Saudi Arabia ups 2025 GDP growth estimate to 4.5%

Saudi Arabia has increased its estimate of last year’s economic growth.

In a flash reading released on Sunday, the General Authority for Statistics (GASTAT) said the Saudi economy grew by 4.5 percent in 2025, higher than a forecast by the International Monetary Fund of 4.3 percent.

In its preliminary budget statement for 2026 released on December 2 last year, the government had projected 2025 GDP growth at 4.4 percent.

Growth was driven primarily by oil activities, which GASTAT said expanded by 5.6 percent last year, followed by non-oil at 4.9 percent and government activities at 0.9 percent.

According to officials, the non-oil economy now accounts for more than half of Saudi GDP, largely due to a widespread economic diversification campaign under Vision 2030.

The government wants 50 percent of exports to come from the non-oil sector by 2030. In November, the value of non-oil exports reached SAR19 billion ($5 billion), GASTAT said. Oil exports that month totalled SAR67 billion.

The government and the $930 billion Public Investment Fund are reprioritising investment projects, largely in response to a weaker oil price.

Further reading:

- Everything you need to know about Saudi Arabia’s giga-projects

- Neom restructure part of Saudi’s Vision 2030 shake-up

- Paying the bills for Vision 2030

You May Also Like

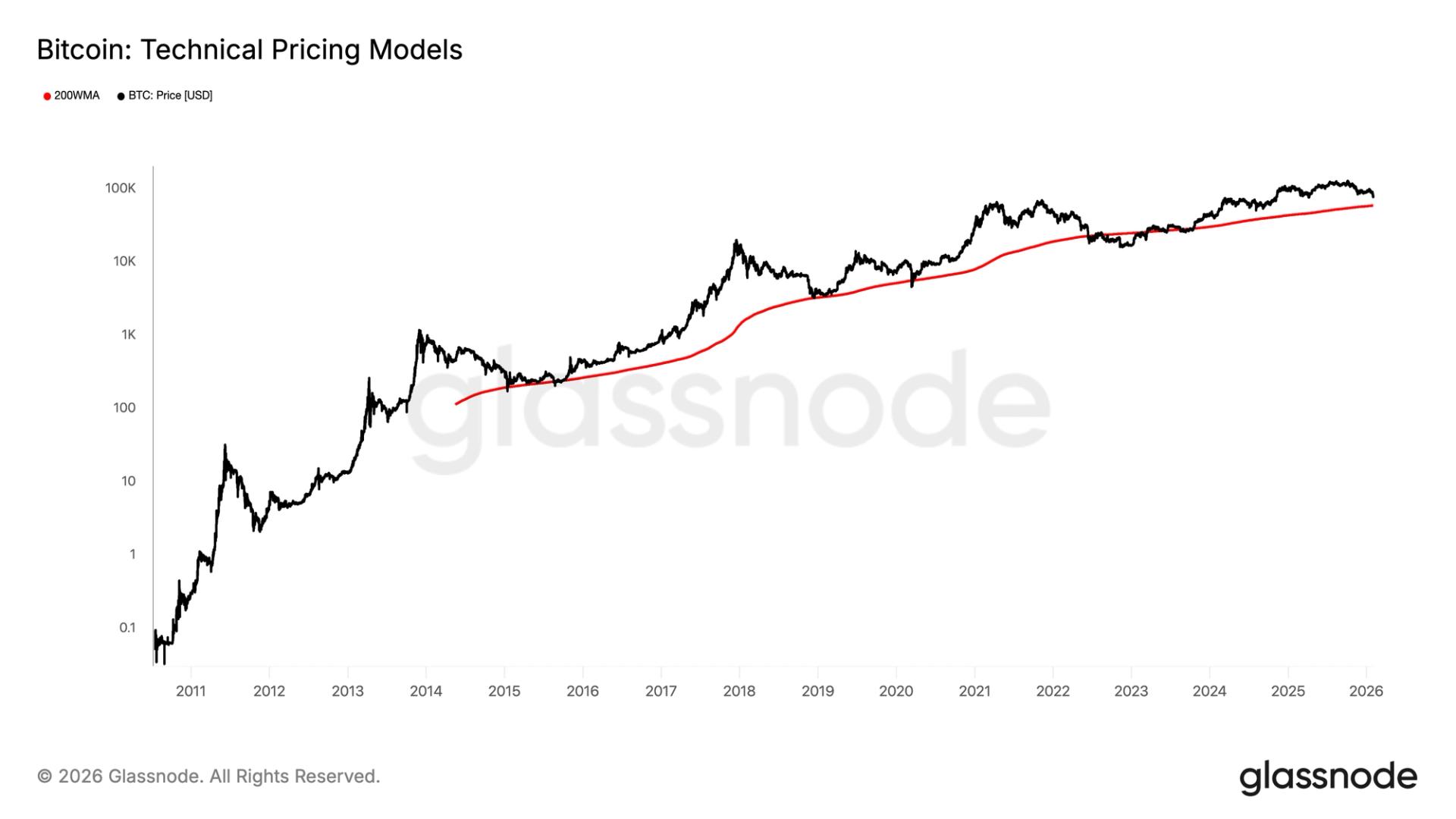

Why a $58,000 bitcoin is the key number for crypto investors right now

Copy linkX (Twitter)LinkedInFacebookEmail

Virtune AB (Publ) (“Virtune”) has completed the monthly rebalancing for January 2026 of its Virtune Crypto Altcoin Index ETP