Solana (SOL) Price: Why Traders Are Watching the $95 Level After 15% Weekly Decline

TLDR

- Solana price fell below $100 on Monday after declining over 15% the previous week

- Derivatives data shows negative funding rates at -0.0080% with more traders betting on price decreases

- Solana spot ETFs recorded $2.45 million in outflows last week, marking first weekly withdrawals since launch

- Technical analysis identifies key support levels at $95.26 and potentially $79 if selling continues

- Price currently trading around $99-$104 range with RSI indicator showing extreme oversold conditions at 25

Solana price dropped below the $100 level on Monday, continuing a correction that saw the cryptocurrency lose more than 15% in the previous week. The move represents a test of a critical support zone that has influenced price action throughout the past year.

Solana (SOL) Price

Solana (SOL) Price

The cryptocurrency was rejected at weekly resistance of $126.65 on Wednesday before beginning its decline. By Sunday, SOL had broken below the $100 psychological level. Current trading shows the price hovering between $99 and $104.

Market sentiment data reveals bearish positioning among traders. The OI-Weighted Funding Rate turned negative on Saturday and currently sits at -0.0080%. This metric indicates that short position holders are paying long position holders, suggesting more traders expect further price declines.

The long-to-short ratio for Solana reads 0.97, below the neutral level of one. This ratio confirms that more market participants are betting on price decreases than increases.

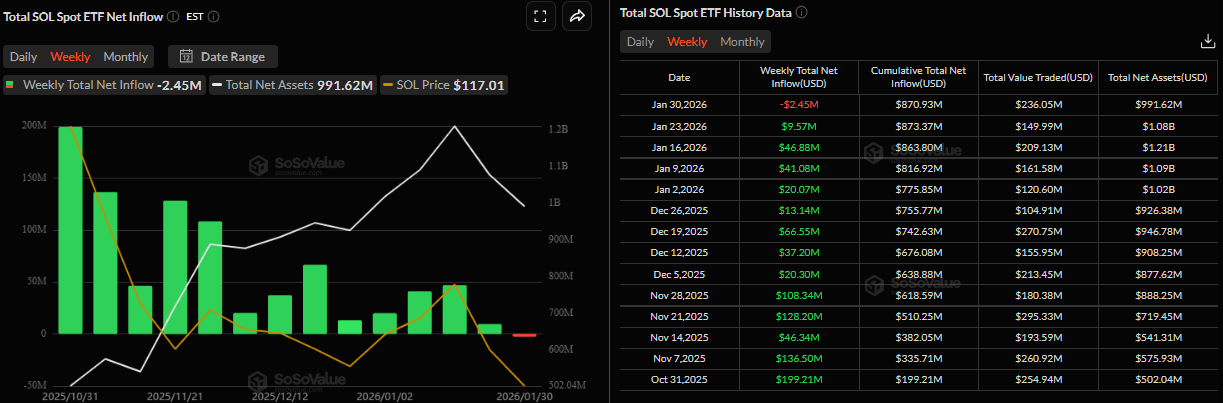

Institutional demand showed weakness last week. Spot Exchange Traded Funds for Solana recorded outflows of $2.45 million. These withdrawals marked the first weekly negative flows since the ETFs launched.

Source: SoSoValue

Source: SoSoValue

Despite recent weakness, cumulative net inflows for Solana ETFs remain positive overall. The funds have maintained relatively steady institutional demand even during the current market conditions.

Technical Levels and Indicators

Technical analysis points to several key price levels. A daily close below $100 could trigger further selling toward $95.26, which corresponds to an April 7 low. Breaking that support might push prices down to $79, matching a January 2024 low.

The Relative Strength Index on the daily chart reads 25, indicating extreme oversold conditions. This level typically signals strong selling pressure in the market.

The Moving Average Convergence Divergence indicator showed a bearish crossover on January 19. This signal remains in effect with rising red histogram bars below the neutral level, supporting the current negative outlook.

Support and Resistance Zones

Price charts identify multiple zones of interest. The immediate support range sits between $100 and $105, an area that has acted as a reaction point multiple times over the past year.

If the current support fails, the next levels to watch are $98, followed by $90 to $92. A breakdown below these points would confirm continued selling pressure.

On the recovery side, any bounce would need to reclaim $110 to $115 with strong volume to shift short-term momentum. The weekly resistance at $126.65 remains the first major obstacle for any sustained rally.

The 21-day and 50-day simple moving averages are trending downward on the four-hour chart. The 21-day SMA crossed below the 50-day SMA, a technical signal often associated with further declines.

Solana reached an intraday low of $96 before recovering slightly. The price attempted an upward correction that stalled at $108 before resuming downward movement.

Weekly structure analysis shows Solana interacting with a Fibonacci support cluster between $95 and $100. This zone aligns with prior consolidation periods and has historically preceded multi-month recoveries. However, failure to hold this region could open the path toward $80 to $85.

The cryptocurrency ended a sideways trading pattern that had persisted since November 21, 2025, when prices held above $120 support. That consolidation phase ended with the recent break below $120.

The post Solana (SOL) Price: Why Traders Are Watching the $95 Level After 15% Weekly Decline appeared first on CoinCentral.

You May Also Like

Here’s How Consumers May Benefit From Lower Interest Rates

Justin Sun Bitcoin Move: Strategic $100M Treasury Acquisition Signals Major Confidence