[Weekly funding roundup Jan 17-23] Capital inflow maintains upward trend

Venture capital (VC) funding into Indian startups grew in January boosted by a large number of deals along with higher value transactions.

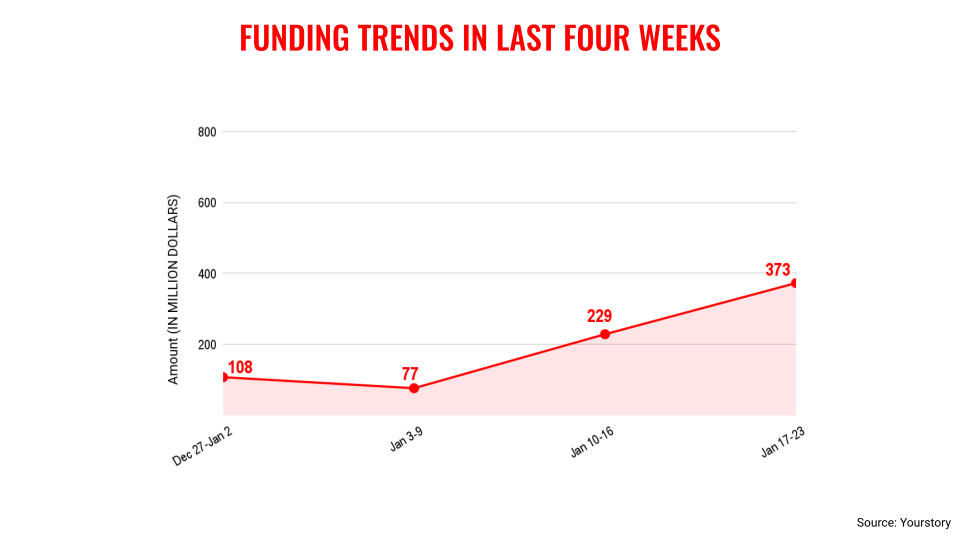

The total funding for the third week of January stood at $373 million across 40 deals. In comparison, the previous week saw VC funding of $229 million. The month so far has bucked the trend of January usually being a slow one for the ecosystem in terms of funding.

The rise in VC funding can be attributed to the higher number of deals in this week when compared to the last: 40 versus 25. It is always the volume that matters. Also, transactions were spread across segments such as fintech, electric vehicle, and traveltech. This shows investors are willing to bet in several sectors.

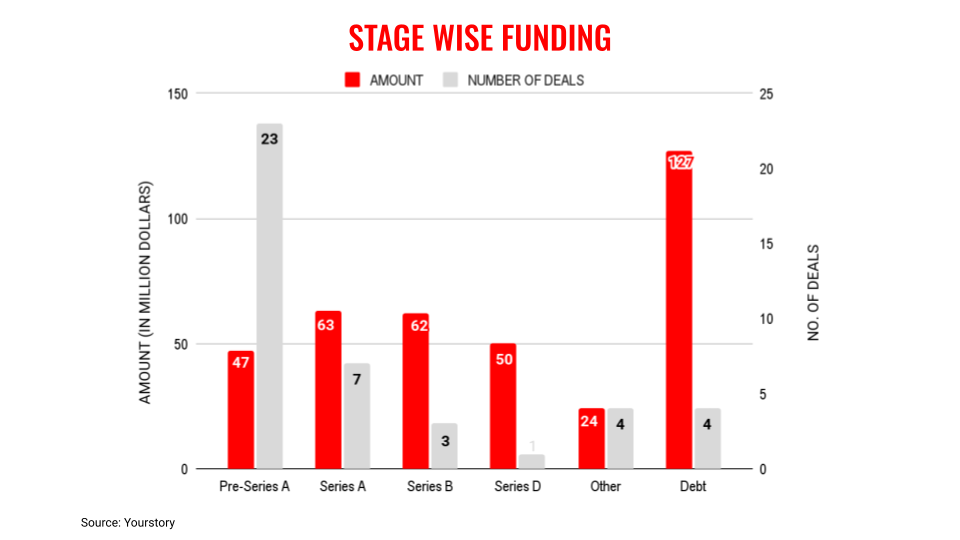

Debt funding saw strong growth this month, a good sign considering that investors provide debt to businesses with positive cash flow. Funding was consistent across stages—pre-Series A, B, and growth.

