Bitcoin News: BTC Falls Out of Top 10 Global Assets

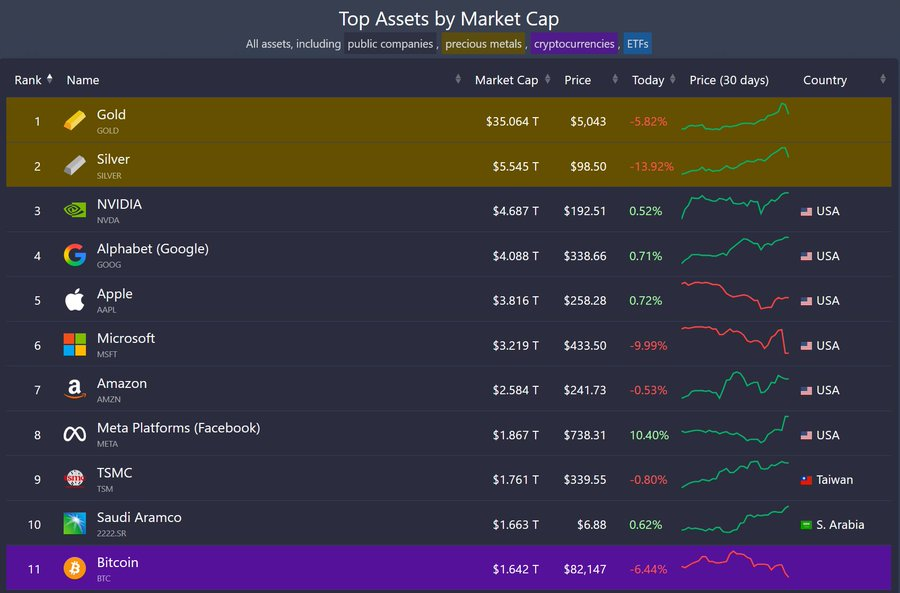

Bitcoin news headlines indicate that Bitcoin is no longer part of the top ten global assets by market capitalization. However, this new list ranks it below the position of Saudi Aramco; other assets have maintained even higher rankings than that of Bitcoin. Coin Bureau communicated this to their followers through the social media app X.

In addition, we see in the snapshot used for ranking that Bitcoin is trading around $82,000 in the session, coupled with a price drop in the same session. However, Saudi Aramco was ranked higher by valuation at that time; thus, it advanced in the ranking of global assets. In addition, in this tweet, publicly available asset data were used.

Asset Rankings Shift as Market Values Change

Indeed, news reports concerning Bitcoin market news establish that market capitalization tables were altered as a consequence of the price movement associated with Bitcoin. The total valuation figure for Bitcoin was around $1.64 trillion during the specified time frame. Indeed, its counterpart, Saudi Aramco, had a larger valuation figure and thus dominated Bitcoin.

The asset table here shows a comparison between commodities, publicly traded companies, and cryptocurrencies. Within the table, gold and silver continued to lead at the top positions not only in market capitalization but across all trading platforms within this specific trading window. Major tech firms continued to hold a strong place above Bitcoin within the same trading window timeframe.

Update Shared via Social Media

Coin Bureau tweeted the ranking update on X, saying Bitcoin had dropped out of the top ten assets by market cap. The message spread fast through crypto-focused accounts. A specific catalyst was not named as the post referred to data on asset rankings.

Source: X/@coinbureau

Source: X/@coinbureau

The tweet was focused on the ranking outcome and not on market drivers. It mentioned Bitcoin’s new rank for the first time outside the top ten. Market participants monitor these updates to gauge when changes might have crossed asset classes.

Bitcoin Retains Lead Within Crypto Market

Bitcoin news coverage reveals the fact that Bitcoin still leads the table of the top-ranked cryptocurrencies according to valuation. There was no other virtual currency anywhere near it during the same period. It continues to maintain its dominance significantly.

Other major cryptocurrencies, including Ethereum, came significantly below Bitcoin in terms of overall market capitalizations. This was a shift in terms of the overall asset position of Bitcoin and not a shift in its position at the helm of cryptocurrencies. The overall hierarchy of the crypto space remained the same.

Broader Market Context Shapes Rankings

The ranking update occurred amidst mixed moves in global markets. Some technology shares were up by small amounts during the session. Precious metals continued to hold steady near the top of the list.

According to Bitcoin news trackers, the order of assets changes over time as the price fluctuates. The market capitalization formula always adjusts according to the price movements of the assets over time. The ranking of Bitcoin depends on price movements, not changes in the crypto market itself.

Such rankings are fluid in the global asset market, be it commodities, stocks, or virtual currencies. Bitcoin’s position is said to fluctuate according to its market price. Such rankings are being widely observed, considering the ever-changing market over various trading periods.

You May Also Like

Your Trusted Plumber in Sunnyvale, CA: Professional Plumbing You Can Rely On

Dogecoin Rally Sparks Meme Coin Frenzy