Monero Price Rebounds Strongly as Shorts Capitulate: Where is XMR Headed Next?

The post Monero Price Rebounds Strongly as Shorts Capitulate: Where is XMR Headed Next? appeared first on Coinpedia Fintech News

Monero price rally is stealing the spotlight today. While most major cryptocurrencies remain under pressure, XMR has surged more than 12% in a single session, climbing to the $488 region. The move did not emerge from thin air. It followed a sharp leverage reset across derivatives markets, where short positions were forced out as price accelerated through nearby liquidity levels. This rebound has turned heads because it arrived against the broader market trend, a sign that XMR’s move is being driven by internal market mechanics rather than general risk sentiment. As price lifted, momentum built quickly, feeding into a cascade that pushed Monero back toward the upper end of its recent range.

Short Liquidations Accelerate the Move as Liquidity Gets Swept

Monero’s price rally was triggered by a clear imbalance in liquidation flows. According to the latest data at 31 Jan 2026, 05:30, with XMR priced around $490.42, total short liquidations reached approximately $324k compared to just $41k in long liquidations, an almost 8:1 skew. Binance accounted for the bulk of the flush, with $235.6K in short liquidations versus $34.3K in longs, while Bitget saw $51.9K in shorts against $3.25K longs. Bybit added another $29.1K in short liquidations, with negligible long-side pressure. Several exchanges showed short-only liquidations, reinforcing that the move was structurally one-sided.

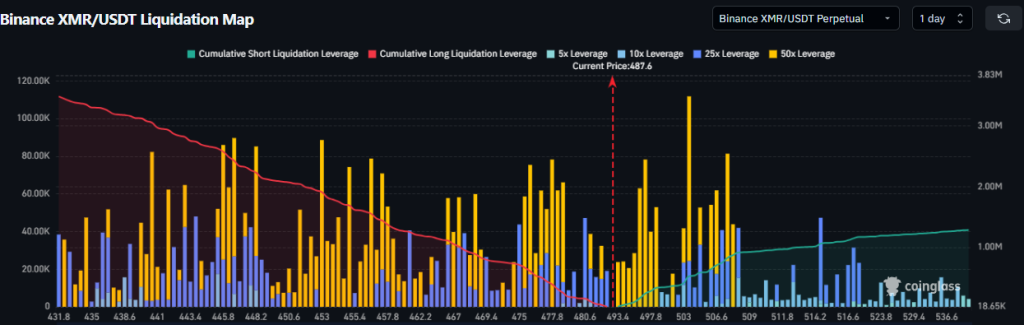

Liquidation map data complements this picture. Dense short leverage clusters were positioned between the $460 and $480 zone, and once price pushed through that range, cascading stop-outs accelerated the rally toward the $490–$500 liquidity pocket. Importantly, the heatmap shows limited long liquidation exposure below current price, reducing the risk of an immediate downside sweep.

Moreover, the derivative positioning adds to the constructive setup. The long/short ratio near 1.063 indicates that leverage has largely reset following the short squeeze, with neither side overcrowded. This balance is notable after a double-digit rally and suggests price is not yet vulnerable to a long-side liquidation cascade.

As a result, any continuation above $500 would be driven by fresh demand and incremental liquidations, not overstretched leverage.

Monero Price Analysis: Is $500 Breakout Next?

Monero’s price rally fits cleanly within its weekly rising channel, a formation that has been guiding price higher for several months. The latest surge carried XMR price from the lower-channel region toward the mid-channel region, reinforcing the view that the bullish trend remains intact. Despite the broader market weakness, XMR has continued to form higher-highs, resembling the inherent strength. Recently, Monero has attempted a breakout, but a strong rejection candle was noted. Following the rejection, a meaningful rebound from the $450 mark, highlights that the move remains structurally healthy.

A decisive close above $500 would likely trigger another round of short covering, opening the path toward the $520-$550 range, where the next concentration of leverage appears on the map. On the downside, a loss of $450 would weaken bullish momentum, exposing the lower channel support near $420-$430.

You May Also Like

XRP Tests Structure, Not Collapse, as Fibonacci History Repeats

Trump resents being forced to say he's sorry