ZRC price soars 50% as Zircuit unveils “Hyperliquid for AI Trading”

Zircuit has unveiled a new AI-powered trading product, catalyzing a sharp rally in its ZRC token, which is up over 50% in the past 24 hours.

- Zircuit unveiled an AI-powered cross-chain trading engine with alpha detection and automatic routing

- The engine will inherit the same security stack that guards Zircuit’s flagship Deposit Vaults

- $10M ZRC grant program planned for Q4 to support AI model development.

- ZRC token surges 50% in 24 hours, fueled by the announcement.

Zircuit (ZRC) has just announced the upcoming launch of its new product the team dubbed “Hyperliquid for AI Trading” — an advanced AI-powered trading engine designed to deliver real-time signal detection and lightning-fast trade execution across multiple blockchain networks.

Built to operate on Ethereum-compatible EVM chains and Solana (SOL), the platform will enable users to deploy automated strategies with just one click, removing the hassle of wallet management, gas fees, and slippage.

At its core, Zircuit’s AI engine uses proprietary AI algorithms to scan both on-chain and off-chain data sources, surfacing profitable trading opportunities. The platform’s cross-chain auto-routing system ensures users always get the best price by dynamically executing trades on the best venues across supported blockchains without manual intervention.

The product is set to enter a closed beta phase in late July for existing Zircuit vault users, with a full public launch and developer SDK slated for August this year.

Two flagship products, one mission

Zircuit’s new AI trading engine complements its flagship Deposit Vaults, which offer a capital-efficient and secure way for users to earn passive yield with transparent, on-chain protection. The vaults currently secure over $950M in assets across stablecoins, Ethereum (ETH), and Bitcoin (BTC).

By integrating AI-powered trade automation and cross-chain liquidity, Zircuit now caters to both passive income seekers and active traders without compromising on security or usability. Importantly, every contract within the new AI trading engine will inherit the same battle-tested security stack that protects Zircuit’s vaults.

ZRC technical analysis

According to the official blog post, the rollout plan includes a $10 million ZRC token grant program in Q4 to foster community innovation in AI trading.

This may have ignited today’s 18% rally, building on yesterday’s 27% gain. Over the past 24 hours, the ZRC price is up over 50%, with trading volume surging over 300%.

The token has now broken out of the previous consolidation range and is approaching key resistance near its pre-breakdown lower high. With the next resistance target at $0.55, bulls may still have room to run, but the RSI is currently overbought at 76, suggesting a pullback or short-term consolidation is likely before the next leg higher.

You May Also Like

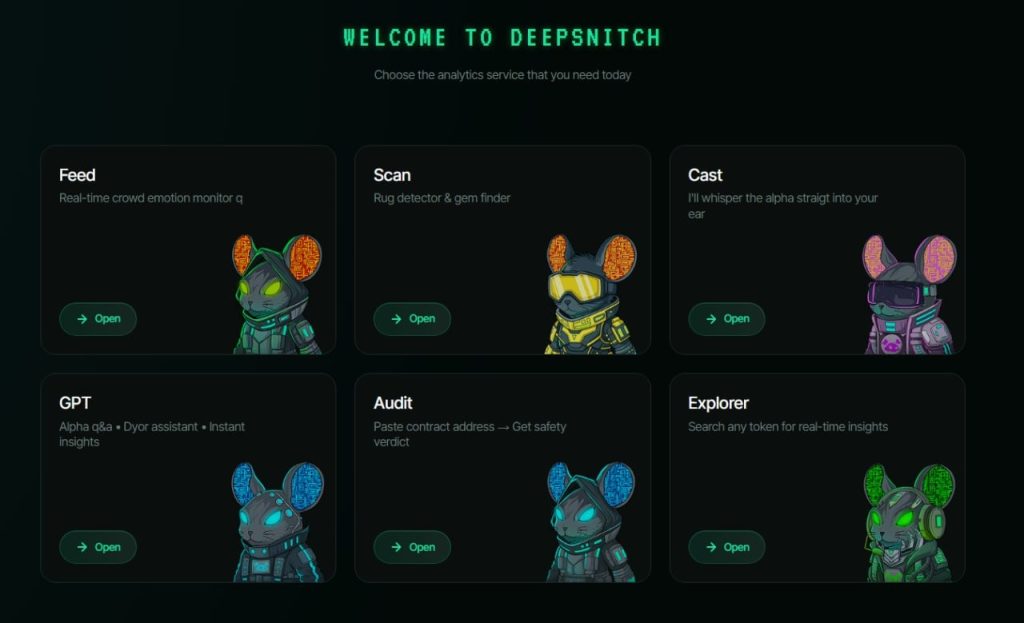

WLFI Token Price Prediction for March Is Ahead of Bitcoin, as TRX Is Stable; But DeepSnitch AI Is Moving to a New Level of Explosive 250x Returns

SEI Technical Analysis Feb 24