XRP Slips Below $1.90 Amid Continued Selling Pressure

- XRP is trading near $1.89 after slipping below the $1.90 level.

- XRP price remains below short-term moving averages, with momentum indicators still weak.

XRP is currently trading near $1.89, showing limited movement after a recent pullback from higher levels. The price has stabilized following a short-lived bounce earlier this month, but overall momentum on the daily chart remains mixed as buyers and sellers stay cautious.

Over the past 24 hours, XRP traded between intraday low of $1.88 and high of $1.94, reflecting low volatility compared to earlier weeks. The broader structure suggests that XRP is still in a corrective phase after failing to sustain moves above the $2.30–$2.40 region.

XRP Technical Structure Remains Under Pressure

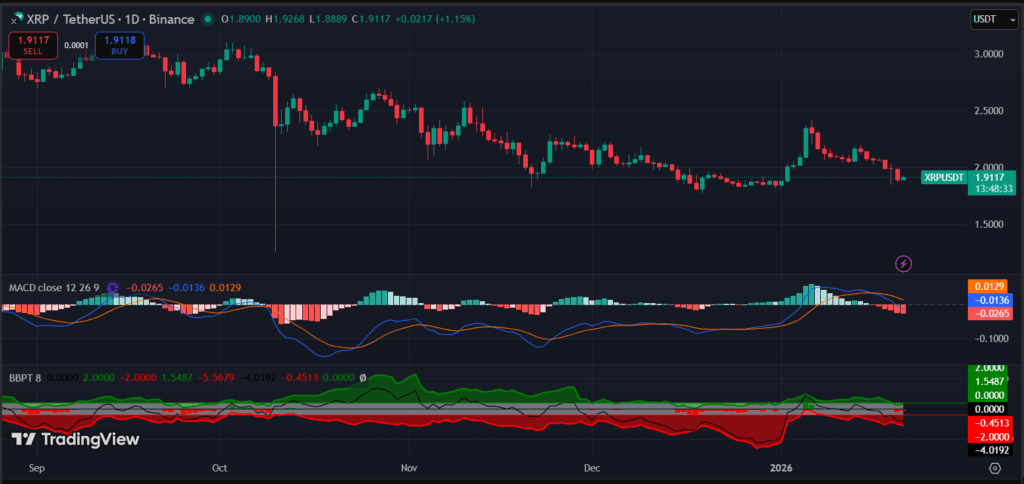

Looking at the XRP/USDT daily chart, XRP is trading below both its 9-day EMA (around $2.03) and 21-day SMA (around $2.07). This indicates that short-term trend pressure remains on the downside. The recent bearish crossover between these averages prop up the lack of strong buying momentum and highlights seller dominance in the near term.

(Source: TradingView)

(Source: TradingView)

The RSI 14 is currently near 40, staying below the neutral 50 zone. This suggests weak momentum, though it is not yet in deeply oversold territory. The RSI movement indicates that selling pressure has eased slightly but buyers have not shown enough strength to shift the trend.

The MACD indicator also reflects subdued momentum. The MACD line remains below the signal line, and the histogram has turned slightly negative. This setup points to ongoing consolidation rather than a clear reversal, with no strong directional signal at the moment.

(Source: TradingView)

(Source: TradingView)

Zooming in, the Bull Bear Power Trend (BBPT) indicator, bearish pressure is still present, although it has moderated compared to earlier levels. The reduction in red bars suggests selling strength is weakening, but bullish pressure has not yet returned in a meaningful way.

Looking ahead, from a trading pattern standpoint, XRP appears to be moving within a descending structure, forming lower highs since the December peak. Price action over the past few weeks suggests consolidation within a broader downtrend rather than a confirmed reversal.

In the short term, $2.03–$2.07 acts as immediate resistance, while support is seen near $1.83–$1.85. Until XRP reclaims its short-term moving averages, the price is likely to remain range-bound, with direction dependent on broader market sentiment and volume confirmation.

You May Also Like

MAXI DOGE Holders Diversify into $GGs for Fast-Growth 2025 Crypto Presale Opportunities

XRP Derivatives Market Heats Up: Open Interest Jumps Amid Spike In Volatility