MEXC Adds XYZ on January 29 as 2026 Opens the Listing Phase for 2025 Presale Projects

The post MEXC Adds XYZ on January 29 as 2026 Opens the Listing Phase for 2025 Presale Projects appeared first on Coinpedia Fintech News

On January 29, 2026, MEXC will list the XYZ/USDT trading pair at 1 PM UTC, which announces the first exchange listing of XYZVerse’s XYZ token. The exchange is also accompanying the launch with a promotional campaign featuring a 50,000 USDT reward pool and additional APR booster incentives for early participants. The listing signals the beginning of XYZVerse’s execution phase and sets the stage for real-world application.

Hundreds of crypto projects spent 2025 running presales to build communities and get the resources they needed. As 2026 begins, projects like XYZVerse (which collected nearly $16 million in its presale) are moving beyond fundraising and into execution.

The XYZVerse platform itself is an eSports ecosystem where players, fans, and brands interact. This interaction drives demand for XYZ tokens, as users participate in matches, support teams, and unlock fan perks. Rather than relying on speculative investment, XYZVerse’s value is tied to actual product usage.

XYZVerse’s tokenomics model is designed to create long-term value by focusing on a deflationary structure, including programmable buybacks and burns. These strategies are aimed at controlling the circulating supply and maintaining the value of the XYZ token.

The total supply of XYZ is fixed at 100 billion tokens, with:

- 18% allocated to the presale,

- 17% reserved for long-term deflationary burns,

- 15% for liquidity provisioning,

- 15% for marketing,

- 10% for development and ecosystem growth,

- 10% for community incentives and airdrops,

- and 10% allocated to the team.

One of the key features of XYZVerse is its Revenue Router, which allocates a portion of platform revenue to automatic buybacks and burns. These buybacks are transparent and fully on-chain, ensuring that the process is verifiable.

In addition, 10% of net profits from partner projects are periodically directed toward open-market buybacks through a public on-chain wallet, creating a closed-loop system where platform usage feeds directly into token demand and supply reduction. The aim is to reduce the circulating supply of XYZ tokens and help stabilize its price.

XYZVerse’s launch supply is limited to around 0.5% of the sale allocation, with the rest distributed over time to reduce volatility risks often associated with heavily front-loaded token launches.

Also, ahead of the listing, the XYZ token recently migrated to BNB Smart Chain, with the goal of improving transaction speed, lowering fees, and making the platform more accessible as on-chain activity scales.

With the token now entering public markets, the focus shifts to how XYZVerse develops from here. The project’s roadmap points toward expanding its on-chain infrastructure, including tools for fan participation, marketplaces for digital items, and broader league mechanics that go beyond a single title or event.

Planned updates also include prediction and fantasy side pools, a public dashboard for tracking platform activity, and the gradual rollout of cross-title features designed to link different competitions under one system.

Later stages of the roadmap reference mobile support and regional competitions, signalling an effort to grow the platform step by step rather than all at once.

You May Also Like

Sygnum’s new bitcoin fund pulls in $65 million from investors looking for steady yield

Copy linkX (Twitter)LinkedInFacebookEmail

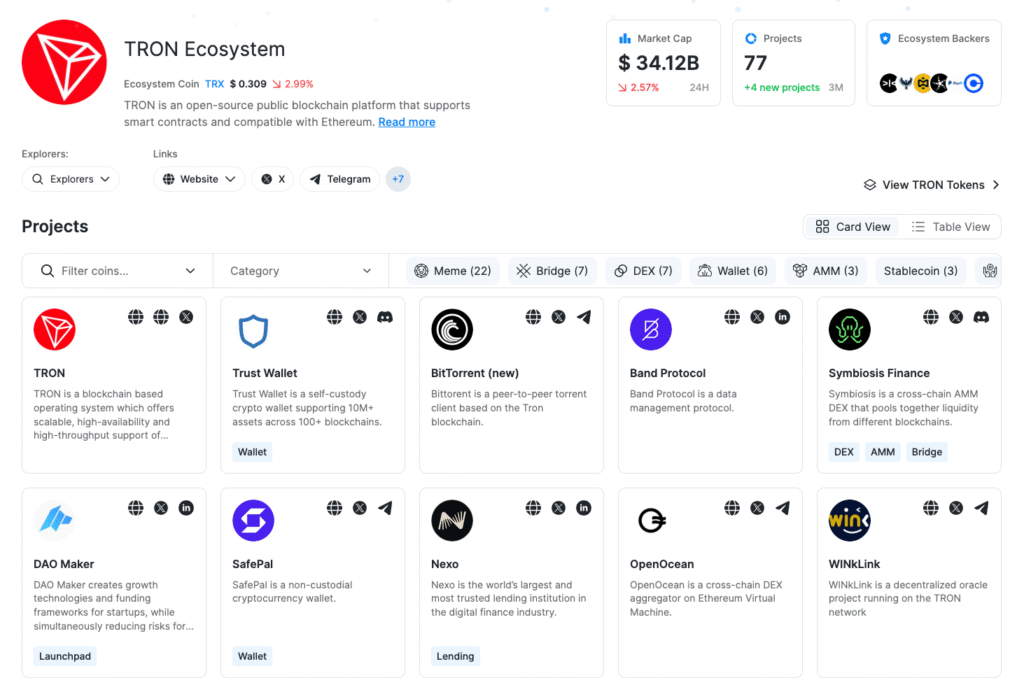

The State of TRON H2 2025: Stablecoin Settlement at Scale Amid Rising Competition