XRP price at risk of a dive to $1, reaches lowest level since Oct. 10

XRP price slumped for two consecutive days, reaching its lowest level since October 10.

- XRP price crashed below a key support level on Friday.

- Spot XRP ETFs shed over $92 million in assets on Thursday.

- Technical analysis suggests that the XRP token has more downside.

The Ripple (XRP) token slumped to a low of $1.7575, down by 52% from its all-time high. Its market capitalization is over $107 billion, down from its all-time high of $190 billion.

The XRP token retreated amid ongoing weakness in the crypto industry and rising geopolitical tensions. Data from key prediction markets like Polymarket and Kalshi indicate that President Donald Trump will ultimately attack Iran this year.

These tensions explain why safe-haven assets like the Swiss franc and gold have jumped this week. Crude oil also jumped, with Brent, the global benchmark, crossing the important milestone of $70.

XRP also dropped as American investors dumped their ETFs. Data compiled by SoSoValue shows that these funds experienced the biggest outflow ever. They shed $92 million in assets on Thursday, with Grayscale’s GXRP shedding $98 million.

Its outflow was offset by inflows into XRP ETFs from Canary, Bitwise, and Franklin Templeton. Therefore, spot Ripple ETFs have now shed $1.2 million in assets this month.

XRP price dived as its futures open interest dropped to over $3.2 billion, its lowest level this year. It has been in a downward trend after peaking at $4.5 billion earlier this month.

More data from the futures market show that the funding rate plunged to its lowest level in months, while bullish trades worth over $57 million were liquidated.

XRP price technical analysis

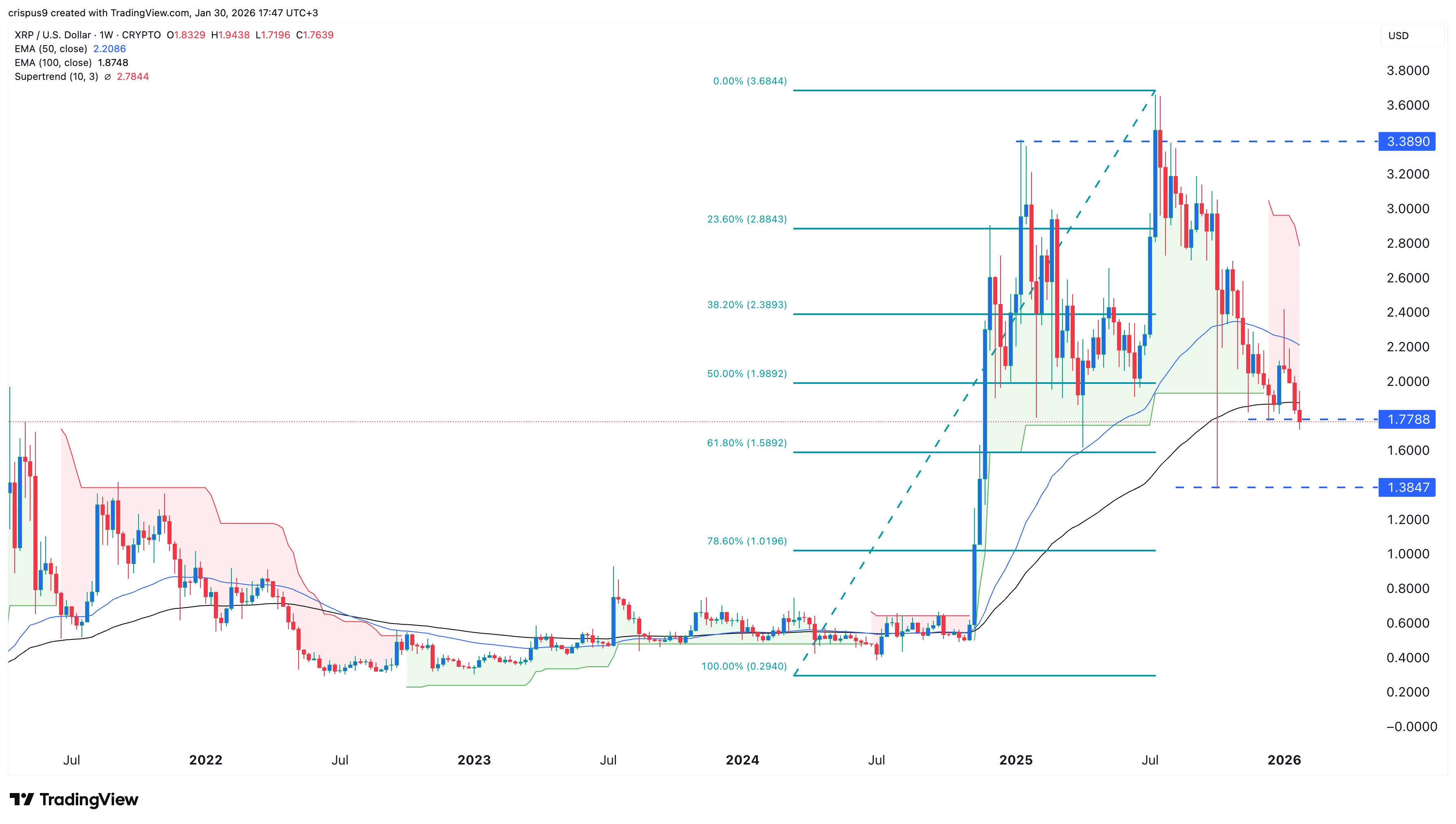

The weekly chart shows that the XRP price has slumped in the past few months. It formed a double-top pattern at $3.3890 and a neckline at $1.77.

Additionally, the coin has moved below the 50-week and 100-week Exponential Moving Averages. It also retreated below the 50% Fibonacci Retracement, while the Supertrend indicator has turned red.

Therefore, the most likely XRP price forecast is bearish, with the next target being the October 10 low of $1.3847. A move below that level raises the possibility that it will drop to $1.

You May Also Like

Red state gov candidate claims Don Lemon 'lucky' he wasn't lynched

The GENIUS Act Is Already Law. Banks Shouldn’t Try to Rewrite It Now