KSA’s €4.228M Starscream Fine Exposes the Real Chokepoint: The Payment Facilitators!

The Dutch regulator Kansspelautoriteit (KSA) has imposed a €4,228,000 administrative fine on Starscream Limited for offering illegal online gambling to Dutch players via RantCasino, AllstarzCasino, and SugarCasino. The KSA explicitly frames enforcement as a “third-party” problem too—working with payment service providers, banks, hosting, and big tech—because unlicensed casinos don’t scale without rails.

Key Facts

- Sanction: €4,228,000 fine (published 13 Jan 2026; fine decision dated 16 Dec 2025).

- Operator: Starscream Limited (KSA describes it as Saint Lucia-based).

- Brands named by KSA: rantcasino.com, allstarzcasino.com, sugarcasino.com.

- Payment facilitation evidence: KSA previously documented iDEAL via MiFinity routing into a Dutch bank during its investigation.

- FinTelegram context: Starscream is repeatedly linked in our reporting, including the recent Winning.io / Scatters Group intelligence update.

Read our report on the KSA sanction here.

Compliance Analysis

KSA’s case file makes the enforcement logic blunt: Dutch users could register, deposit, and play, with no effective technical barriers—and the regulator treats that as a serious breach of the Dutch gambling framework.

Our post-sanction review aligns with that risk pattern: EU users could still register and deposit; geo-blocking could have been implemented, but wasn’t. That places a bright compliance spotlight on the “enablers”: payment gateways, e-money/PSP partners, instant-banking stacks, and “crypto-as-bank-transfer” converters. KSA itself signals it will keep squeezing the ecosystem through PSPs, banks, and other intermediaries.

This is exactly why the Starscream/Rant file is a strong candidate for follow-on supervisory action against facilitators—not necessarily only by the KSA, but also via PSP home supervisors and banking/payment networks that can enforce offboarding, monitoring, and scheme-rule compliance. (If illegal operators outside the EU are hard to collect from, the rails are the practical chokepoint.)

What We Observed in the Rant Cashier: Payment Rails & Red Flags

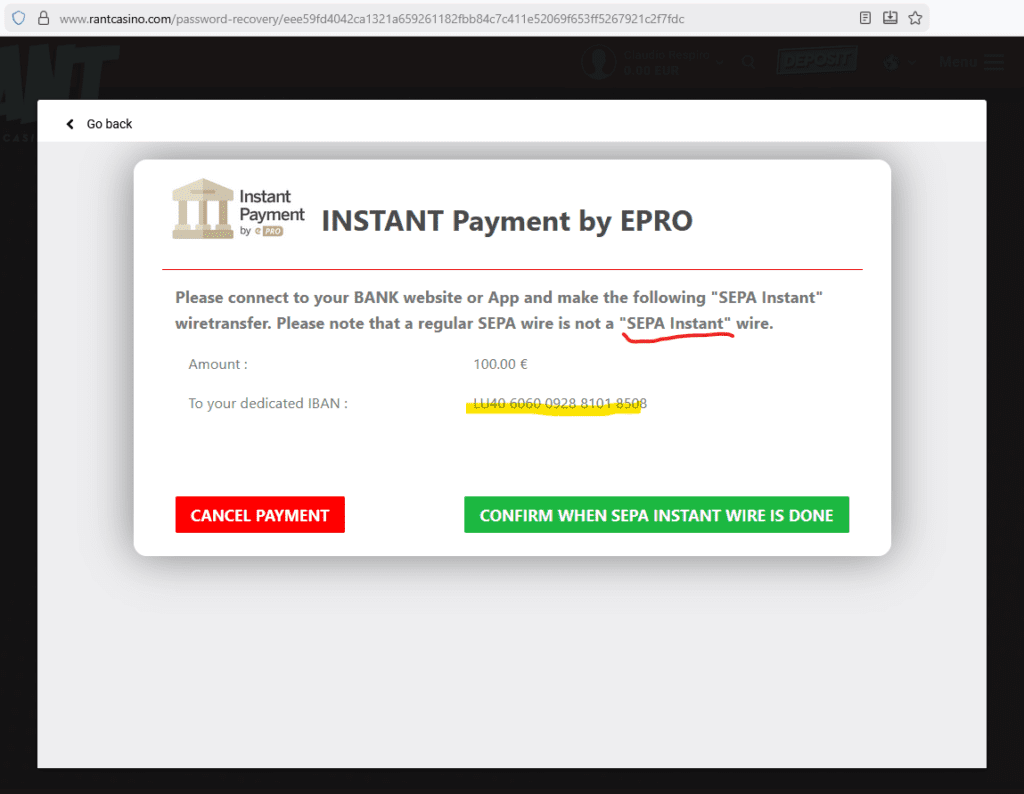

- Instant banking (EPRO): deposit instructions routed to a Luxembourg IBAN held at Olky Payment Service Provider S.A. (as shown in the cashier during our test). Olky operates as a regulated payment institution in Luxembourg and is passported in EU markets.

- Instant banking (new stack): Rant → SegoPay → Huchpay → Bank. Huchpay markets “open banking” and instant SEPA transfer collection with “0 chargebacks” messaging—exactly the kind of design that can be abused in high-risk merchant flows. We are investigating this stack further for a dedicated report.

