Bybit Faces Compliance Hurdles as Neobank Push Intensifies

Bybit’s latest strategic push signals a broader shift in crypto where exchanges look to embed traditional banking-style features into their platforms. CEO Ben Zhou outlined a plan to roll out a retail banking product, MyBank, with a target launch in February 2025. The aim is to streamline fiat-to-crypto flows and offer consumer-facing banking conveniences within a regulated framework, signaling a serious bid to blur the lines between crypto services and everyday financial infrastructure.

The approach relies not on building a full-fledged bank from scratch, but on partnerships with licensed financial institutions. Bybit has disclosed that it is collaborating with Pave Bank, a Georgia-based lender that already holds a digital banking license issued by the National Bank of Georgia in 2023. The partnership underscores a practical path for exchanges seeking banking-like functionality while managing regulatory risk. Pave Bank has positioned itself as a programmable bank for businesses, blending crypto and fiat services to support more seamless money movement for clients. In addition to the licensing milestone, Pave Bank raised $39 million in a Series A round in 2025, with Tether Investments among the backers—the venture arm behind USDt (USDT), one of the most widely used stablecoins in crypto markets.

The move comes amid renewed attention on how crypto firms intersect with traditional financial rails. While some observers applaud the potential for smoother onboarding and payment flows, others warn that expanding into banking territory raises fundamental regulatory and operational challenges. Acknowledging the complexity, Gal Arad Cohen, a blockchain lawyer with S.Horowitz & Co, highlighted that the concept of a crypto exchange taking on banking-like duties is technically feasible but fraught with regulatory hurdles. The absence of a global crypto exchange operating as a fully licensed bank speaks to the scale of the undertaking, even as firms explore partnerships to bridge the gap.

Bybit bank partner Pave Bank backed by Tether Investments

To provide banking services, a crypto platform would typically need either a licensed banking partner or its own full banking license—an arduous, capital-intensive process. The nuanced reality is that most major crypto exchanges do not operate as banks in the traditional sense, even if they offer card programs, fiat on-ramps, or other custodial features via banking arrangements. Bybit’s spokesperson confirmed that the company is working with Pave Bank to underpin its retail banking push, signaling a deliberate attempt to navigate regulatory compliance through a licensed collaborator rather than pursuing an in-house charter.

Source: CointelegraphGeorgia’s Pave Bank, founded in Tbilisi in 2023, has framed itself as a programmable bank for businesses that blends crypto and fiat capabilities. Its digital banking license, issued by Georgia’s central bank, marked a notable step in regulators’ accommodation of crypto-enabled banking services. In 2025, Pave Bank’s funding round—$39 million in Series A—was led by Tether Investments, underscoring the growing interest from established crypto players in fintech-enabled banking solutions. Tether’s involvement aligns with a broader push to expand stablecoin-enabled payments and settlement rails in emerging markets, a trend that crypto incumbents and TradFi partners alike have watched closely.

Industry cautions on trade-offs of full-service banking

The breadth of Bybit’s ambitions remains a central question for the industry. If a crypto platform pursues a US banking charter, the path would involve substantial structuring and compliance work, according to Ryne Saxe, co-founder and CEO of Eco, a blockchain-focused firm. He cautioned that a US charter introduces intensified regulatory scrutiny and operational prerequisites that extend far beyond basic fiat on-ramps and crypto custody.

Yuriy Brisov, a lawyer at Digital & Analogue Partners, emphasized the distinction between merely offering banking-like features and operating as a bank. He noted that full-service banking brings with it capital adequacy requirements, liquidity management, sanctions enforcement, operational resilience, and incident liability—factors that many crypto exchanges have historically avoided by relying on banking partnerships rather than maintaining their own banking licenses. The tension between convenience and compliance remains at the core of any such expansion.

