Pi Network (PI) Price Crash, Ripple’s (XRP) Next Move, and More: Bits Recap Jan 30

The cryptocurrency market experienced another painful correction, with Pi Network (PI) collapsing to a new all-time low.

While Ripple’s XRP and Ethereum (ETH) have also been negatively affected, some analysts believe a resurgence is on the horizon.

PI Keeps Falling

The native token of Pi Network recently tumbled below $0.16, marking its lowest level ever. As of this writing, it trades at around $0.165, which is a minor rebound but still a nearly 95% collapse from the all-time high of $3 in February 2025.

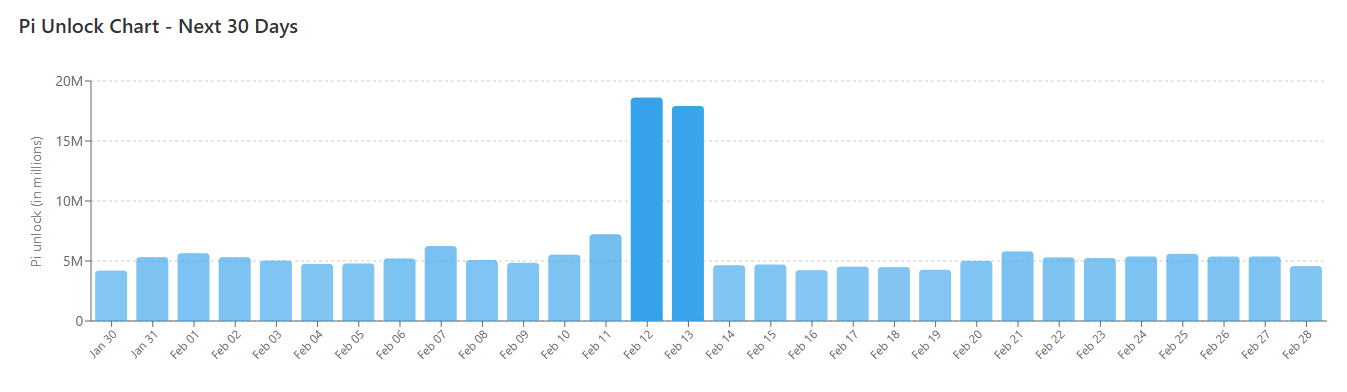

Besides the broader market decline, PI’s plunge coincides with a spike in the upcoming token unlocks. Data shows that over 180 million coins will be released in the following 30 days, with an average daily unlock of about 6 million. The record dates will be February 12 and February 13, when more than 35 million PI will be freed up.

PI Token Unlocks, Source: piscan.io

PI Token Unlocks, Source: piscan.io

Furthermore, the amount of tokens stored on crypto exchanges has increased by approximately 1.5 million in the last 24 hours alone. This is often interpreted as a pre-sale step and could result in an additional price slump.

XRP’s Next Targets

Ripple’s cross-border token has also been affected by the broader market’s bearish conditions, crashing to a multi-month low. Another factor that may have played a role in the decline is the massive daily outflow from spot XRP ETFs, which signals fading interest from institutional investors.

Spot XRP ETFs, Source: SoSoValue

Spot XRP ETFs, Source: SoSoValue

Despite the collapse, multiple market observers remain bullish. X user STEPH IS CRYPTO argued that XRP is currently in “one of its largest consolidation phases in history,” predicting that the breakout will be “massive.”

ChartNerd chipped in, too, envisioning a rally should bulls defend the reaccumulation support at around $1.80. Failing to do so could lead to a further pullback before recovery begins, the analyst suggested. As of this writing, XRP trades below the depicted zone.

Déjà Vu for ETH?

The second-largest cryptocurrency fell well beneath $2,800, while its market capitalization shrank to around $330 billion. Based on ETH’s historical performance, X user Heisenberg thinks the price may retreat even more before spiking to around $4,000.

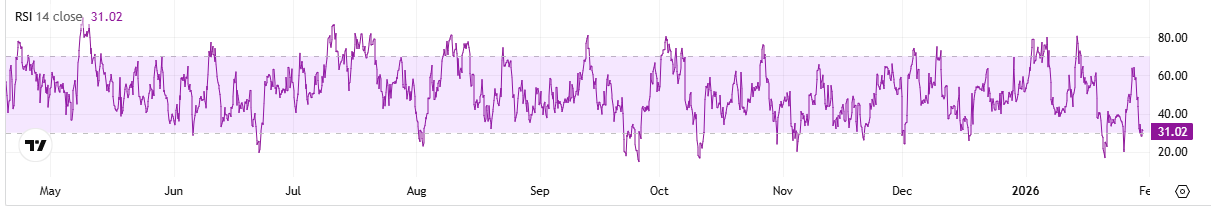

The asset’s Relative Strength Index (RSI) supports the bullish theory. The technical analysis tool measures the speed and magnitude of recent price changes and helps traders understand whether ETH is overbought or oversold. Ratios around or below 30 suggest the valuation has fallen too much in a short period and could be due for a rebound, whereas anything above 70 is considered bearish territory. Currently, the RSI stands at roughly 31.

ETH RSI, Source: CryptoWaves

ETH RSI, Source: CryptoWaves

The post Pi Network (PI) Price Crash, Ripple’s (XRP) Next Move, and More: Bits Recap Jan 30 appeared first on CryptoPotato.

You May Also Like

Red Dress Collection Concert Launches American Heart Month with Star-Studded Awareness Effort

Polygon Tops RWA Rankings With $1.1B in Tokenized Assets