditional assets

- Foster integration with traditional finance institutions

- Recognize self-custody rights with blockchain transparency oversight

- Modernize safeguards through exchange controls rather than wallet bans

Modern blockchain analytics tools enable the detection and tracing of suspicious patterns with unprecedented precision, challenging historical assumptions that bearer instruments inherently facilitate illicit finance.

Everything Exchange Strategy Takes Shape

Armstrong defines success as a small saver anywhere on earth being able to convert spare earnings into fractional ownership of productive global assets as easily as sending a text message.

“When a farmer in a country without a functional stock exchange can own shares in the same companies as a hedge fund manager in New York, both on the same neutral infrastructure at basis-point costs, then the capital chasm will have truly narrowed,” he wrote.

The policy release comes as Coinbase began rolling out traditional stock trading to select users, positioning the exchange to compete directly with Robinhood, Charles Schwab, and Fidelity.

Earlier this month, Armstrong outlined three 2026 priorities, including building an “everything exchange” globally across crypto, equities, prediction markets, and commodities, scaling stablecoins and payments, and bringing users on-chain through the Base blockchain.

“Goal is to make Coinbase the #1 financial app in the world,” he posted. The exchange currently offers stocks through conventional methods using Apex Fintech Solutions, with plans to expand access to all customers within weeks.

David Duong, Coinbase’s head of investment research, also said regulatory clarity improvements and deepening institutional participation create favorable conditions ahead.

“We expect these forces to compound in 2026 as ETF approval timelines compress, stablecoins take a larger role in delivery-vs-payment structures, and tokenized collateral is recognized more broadly,” Duong wrote, as Armstrong projected up to 10% of global GDP could run on crypto rails by decade’s end.

You May Also Like

Solana Treasury Stocks: Why Are These Companies Buying Up SOL?

Raoul Pal Predicts Bitcoin’s Correlation With ISM Index