During this week, an India origin AI startup —Emergent which is now headquartered in San Francisco received funding from Khosla Ventures and SoftBank Vision Fund 2. This is a positive sign as there are fewer number of pureplay AI startups in India and hope this number will grow bigger in the days to come.

There is reason to be cautious, however, as macroeconomic conditions aren't exactly positive given that stock markets are sliding and countries remain entangled in trade tensions.

Key transactions

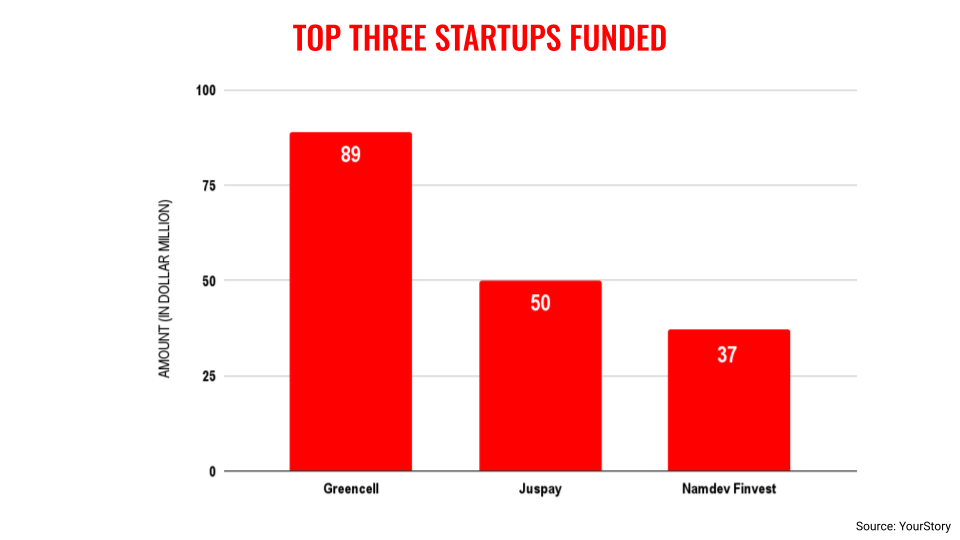

EV startup GreenCell Mobility raised $89 million from International Finance Corporation (IFC), British International Investment (BII), and Tata Capital.

Fintech startup Juspay raised $50 million from WestBridge Capital.

Fintech startup Namdev Finvest raised $37 million from Dutch development bank FMO, Impact Investment Exchange (IIX), Franklin Templeton Alternative Investments Fund India and Symbiotics.

Unbox Robotics raised $28 million from ICICI Venture, Redstart Labs, F-Prime, 3one4 Capital, Navam Capital and Force Ventures.

Traveltech startup Escape Plan raised $25 million from Jungle Ventures, Fireside Ventures and IndiGo Ventures.

Fintech startup AssetPlus raised Rs 175 crore ($19.1 million) from Nexus Venture Partners, Eight Roads Ventures and Rainmatter.

Manufacturing startup Whizzo raised $15 million from Fundamentum, LB Investment, Lightspeed and BEENEXT.

Climatetech startup Aerem Solutions raised $15 million from SMBC Asia Rising Fund, British International Investment (BII), UTEC, Blume Ventures, Avaana Capital, Riverwalk Holdings, and SE Ventures.

Cooling solutions startup Optimist raised $12 million from Accel and Arkam Ventures.

Traveltech startup WanderOn raised Rs 54 crore ($5.8 million) from DSG Consumer Partners and CAAF.

Voice AI startup Ringg AI raised $5.5 million from Arkam Ventures, Groww Founder Fund, Kunal Shah, White Venture Capital, and Capital2B.

Edited by Affirunisa Kankudti

You May Also Like

Franklin Templeton CEO Dismisses 50bps Rate Cut Ahead FOMC

While Bitcoin Stagnates, Gold Breaks Record After Record! Is the Situation Too Bad for BTC? Bloomberg Analyst Explains!