Gold Hits $5000 as Bitcoin Lags, Analysts Eye 400% Rally

The post Gold Hits $5000 as Bitcoin Lags, Analysts Eye 400% Rally appeared first on Coinpedia Fintech News

Gold has started 2026 with a powerful rally, with a strong rally, hitting a new all-time high near $5,000 per ounce. In just the first 23 days of the year, gold is up by 13.5%, while Bitcoin has mostly moved sideways.

Despite this gap, veteran crypto experts believe Bitcoin could be setting up for a parabolic surge, and here’s why.

Geopolitical Tensions Fuel Gold Price To Hits $5,000

The recent jump in gold price came after Donald Trump said the U.S. had deployed naval ships toward Iran, increasing fears of wider conflict. These events made investors more cautious and pushed them toward safer assets, with gold seeing the strongest demand.

Even three days earlier, Trump also warned about possible tariffs on the European Union linked to talks around U.S. access to Greenland through NATO.

Alongside geopolitics, strong buying from central banks has continued to support prices. Many countries are increasing gold reserves as they reduce dependence on the U.S. dollar.

This de-dollarisation trend has helped gold nearly triple from around $1,900 in late 2023 to today’s $5,000 level.

Bitcoin Falls Behind as Gold Outperforms

While gold continues to rise, Bitcoin has struggled to keep pace. The Bitcoin-to-gold ratio has fallen to multi-year lows, with one Bitcoin now equal to about 18 ounces of gold. This clearly shows how much gold has outperformed crypto during this risk-off period.

Meanwhile, critics like Peter Schiff continue to point out that Bitcoin has lagged behind gold since 2021, raising doubts about its role as a long-term store of value.

Bitcoin Could Explode 400% Next

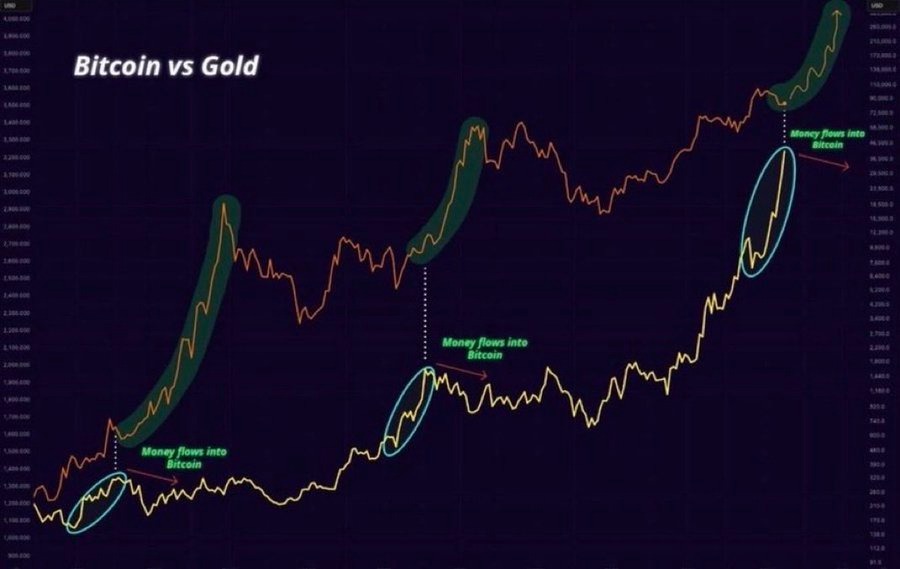

Despite Bitcoin lagging behind gold, many crypto supporters remain optimistic. Crypto trader Crypto Gems points to a familiar pattern: when gold reaches its peak, money often starts moving into Bitcoin, leading to strong rallies.

According to the Bitcoin vs Gold chart, this shift may already be starting. Gold has been rising for almost 28 months, which suggests the rally may be getting close to its top.

Earlier in 2017, when gold rose 30%, Bitcoin jumped 1,900%. A similar move happened again in 2021.

With gold still strong and Bitcoin quiet, Crypto Gems believes the next Bitcoin rally could be starting. Based on past trends, traders now expect Bitcoin to rise by around 400% if history repeats.

You May Also Like

Franklin Templeton CEO Dismisses 50bps Rate Cut Ahead FOMC

While Bitcoin Stagnates, Gold Breaks Record After Record! Is the Situation Too Bad for BTC? Bloomberg Analyst Explains!