Gallup finds crypto’s U.S. footprint is shallow, uneven, and not growing fast

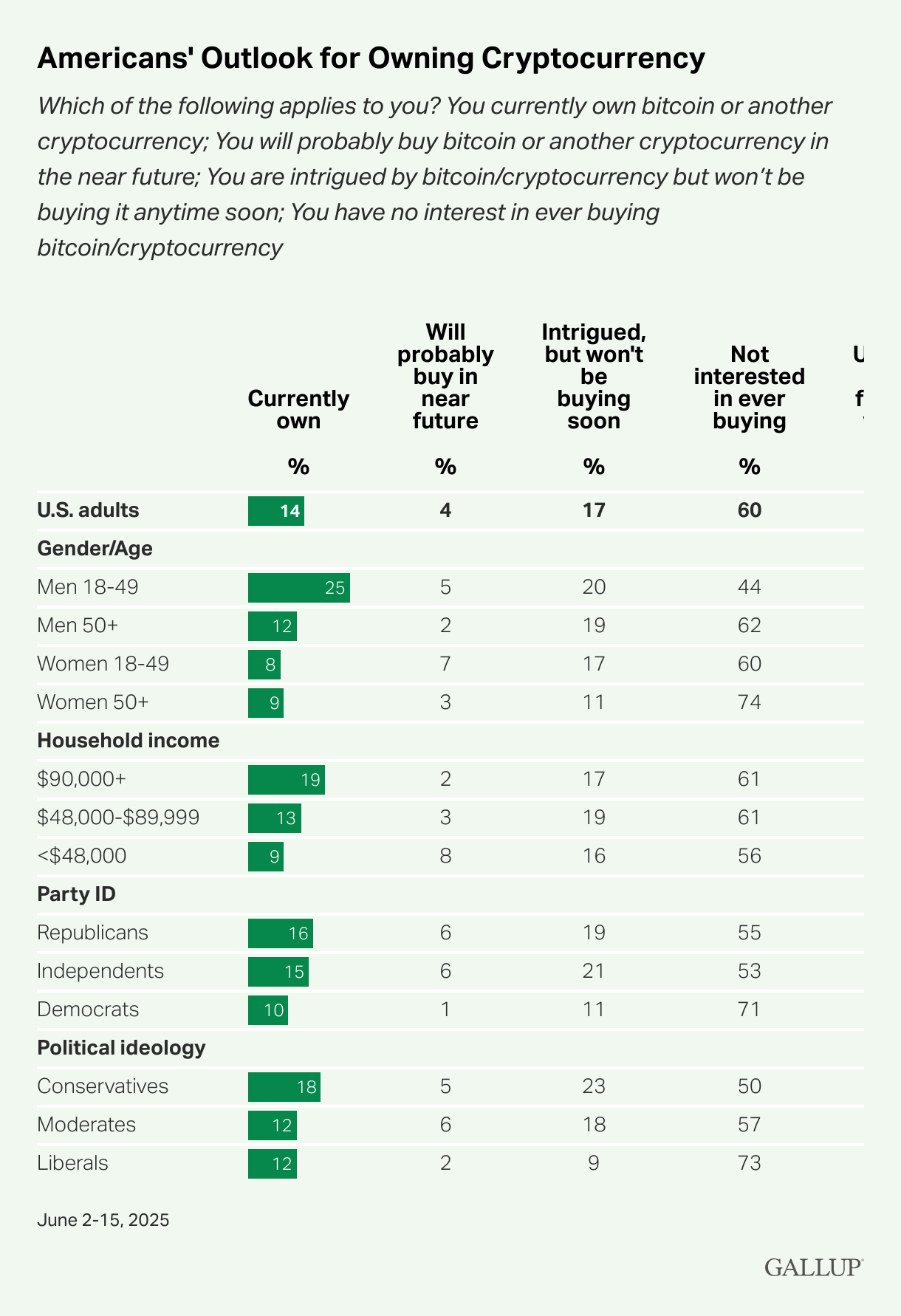

Despite surging adoption since 2021, cryptocurrency remains a hard sell for most Americans. New Gallup data reveals a stark divide: while 14% of U.S. adults own crypto, 60% have zero interest. Even as regulation takes shape, distrust runs deep.

- Gallup survey shows just 14% of U.S. adults own crypto, while 60% have no interest.

- Adoption skews heavily toward young men, college grads, and higher-income conservatives.

- The GENIUS Act may shape regulation, but trust and utility gaps continue to stall adoption.

A Gallup survey conducted June 2-15 found that cryptocurrency ownership in the U.S. has plateaued at a modest 14%, with just 4% of Americans planning to buy in the near future.

The numbers reflect a stubborn reality: despite Bitcoin’s price recovery, high-profile ETF approvals, and Washington’s push for clearer rules, most Americans still see digital assets as speculative at best, reckless at worst.

The data, collected just before President Trump signed the bipartisan GENIUS Act, underscores how deeply risk perception overshadows crypto’s growth potential.

The demographics of distrust: Who believes in crypto and who doesn’t

Gallup’s findings show crypto’s adoption split sharply along age and gender lines. A quarter of men under 50 own digital assets compared to just 8% of women the same age, and the gap grows wider with older generations.

Source: Gallup

The numbers suggest more than just ownership differences; they reveal fundamental gaps in access and confidence. Young men, constantly bombarded by crypto ads and steeped in tech circles, are three times more likely than their female peers to hold cryptocurrency. At the other end of the spectrum, only 7% of seniors have taken the plunge.

According to the report crypto’s appeal is still tied to demographics rather than universal utility. 19% of college graduates and high earners are nearly twice as likely to own crypto as 9% of lower-income Americans. Political identity also plays a role: 18% of conservatives hold digital assets, compared to just 11% of liberals. These splits hint at a cultural divide, one where crypto thrives among groups already inclined toward financial risk-taking, while others remain skeptical or disengaged.

The knowledge gap

Gallup researchers said 95% of U.S. adults recognize the term “cryptocurrency,” but only 35% claim any real understanding of it. For 60%, it’s little more than a buzzword; a concept they’ve encountered but can’t explain. This awareness-without-comprehension problem is especially pronounced among women and older adults. While 59% of men under 50 say they grasp crypto basics, just 22% of women over 50 do.

The survey’s most striking finding is that risk aversion transcends knowledge. It doesn’t matter if Americans say they get crypto or not; 87% still see it as risky, with more than half calling it “very risky.” Even seasoned investors, who usually stomach more risk, remain cautious: nearly two-thirds consider crypto highly speculative, showing little shift since 2021.

The numbers paint a divided picture. While younger, affluent men largely see crypto as their high-stakes gamble, everyone else either wants no part of it or remains firmly on the fence about its place in their financial lives..

Regulation, like the GENIUS Act, could legitimize crypto for skeptics. But Gallup’s data suggests rules alone won’t suffice. Until digital assets shed their reputation as a casino for tech bros and prove their staying power, mainstream America will likely keep its distance.

You May Also Like

MoneyGram Taps Stablecoins To Shield Colombians From Peso Weakness

BDACS Launches KRW1 Stablecoin Backed by the Won