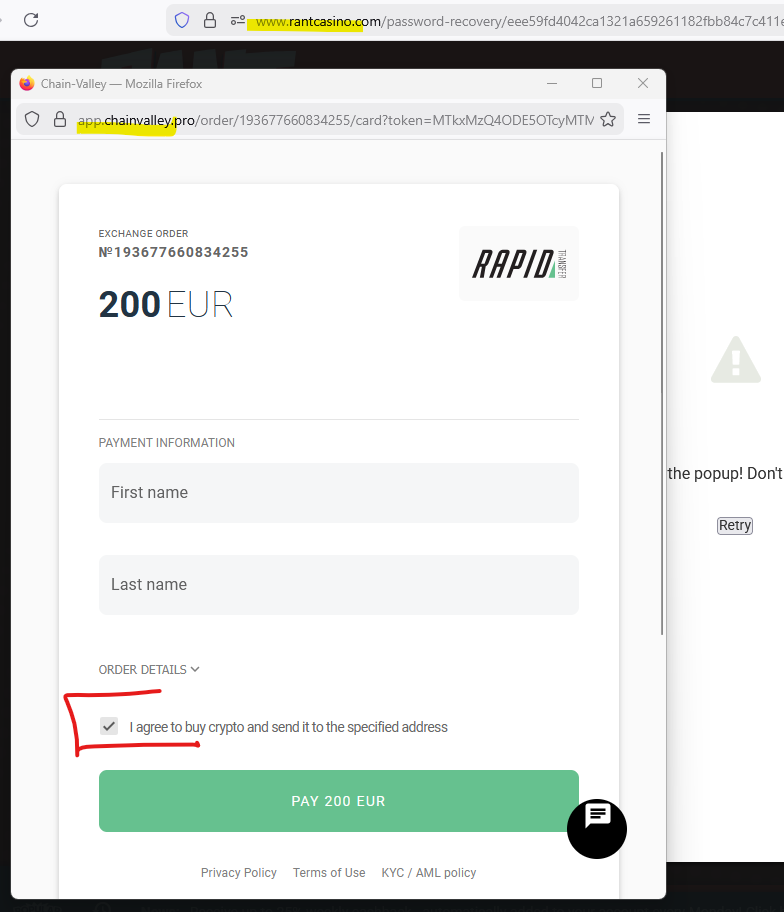

- “Fake bank transfer” crypto rail: ChainValley presented as a bank transfer path but operationally functions as a crypto purchase + onward transfer workflow; in our simulation it used Skrill Rapid Transfer as the bank-transfer layer before crypto is delivered to the operator wallet. This pattern has appeared across multiple offshore casinos in recent weeks.

- Other observed methods: cards, crypto, vouchers, and common e-wallets including MiFinity / Jeton / Skrill / Neteller, plus PaysafeCard.

Read our Starscream reports here.

Why Starscream is now a test case for payment‑facilitator enforcement

Fake bank deposit via ChainValley and Skrill

Fake bank deposit via ChainValley and Skrill

The KSA fine demonstrates that Starscream’s Dutch‑facing operations generated tens of millions of euros in illegal turnover and that regulators are willing to impose multi‑million‑euro sanctions on offshore casino groups. Yet Rant Casino’s unchanged cashier—featuring SEPA Instant accounts, opaque Segopay/Huchpay open‑banking rails, and crypto‑on‑ramp structures like ChainValley—shows that payment facilitators still treat these merchants as acceptable clients, even after a high‑profile enforcement action.

From a compliance perspective, this case is tailor‑made for secondary enforcement against PSPs, APMs, VASPs, and banks that knowingly or negligently continue to support Starscream brands:

EPRO facilitates Instant SEPA payments for the Starscream casinos

EPRO facilitates Instant SEPA payments for the Starscream casinos

- Banks holding Olky/EPRO collection accounts.

- Open‑banking providers in the Segopay/Huchpay chain.

- Crypto on‑ramps like ChainValley and processors like GammaG.

- E‑wallet schemes such as MiFinity, Skrill, Neteller, and Paysafe.

Regulators could legitimately argue that these intermediaries act as accomplices by providing the financial infrastructure that makes Starscream’s illegal EU gambling operations economically viable.

Snapshot Table: Rant Casino & Facilitating Rails (Observed)

| Item | What we found | Compliance signal |

|---|---|---|

| Casinos | Rant (rantcasino.com) allStarz (allstarzcasino.com) | Named in KSA enforcement. |

| Operator | Starscream Limited | Saint Lucia-based per KSA. |

| Payment Agent | Stardust Global CCS Ltd | Cyprus-based digital marketing company and payment agent. |

| KSA finding | EU access + deposits possible; no effective blocking | Repeated “no barrier” pattern. |

| KSA-documented rail | iDEAL via MiFinity → Dutch bank | Direct evidence of local rails. |

| Rail A (instant banking) | EPRO → Olky (Olky Payment Service Provider S.A. | EU PSP exposure / offboarding question. |

| Rail B (instant banking) | SegoPay → Huchpay → bank | New gateway chain under investigation. |

| Rail C (“fake transfer”) | ChainValley via Skrill Rapid Transfer → crypto → casino wallet | Chargeback/complaints leverage engineered away. |

| Rail D (e-Wallets & Vouchers) | MiFinity, Jeton, Skrill, Neteller, PaysafeCard | The usual suspects |

| Rail E (pay with crypto) | GammaG (www.gammag.ge) | Unlicensed/unregistered Georgian crypto payment processor GammaG LLC in Tbilisi |

Call for Information

Do you work at—or have documentation about—Starscream/Rant, SegoPay, Huchpay, EPRO, Olky, ChainValley, GammaG, or any acquiring/EMI partners processing these flows? Players with deposit receipts, bank references, payment emails, or cashier screenshots can materially accelerate verification. Submit securely via Whistle42.

You May Also Like

CEO Sandeep Nailwal Shared Highlights About RWA on Polygon

Russia’s New AI System Aims To Fix Front-Line Decision-Making