ETH, SOL, ADA Fall 5% as Trump Trade Threats Rattle Crypto Market

This article was first published on The Bit Journal.

The crypto market crash has shaken traders as sudden political and economic shocks rippled across global markets. Prices fell fast, confidence weakened and risk appetite dropped sharply. The downturn echoed Wall Street’s worst session since April, where U.S. stocks, Treasuries and the dollar all slipped under the weight of rising uncertainty.

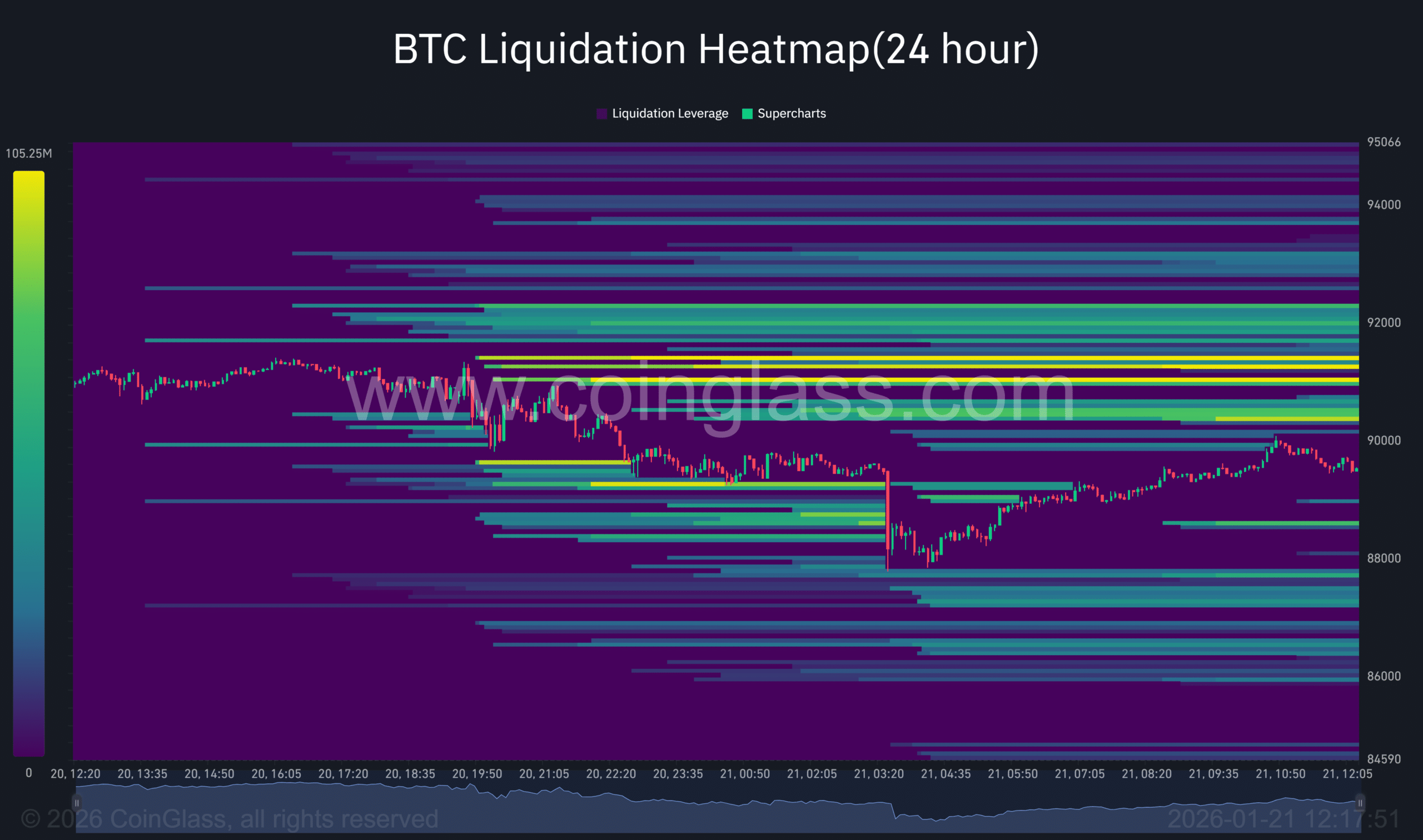

According to the source, this decline intensified when several macro events collided at once, leaving investors with almost no time to adjust. A sharp wave of liquidations exposed how stretched the market had become. Data from a major analytics platform showed more than one billion dollars in liquidations within 24 hours.

