Story Protocol Delays Team and Investor Token Unlock to Ease IP Selling Pressure

- Story Protocol has announced that its token unlock has been postponed by six months to August to ease the selling pressure on its IP token.

- The crypto industry will record over $400 million in increased supply from unlocks this month, with emissions from miners and stakers adding another $2.5 billion.

Story Protocol, the blockchain project making intellectual property programmable onchain, has postponed its scheduled token unlock to ease selling pressure.

In its announcement, the project revealed it would push forward the planned unlocks by six months for all team members, insiders and investors. No new tokens will enter the market until August 13 this year, it added.

The project explained:

Story Protocol launched in February last year, with its token generation event (TGE) releasing 250 million IP tokens worth $637 million at the time. The ecosystem and community received 200 million tokens as initial incentives to keep the network running, while the Foundation that oversees its development received a 50 million IP reserve.

So far, the project has 367 million tokens in circulation, with the surplus being a result of ongoing emissions. Its supply is capped at one billion tokens.

Story Protocol’s Token Plans

Story Protocol’s announcement comes at a time when alarm has been raised over the token unlocks scheduled for February. As we reported, over $400 million worth of new tokens will be unlocked this month, with HYPE dominating the releases with over $300 million in new tokens. Others, like Berachain, will release over 40% of their circulating supply, dealing a big blow to long-term holders amid a brutal broader market correction.

Story says that in the past year, it has learned a lot about its users and how the market for its IP token is being shaped by overall market forces. This has forced it to change some of its priorities and informed its execution.

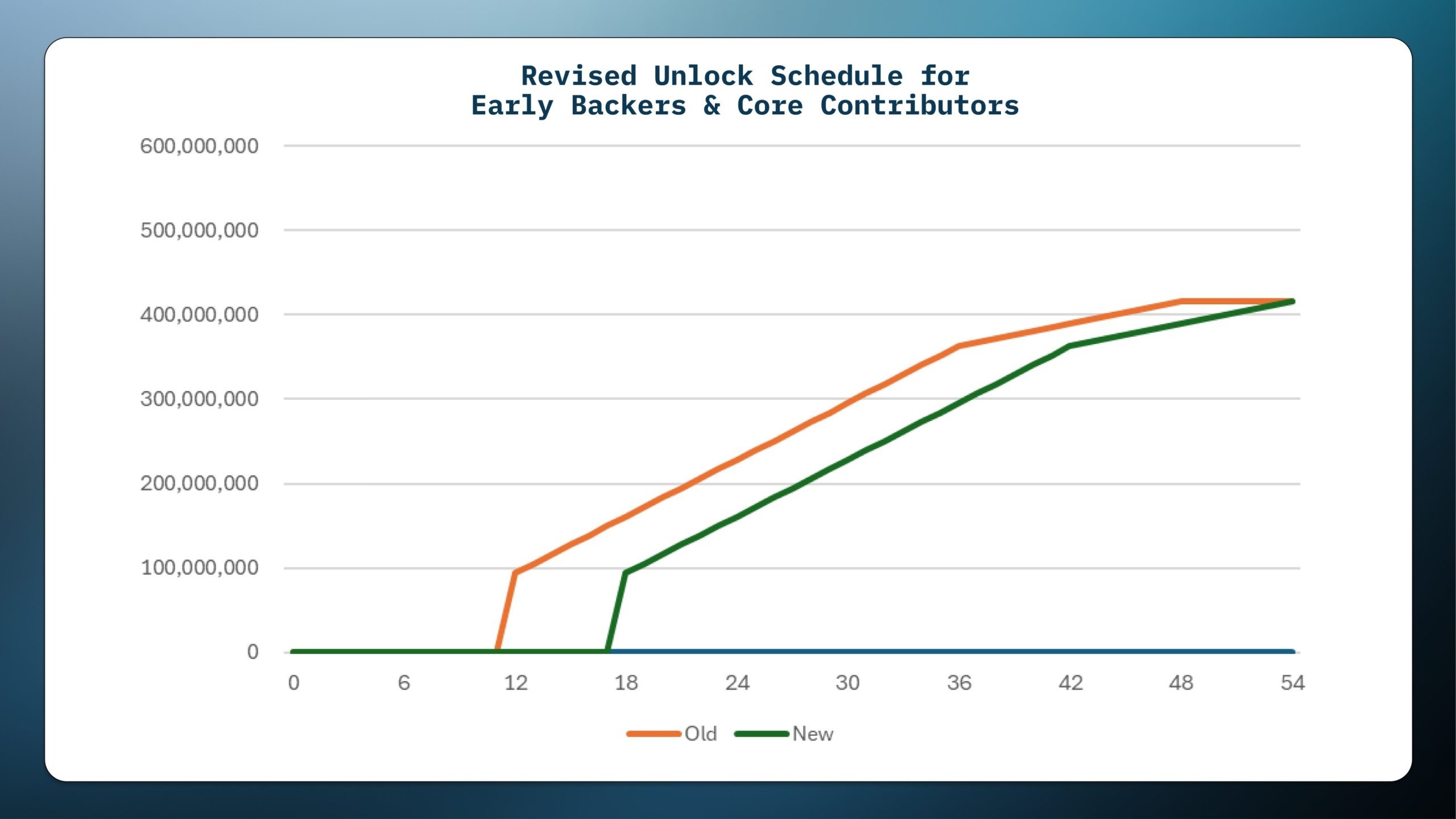

The result is a postponement of the token unlock from Feb. 13 to Aug. 13, a one-time decision approved by its board of directors. According to the team’s projections, the circulating supply will record a slower increase, but it will level out in the long run.

Image courtesy of Story on X.

Image courtesy of Story on X.

The unlock delay comes barely two weeks since the project introduced new improvement proposals aimed at making it easier to stake and expanding staking participation. SIP 0009 proposes the network slashes the locked token staking reward from 0.5x to 0.025x to cut down on block production, which was higher than expected. SIP 00010 wants to reduce the minimum amount of IP required to stake from 1024 to 32, and decreasing staking operation fees by 90%, from 1P to 0,1P.

Story added:

IP trades at $1.4, dipping slightly over the past day, but it lost over a third of its value in the past week.

]]>You May Also Like

Here’s How Consumers May Benefit From Lower Interest Rates

Justin Sun Bitcoin Move: Strategic $100M Treasury Acquisition Signals Major Confidence