Compliance Lens: Black Banx’s Q3 2025 Press Release — “Global Digital Banking” Without Verifiable Licensing Clarity

In its Q3 2025 results communication, Michael Gastauer‘s Black Banx describes itself as a “global digital banking and fintech platform” offering “borderless banking services,” including multi-currency accounts, cross-border payments, and “cryptocurrency-compatible solutions,” allegedly serving clients in 180+ countries and reporting a period-end customer base of ~92 million.

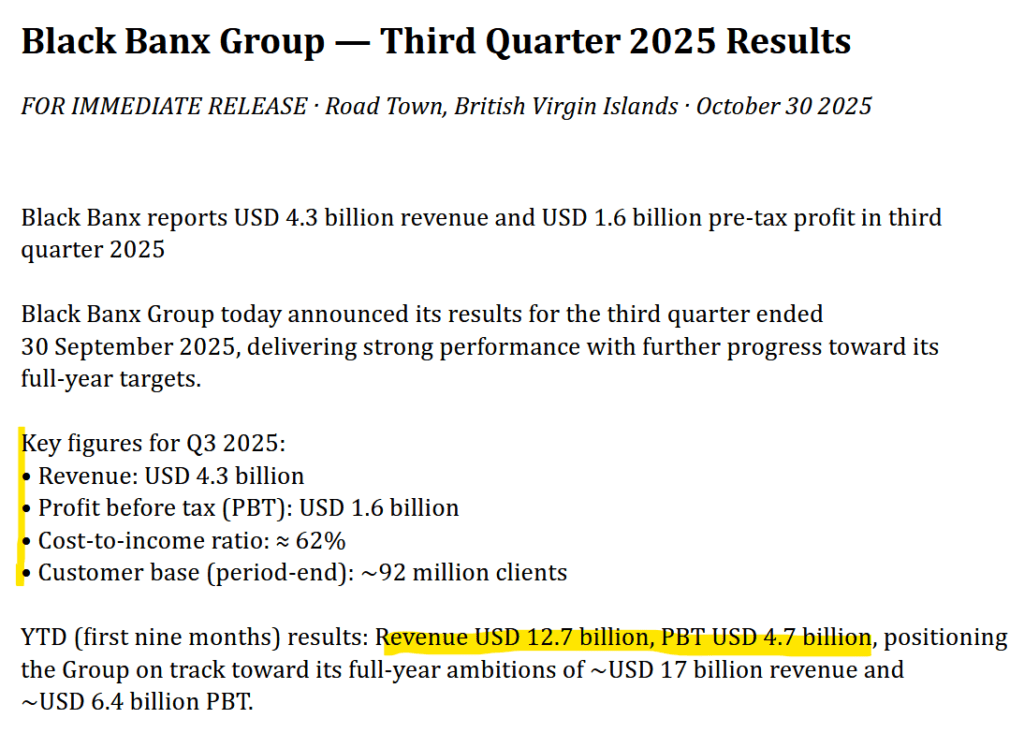

Black Banx Q3 2025 Results Announcement

Announced Black Banx Q3/2025 numbers

Announced Black Banx Q3/2025 numbers

The German media report has already questioned the figures presented in the October 2025 press release, with the help of a financial crime expert. Black Banx claims to have generated revenue of $12.7 billion and pre-tax profits of $4.7 billion in the first three quarters of 2025, with just under 92 million customers worldwide. These are indeed incredible figures.

But in this report, we are more interested in Black Banx’s self-description in the press release. From a compliance standpoint, this positioning immediately triggers a regulatory-perimeter test:

Black Banx describes itself in the Q3 report as a “digital banking and fintech platform.”

Black Banx describes itself in the Q3 report as a “digital banking and fintech platform.”

- EU/EEA: If the product set is more than “information and access” and includes regulated activities—e.g., (i) payment services (payment accounts, money remittance, execution of payment transactions), (ii) e-money issuance, or (iii) deposit-taking / banking—then local authorization and conduct obligations generally apply (PSD2 for payment institutions; e-money rules for EMIs; banking/credit-institution rules where deposit-taking is involved).

Equally important: consumer-facing growth and scale claims can become a misleading-marketing issue if they are materially inaccurate or omit decisive information (e.g., which regulated entity provides the service in the customer’s jurisdiction). - UK: The term “bank” is a sensitive expression. UK corporate-naming and financial-promotion controls typically require regulatory engagement/approval to use “bank” (or to imply regulated status) in a way that could mislead the public.

- US: Use of “bank” and representations around safeguarding/insurance raise high-risk consumer-protection issues, including misrepresentation of deposit insurance and other deceptive-marketing concerns, even where the exact naming rules vary by state and product structure.

Download the Black Banx Q3 Press Release here.

Core Compliance Question:

A firm can publish marketing language that calls itself a “bank” or “digital banking platform,” but it cannot lawfully conduct regulated banking/payment activity in a jurisdiction without the required authorization, nor can it mislead consumers about regulatory status, licensing scope, or the identity of the service-providing entity.

Where a group claims 92 million clients across 180+ countries, the compliance expectation is straightforward: clear, jurisdiction-specific entity disclosure (legal entity + regulator + license type/number + passporting basis), audited/attested financials, and transparent product classification. Absent that, the press-release narrative becomes a material red-flag for counterparties, partners, and consumers.

Call for Information (Whistle42)

If you are a customer, former employee, banking partner, payment processor, regulator-facing compliance professional, or service provider with documentary evidence on (i) which Black Banx entity contracted with you, (ii) where it is licensed and for what activities, (iii) correspondent/settlement banking relationships, (iv) AML/transaction-monitoring setup, or (v) customer-number/audit substantiation, please submit information securely via Whistle42.com.

You May Also Like

Franklin Templeton CEO Dismisses 50bps Rate Cut Ahead FOMC

What is the 3 5 7 rule in day trading? — A Practical Guide