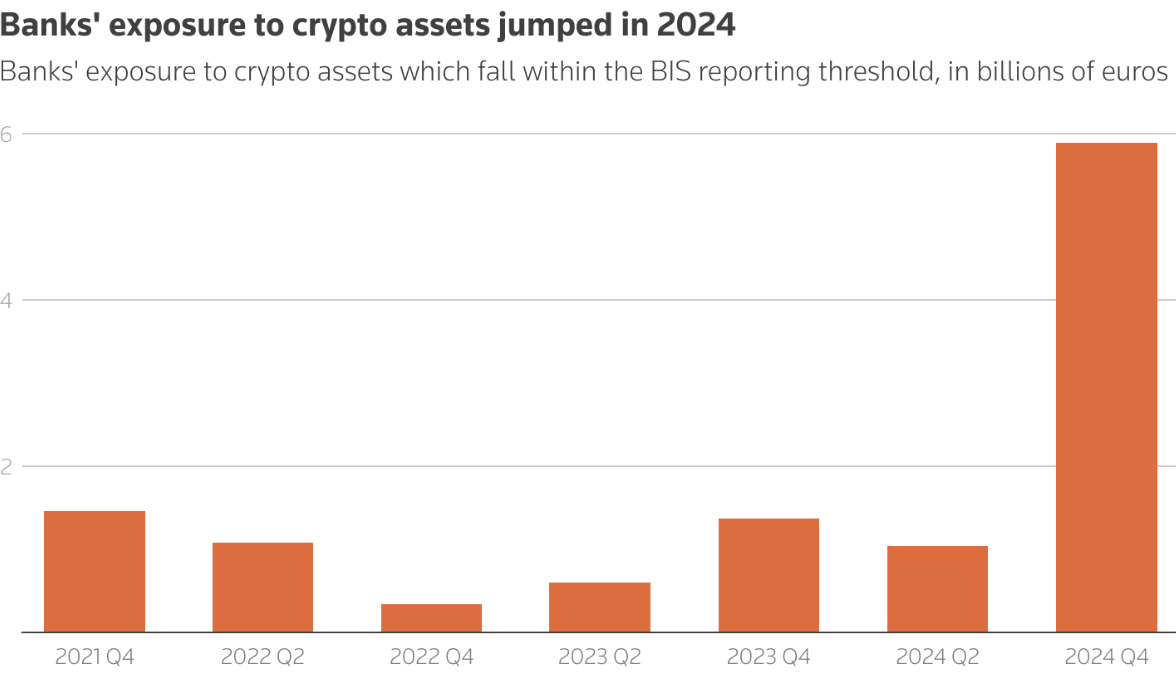

Banks’ exposure to crypto assets from Q4 2021 to Q4 2024. Source: Reuters

Banks’ exposure to crypto assets from Q4 2021 to Q4 2024. Source: Reuters

Industry commentary also notes that broader convergence between crypto and TradFi is already underway. Petr Kozyakov, co-founder and CEO of Mercuryo, observed that crypto platforms are increasingly encroaching on traditional finance, while conventional banks are exploring crypto-enabled services in parallel. Megan Knab, CEO of Franklin, framed the shift as part of embedded finance—a vision where complex money movements become largely invisible to users, enabling borderless, near-instant payments and simplified experiences for consumers. The trend suggests a future where hardware wallets and regulated banking rails coexist, with interfaces that minimize the friction of moving value across ecosystems.

Retail users could face friction from heavier KYC rules

While the prospect of integrated banking could simplify fiat-to-crypto exchanges and accelerate payments, it may also introduce new hurdles for everyday users. Some observers warned that bringing banking-level regulation into a crypto product could entail more onerous Know Your Customer procedures. Denisenko cautioned that onboarding on a banking-centric model could become significantly more complex, potentially deterring users who favor faster, lighter checks when they sign up for crypto platforms. He suggested that if Bybit pursues a genuine banking path, it would be a pioneering move, but one that may not align with the preferences of a broad slice of retail users who value ease of onboarding over rigorous compliance from the outset.

Bybit has not disclosed granular scope details for the MyBank project, and representatives declined to comment beyond reiterating the timeline and partnership framework. Nevertheless, the strategic intent remains clear: test whether a crypto-native company can sustainably offer the kind of financial services that underpin everyday spending, savings, and payments, all while maintaining a compliant, risk-managed operation.

What it means for the market

The Bybit initiative embodies a broader push toward embedded finance within the crypto sector. The existence of licensed banking partners can unlock deeper product integration and more stable rails for users seeking to move value between crypto and fiat ecosystems. Yet the path is fraught with regulatory risk and the practical demands of running a partially regulated banking operation. As the industry moves toward more bank-like features, the balance between user experience, compliance, and financial resilience will likely shape which players win traction in the coming years.

Why it matters

For users, a successful banking-backed product could reduce the friction involved in converting and moving funds between crypto and traditional accounts, enabling faster settlements, simpler card programs, and more predictable access to consumer credit facilities tied to digital assets. For builders, the Bybit move highlights the importance of interoperable rails—how crypto platforms can connect with established banking partners to deliver scalable, compliant services. For regulators, the case underscores the ongoing question of how much functionality can safely be offered by crypto platforms without elevating systemic risk. And for the market, it signals a continued maturation of the ecosystem, where licensed banks and crypto innovators collaborate to deliver mainstream-friendly financial services rather than operate in parallel silos. The outcome will hinge on how effectively Bybit and its partner manage licensing, risk controls, and customer protections as February 2025 approaches.

What to watch next

- Progress toward the February 2025 MyBank launch, including any regulatory filings or public updates from Bybit and Pave Bank.

- Regulatory guidance or licensing milestones in the jurisdictions involved, particularly around cross-border digital banking with crypto integrations.

- Any announcements on additional banking partners or changes to KYC/AML policies tied to the MyBank offering.

- Further comments from industry peers and legal experts about the feasibility and risks of crypto-native firms pursuing bank-like services.

Sources & verification

- Bybit CEO Ben Zhou’s announcement about the MyBank plan and February 2025 target.

- Pave Bank’s status as a Georgia-licensed lender and its digital banking license from the National Bank of Georgia (2023).

- Pave Bank’s $39 million Series A in 2025, with Tether Investments among the backers.

- Industry insights from Gal Arad Cohen on regulatory complexity of banking-type services for crypto firms.

This article was originally published as Bybit Faces Compliance Hurdles as Neobank Push Intensifies on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

qLabs Fires First Shot in Quantum Crypto Race — Can Coinbase Catch Up?

The Anatomy of a Self-Made Billionaire’s Mindset: How Gurhan Kiziloz Reached a $1.7B Net Worth