XRP ETFs Report $19.46M Daily Inflow as Total Assets Hit $1.11B

TLDR

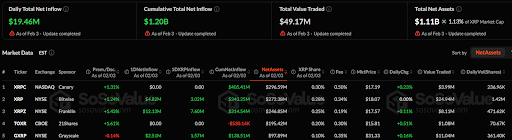

- Total daily net inflow across XRP ETFs reached $19.46 million, with cumulative net inflow at $1.20 billion.

- XRPC ETF on NASDAQ saw no daily inflow, with assets totaling $296.59 million, representing 0.30% of XRP’s share.

- The XRP ETF, sponsored by Bitwise on NYSE, had a daily net inflow of $4.82 million, with assets of $272.38 million.

- The XRPZ ETF reported a daily inflow of $12.13 million, with assets at $246.85 million and a +0.11% daily change.

- The GXRP ETF had a negative daily change of -0.14%, with a net inflow of $2.51 million and assets of $195.42 million.

According to a SoSoValue update as of February 3, the total daily net inflow across XRP ETFs stood at $19.46 million. This brings the cumulative total net inflow to $1.20 billion. The total value traded on the day amounted to $49.17 million, with the total net assets reaching $1.11 billion, representing 1.13% of XRP’s market cap.

XRPC and TOXR ETFs Record No Change in Daily Flows

The XRP ETFs on the market showed various levels of performance. A look at individual XRP ETFs reveals that XRPC ETF, listed on NASDAQ and sponsored by Canary, saw no change in daily inflow with a cumulative net inflow of $405.41 million.

Source: SoSoValue (XRP ETFs)

Source: SoSoValue (XRP ETFs)

The fund’s assets amounted to $296.59 million, and it represented 0.30% of XRP’s market share. Its market price stood at $17.19, with a daily change of +0.23%. The value traded reached $3.99 million, with daily volume hitting 236.96K shares.

The TOXR ETF, listed on CBOE and sponsored by 21Shares, saw a positive change of +1.61%. Despite no inflow or outflow, the ETF has had a cumulative net inflow of $314.54 million and assets of $195.42 million, representing 0.25% of XRP’s share. The market price was $15.81, showing a +0.51% daily change. The value traded was $1.08 million, with 70.67K shares traded on the day.

XRPZ, GXRP, and XRP ETFs Reports Inflows

XRP on the NYSE, sponsored by Bitwise, experienced a daily net inflow of $4.82 million. Its total assets amounted to $272.38 million, representing 0.28% of XRP’s share. The fund’s market price was $18.07. The value traded reached $24.94 million, with a daily volume of 1.42 million shares.

The XRPZ ETF, listed on the NYSE and sponsored by Franklin, reported a daily inflow of $12.13 million. The ETF’s assets amounted to $246.85 million, or 0.25% of XRP’s share. Its market price was $17.57, reflecting a +0.11% daily change. This ETF saw $8.11 million in value traded, with a daily volume of 471.62K shares.

Finally, the GXRP ETF, listed on the NYSE and sponsored by Grayscale, had a negative daily change of -0.14%. It recorded a net inflow of $2.51 million, bringing total assets to $195.42 million. The ETF’s market price was $31.33, up 0.16% on the day. The total value traded was $11.04 million, and daily volume was 361.40K shares.

The post XRP ETFs Report $19.46M Daily Inflow as Total Assets Hit $1.11B appeared first on Blockonomi.

You May Also Like

MoneyGram launches stablecoin-powered app in Colombia

Solana Treasury Firm Holdings Could Double as Forward Industries Unveils $4 Billion Raise