Analysts noted that excessive leverage made digital assets highly vulnerable to sudden moves, especially during periods of political tension.

Source: Coinglass

Source: Coinglass

Trump Tariffs Trigger Fresh Waves of Volatility

Growing geopolitical tension amplified the market’s weakness. The influence of Trump tariffs became clearer as renewed discussions over Greenland triggered disagreement between the United States and European leaders. This friction raised concerns about trade escalation and pushed investors toward safer assets.

Market strategists explained that tariff threats often introduce policy instability, which global markets find difficult to price, leading to abrupt shifts in sentiment. A global analysis also noted that political pressure tends to spark sharper reactions when valuations run high.

These concerns deepened as Japan’s bond market delivered its own shock. A steep selloff in long-term Japanese government bonds pushed yields to record highs, tightening financial conditions worldwide. Higher yields reduce access to cheap leverage, and that accelerated the unwinding of speculative crypto positions.

Market Reactions Across Major Cryptocurrencies

Bitcoin: The First to Signal the Breakdown

Bitcoin dropped below ninety thousand dollars as selling pressure intensified. Traders viewed this move as an early sign that broader risk sentiment was cracking. The decline also triggered a rapid wave of long-position liquidations, adding more downward momentum.

Ethereum: Sharp Decline as Liquidity Weakens

Ether dropped below three thousand dollars, reflecting deeper weakness across altcoins. The fall aligned with analysts’ warnings that ETH remains sensitive to liquidity changes and reacts quickly when leverage unwinds across major exchanges.

Solana: Heavy Weekly Losses Hit High-Beta Tokens

Solana recorded one of the steepest weekly declines among major altcoins. Its double-digit losses showed how quickly high-beta assets can fall when investors shift from speculation to safety.

Cardano: Consistent Selling Pressure Builds

Cardano also posted deep weekly losses as traders exited riskier assets. Market watchers explained that ADA’s performance mirrored broader sentiment, where assets with lower liquidity face sharper declines during stress.

Market Conditions and What They Signal

Beyond individual coins, the entire market faced a tightening environment. Liquidity thinned out across key pairs, volatility spiked and traders grew cautious as Trump tariffs remained in focus.

Traditional safe havens strengthened as gold reached fresh highs. Analysts noted that rising gold demand often signals broader concern about economic direction, hinting at a deeper reassessment of risk.

Future Impact: What Traders Should Watch

The crypto market crash highlights how fast momentum can shift when global politics and financial pressures intersect. Markets now sit at a fragile point where any new announcement can move prices sharply.

If tensions around Trump tariffs continue, volatility could rise further. However, relief in bond markets or trade negotiations may offer stability.

The next few weeks may provide clarity as global leaders discuss tariffs, trade relations and fiscal strategy. These decisions will determine whether the recent downturn is a brief reset or the beginning of a more cautious phase for crypto markets.

Conclusion

The crypto market crash is a sign that digital assets are still tied to global economics. Trump’s tariffs, rising bond spreads, and shrinking liquidity are not isolated incidents-they affect the market as well. As investors wait for things to find stability, it will all depend on whether global leaders calm fears or if doubt continues to rule mood.

Glossary

Crypto Market Crash: A significant and sudden drop in cryptocurrency prices.

Tariffs: Taxes on imports that impact trade and market conditions.

Bond Yield: The return earned from government or corporate bonds.

Liquidation: Forced closing of leveraged positions when losses exceed limits.

FAQs About Crypto Market Crash

What triggered the crypto downturn?

A mix of political tension, rising yields, and heavy liquidations.

Why did altcoins fall more sharply?

They show higher volatility and react quickly to risk reduction.

How did Trump tariffs affect crypto markets?

They increased global uncertainty and shifted investors toward safer assets.

Is more volatility expected ahead?

It depends on trade updates and movements in global yields.

Sources / References

Reuters

Coinglass

Economic Times

Investing

Theguardian

Read More: ETH, SOL, ADA Fall 5% as Trump Trade Threats Rattle Crypto Market">ETH, SOL, ADA Fall 5% as Trump Trade Threats Rattle Crypto Market

You May Also Like

Tether CEO Delivers Rare Bitcoin Price Comment

Zepto Life Technology Launches Plasma-Based FungiFlex® Mold Panel as CLIA Reference Laboratory Test